Form 8962 for 2016

What is the Form 8962 For

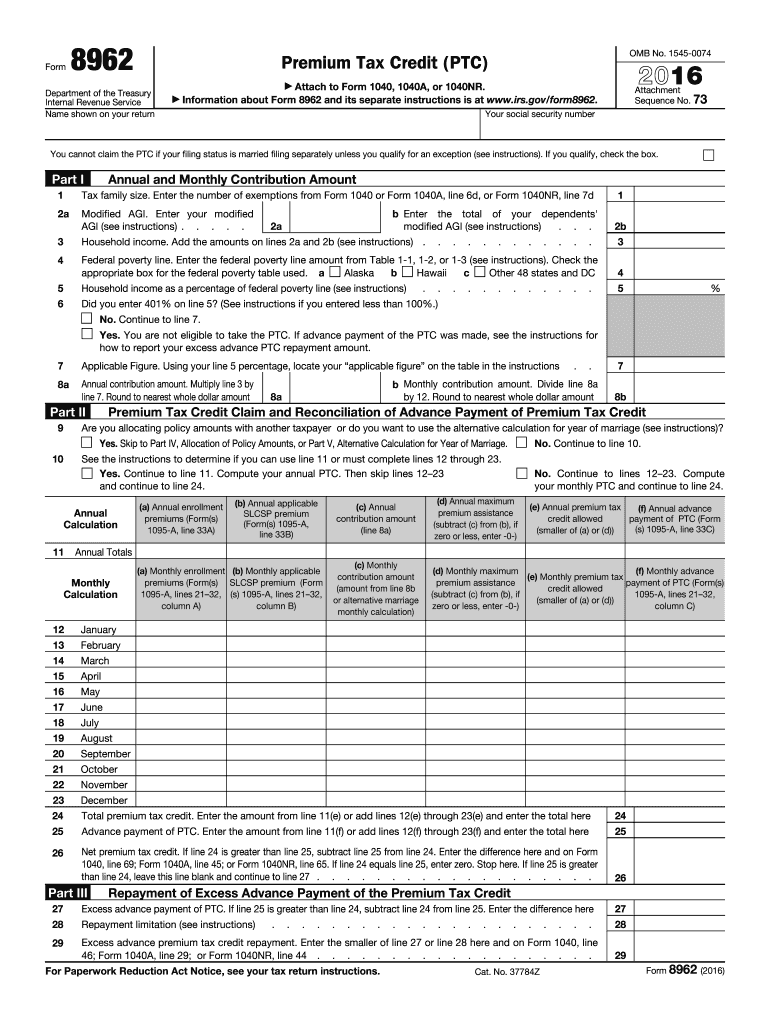

The Form 8962 for 2016 is used to calculate the premium tax credit, which helps eligible individuals and families afford health insurance coverage purchased through the Health Insurance Marketplace. This form is essential for those who have received advance payments of the premium tax credit and need to reconcile these payments with the actual premium tax credit amount they qualify for based on their annual income and household size. Completing the 8962 form accurately ensures that taxpayers receive the correct amount of credit and helps avoid potential tax liabilities.

How to Obtain the Form 8962 For

Taxpayers can obtain the IRS Form 8962 for 2016 directly from the IRS website. The form is available for download in PDF format, allowing individuals to print it for completion. Additionally, tax preparation software often includes this form, making it easier for users to fill it out digitally. It is important to ensure that the version downloaded is for the correct tax year, as forms can change from year to year.

Steps to Complete the Form 8962 For

Completing the Form 8962 involves several key steps:

- Gather necessary information, including your Form 1095-A, which provides details about your health coverage and premium amounts.

- Fill out Part I of the form to report your annual household income and the number of individuals in your household.

- Complete Part II to calculate your premium tax credit based on the information from your 1095-A and your household income.

- In Part III, reconcile any advance payments of the premium tax credit with the actual credit amount calculated.

- Review the completed form for accuracy before submitting it with your tax return.

Legal Use of the Form 8962 For

The Form 8962 is legally binding when completed and submitted with your tax return. It must be filled out accurately to avoid penalties or issues with the IRS. The form serves as a declaration of your eligibility for the premium tax credit and is subject to review by the IRS. Providing false information can lead to serious consequences, including fines or legal action. Therefore, it is crucial to ensure that all information reported on the form is truthful and complete.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8962. Taxpayers should refer to the official instructions accompanying the form, which outline eligibility criteria, how to calculate the premium tax credit, and the reconciliation process for advance payments. It is important to stay updated on any changes to tax laws that may affect the completion of this form, as IRS regulations can change annually. Adhering to these guidelines helps ensure compliance and accurate reporting.

Filing Deadlines / Important Dates

For the tax year 2016, the deadline to file your tax return, including the Form 8962, was April 18, 2017. If you filed for an extension, the extended deadline was October 16, 2017. It is essential to meet these deadlines to avoid penalties and interest on any taxes owed. Taxpayers should also be aware of any changes in deadlines for subsequent tax years, as these can vary.

Quick guide on how to complete form 8962 for 2016

Prepare Form 8962 For effortlessly on any device

Virtual document administration has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Form 8962 For on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Form 8962 For with ease

- Find Form 8962 For and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 8962 For and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8962 for 2016

Create this form in 5 minutes!

How to create an eSignature for the form 8962 for 2016

How to create an eSignature for the Form 8962 For 2016 online

How to generate an electronic signature for the Form 8962 For 2016 in Google Chrome

How to generate an eSignature for putting it on the Form 8962 For 2016 in Gmail

How to generate an electronic signature for the Form 8962 For 2016 right from your mobile device

How to create an eSignature for the Form 8962 For 2016 on iOS devices

How to generate an eSignature for the Form 8962 For 2016 on Android OS

People also ask

-

What is Form 8962 For?

Form 8962 For is used by individuals to calculate and claim the Premium Tax Credit, which helps offset the cost of health insurance purchased through the Health Insurance Marketplace. This form is necessary for those who received premium tax credits and need to reconcile their advance payments with their actual allowance based on their annual income.

-

How can airSlate SignNow help with Form 8962 For?

airSlate SignNow provides an efficient way to manage and eSign documents related to Form 8962 For. With our user-friendly platform, users can easily prepare, send, and receive signed forms, ensuring compliance and simplifying the tax filing process.

-

Is airSlate SignNow affordable for filing Form 8962 For?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to meet the needs of individuals and businesses filing Form 8962 For. Our plans are designed to provide maximum value while making the document signing process seamless and efficient.

-

What features does airSlate SignNow offer for Form 8962 For?

With airSlate SignNow, you can access features such as customizable templates for Form 8962 For, real-time tracking of document status, and secure cloud storage. These features streamline the process and help ensure that all necessary information is accurately captured and signed.

-

Can I integrate airSlate SignNow with other software for Form 8962 For?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms, allowing you to manage Form 8962 For alongside your other applications. This integration enhances productivity by connecting your eSigning processes with your existing workflows.

-

What are the benefits of using airSlate SignNow for Form 8962 For?

Using airSlate SignNow for Form 8962 For simplifies the eSigning process, reduces paperwork, and accelerates the submission of tax documents. Our platform enhances security and compliance, giving users peace of mind while handling sensitive information.

-

How secure is airSlate SignNow for handling Form 8962 For?

airSlate SignNow prioritizes security with top-notch encryption and compliance with industry standards. When managing sensitive documents like Form 8962 For, you can trust that your information is safeguarded against unauthorized access.

Get more for Form 8962 For

Find out other Form 8962 For

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now