Form 8962 2014

What is the Form 8962

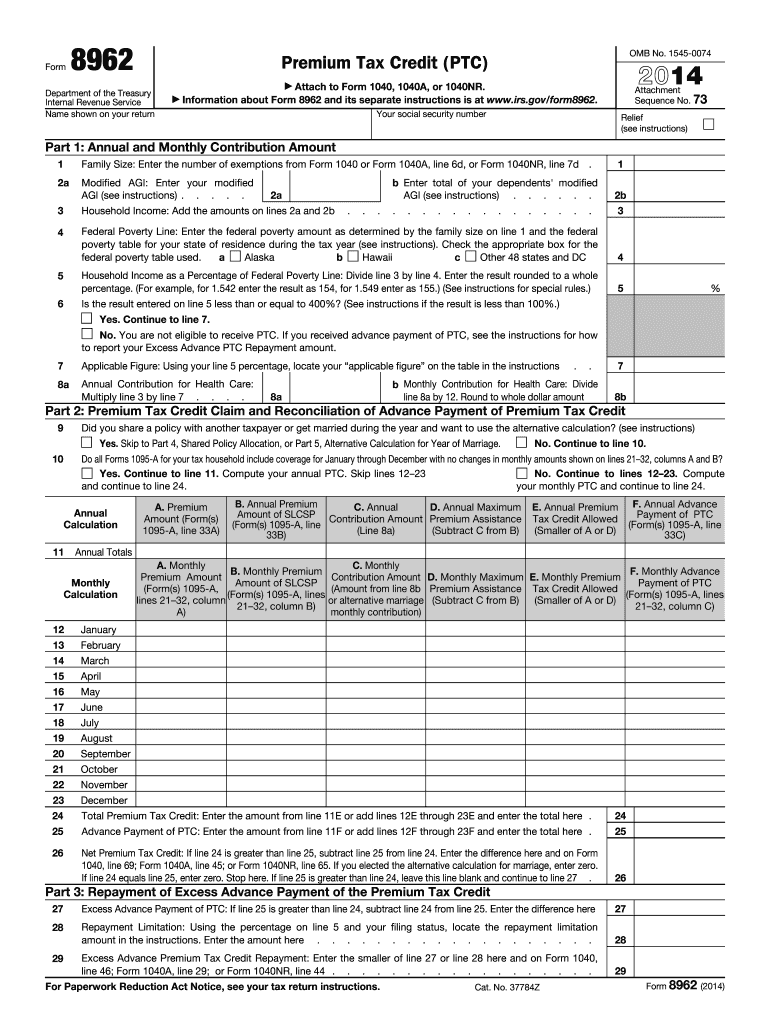

The Form 8962, officially known as the Premium Tax Credit (PTC) form, is used by individuals and families to calculate their eligibility for the premium tax credit under the Affordable Care Act (ACA). This form helps taxpayers reconcile the advance payments of the premium tax credit they may have received during the year with the actual premium tax credit they are eligible for based on their annual income and family size. Completing this form accurately is essential to ensure compliance with tax regulations and to avoid potential penalties.

How to use the Form 8962

Using the Form 8962 involves several steps. First, taxpayers need to gather necessary information, including their Form 1095-A, which provides details about their health insurance coverage purchased through the Health Insurance Marketplace. Next, they will complete the form by providing details such as household income, family size, and the amount of premium tax credit received. After filling out the form, it should be attached to the taxpayer's federal income tax return when filing. This ensures that the IRS can verify the accuracy of the premium tax credit claimed.

Steps to complete the Form 8962

Completing the Form 8962 requires a systematic approach:

- Gather all necessary documents, including Form 1095-A and your tax return.

- Fill in your personal information, including your name and Social Security number.

- Enter your household income and family size to determine your eligibility for the premium tax credit.

- Use the information from Form 1095-A to complete the sections on premium amounts and advance payments.

- Calculate the premium tax credit using the provided worksheets in the form.

- Review all entries for accuracy before submitting.

Legal use of the Form 8962

The legal use of the Form 8962 is governed by IRS regulations. It is essential for taxpayers to ensure that all information provided is accurate and truthful. Misrepresentation or errors can lead to penalties, including the disallowance of the premium tax credit and potential fines. The form must be submitted as part of the annual tax return, and compliance with the requirements set forth by the IRS is crucial for maintaining eligibility for future premium tax credits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8962 align with the annual income tax return deadlines. Typically, individual tax returns are due on April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to file the Form 8962 by this deadline to avoid penalties associated with late filing. Additionally, if taxpayers are seeking an extension, they must ensure that the form is included with their extended return.

Required Documents

To complete the Form 8962, taxpayers need several key documents:

- Form 1095-A: This form provides details about health coverage purchased through the Marketplace.

- Income documentation: This includes W-2s, 1099s, and any other income statements.

- Tax return from the previous year: This can help in determining household size and income.

Eligibility Criteria

Eligibility for the premium tax credit, and thereby the use of Form 8962, is based on several factors:

- Household income must fall between one hundred and four hundred percent of the federal poverty level.

- Taxpayers must have purchased health insurance through the Health Insurance Marketplace.

- Individuals must not be eligible for other qualifying health coverage, such as Medicaid or Medicare.

Quick guide on how to complete 2014 form 8962

Effortlessly Prepare Form 8962 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents promptly without delays. Manage Form 8962 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The Easiest Way to Modify and Electronically Sign Form 8962 with Ease

- Locate Form 8962 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 8962 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8962

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8962

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 8962 and why do I need it?

Form 8962 is used to calculate the premium tax credit and reconcile advance payments of the premium tax credit for health insurance obtained through the Health Insurance Marketplace. Understanding Form 8962 is crucial for ensuring compliance with tax regulations and maximizing your tax benefits.

-

How can airSlate SignNow help me manage Form 8962?

airSlate SignNow simplifies the process of filling out and signing Form 8962 by providing an easy-to-use platform for eSigning documents. With our solution, you can quickly send Form 8962 for signatures, track its status, and ensure that it is completed accurately and on time.

-

Is airSlate SignNow cost-effective for managing Form 8962?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 8962 and other documents. Our pricing plans are competitive, allowing businesses of all sizes to access essential eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with other applications to manage Form 8962?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including Google Drive and Dropbox, making it easy to manage your Form 8962 and other documents. This ensures you can streamline your workflow and access your files from anywhere.

-

What features does airSlate SignNow offer for Form 8962 processing?

airSlate SignNow offers various features for processing Form 8962, including customizable templates, automated reminders, and real-time tracking. These features help ensure that your documents are completed efficiently and securely.

-

Is my data secure when using airSlate SignNow for Form 8962?

Yes, data security is a top priority at airSlate SignNow. We use advanced encryption and comply with industry standards to protect your sensitive information, including Form 8962, ensuring that your data is safe at all times.

-

How can airSlate SignNow improve my team's efficiency in handling Form 8962?

By using airSlate SignNow, your team can enhance efficiency in handling Form 8962 through automated workflows and easy collaboration. Our platform reduces the time spent on paper-based processes, allowing your team to focus on more critical tasks.

Get more for Form 8962

- Fillable online help the environment and achieve peace of mind fax form

- National grid connectsnewupgraded electric servicetools form

- Export to xml save one soul animal rescue league form

- Foreign registration statement rcw 2395 form

- Notetheapplicantmustalsoincludethemselvesinthissection form

- Mckinney vento intake sample form

- Please complete sign amp return form

- Pasco dog license application form

Find out other Form 8962

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple