Get and Sign 8962 Form 2021

Understanding the 8962 Form for 2021

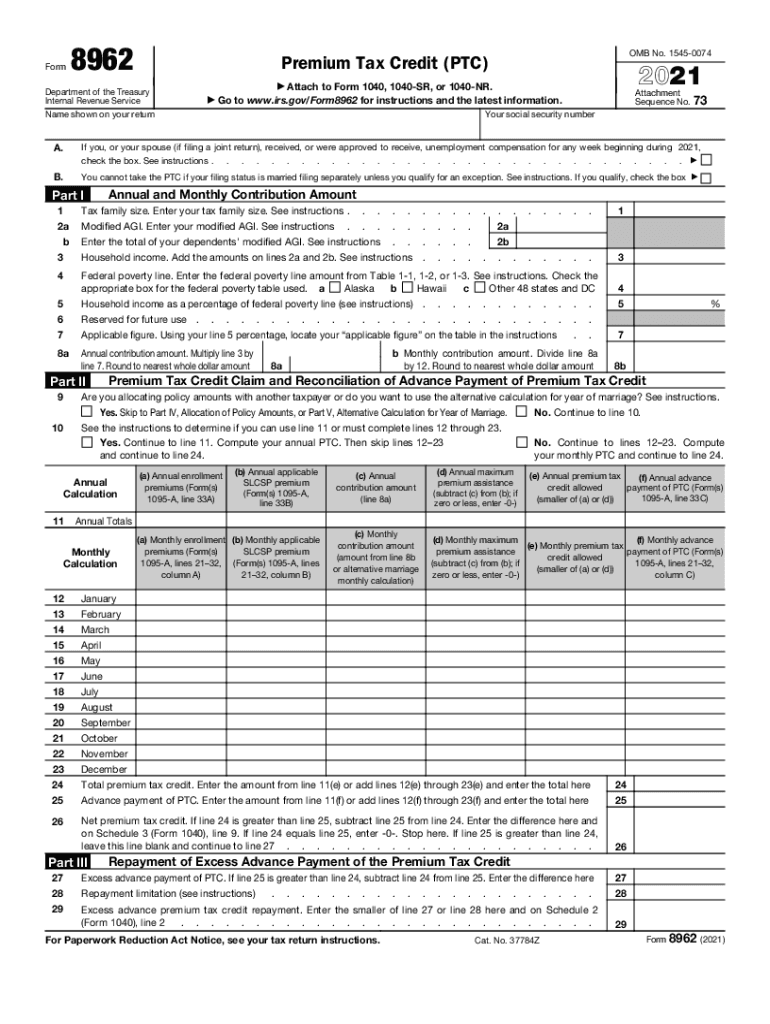

The 8962 form, also known as the IRS Form 8962 for 2021, is essential for taxpayers who wish to claim the Premium Tax Credit (PTC). This credit assists individuals and families in affording health insurance purchased through the Health Insurance Marketplace. To qualify for the PTC, you must meet specific income requirements and file a tax return. This form helps determine the amount of credit you can claim based on your household size and income.

Eligibility Criteria for the 8962 Form

To be eligible to use the 8962 form for 2021, you must meet several criteria:

- You must have purchased health insurance through the Health Insurance Marketplace.

- Your household income must fall within the range specified by the IRS for the Premium Tax Credit.

- You cannot be eligible for other types of minimum essential coverage, such as Medicaid or Medicare.

- You must file a federal tax return for the year in which you are claiming the credit.

Steps to Complete the 8962 Form

Filling out the 8962 form involves several key steps:

- Gather necessary documents, including Form 1095-A, which provides information about your health insurance coverage.

- Calculate your household income and compare it to the federal poverty level to determine your eligibility for the PTC.

- Fill out the 8962 form, providing details about your health insurance coverage, household size, and income.

- Review the completed form for accuracy before submitting it with your tax return.

IRS Guidelines for Filing the 8962 Form

The IRS provides specific guidelines for filing the 8962 form. Ensure you follow these instructions to avoid delays or issues with your tax return:

- Submit the form along with your federal tax return, either electronically or by mail.

- Ensure that the information on the 8962 form matches the details on your Form 1095-A.

- Keep copies of all documents for your records, as the IRS may request them in the future.

Required Documents for the 8962 Form

When completing the 8962 form, you will need the following documents:

- Form 1095-A: Health Insurance Marketplace Statement.

- Your tax return from the previous year for reference.

- Documentation of any changes in your income or household size during the year.

Form Submission Methods

You can submit the 8962 form through various methods:

- Electronically, by including it with your e-filed tax return.

- By mail, sending it to the appropriate IRS address based on your state of residence.

- In-person, if you are visiting a local IRS office for assistance.

Quick guide on how to complete fillable online you cannot claim the ptc if your filing

Effortlessly prepare Get and Sign 8962 Form on any device

Managing documents online has become increasingly favored by both companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Get and Sign 8962 Form on any device through airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

Edit and eSign Get and Sign 8962 Form with ease

- Locate Get and Sign 8962 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional wet signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to share your form—via email, SMS, or an invitation link—or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Get and Sign 8962 Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online you cannot claim the ptc if your filing

Create this form in 5 minutes!

How to create an eSignature for the fillable online you cannot claim the ptc if your filing

How to create an e-signature for your PDF document online

How to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to generate an e-signature from your smart phone

How to generate an electronic signature for a PDF document on iOS

How to generate an e-signature for a PDF file on Android OS

People also ask

-

What is the 8962 form 2021 printable?

The 8962 form 2021 printable is a tax form used to calculate the premium tax credit and reconcile any advance payments. It's essential for individuals receiving health insurance through the Marketplace. By using the form, you can ensure accurate reporting and compliance with IRS regulations.

-

How can I obtain the 8962 form 2021 printable?

You can easily obtain the 8962 form 2021 printable from the IRS website or through our airSlate SignNow platform. We provide a user-friendly interface that allows you to download and print the form quickly. This ensures you have access to the latest version for seamless completion.

-

Is the 8962 form 2021 printable available for free?

Yes, the 8962 form 2021 printable is available for free download. However, if you choose to use airSlate SignNow for eSigning and sending documents, there may be associated costs with our platform. Our solution is designed to offer cost-effective options tailored to meet your business needs.

-

What features does airSlate SignNow offer for the 8962 form 2021 printable?

airSlate SignNow offers an array of features for the 8962 form 2021 printable, including eSignature capabilities, document sharing, and tracking. Our platform simplifies the signing process while ensuring compliance with legal requirements. This enhances efficiency and saves time during tax season.

-

Why should I use airSlate SignNow for the 8962 form 2021 printable?

Using airSlate SignNow for the 8962 form 2021 printable streamlines your document management. It allows for easy electronic signatures and secure storage, reducing the need for paper documents. Our solution ensures your forms are handled efficiently, giving you peace of mind during filing.

-

Can I integrate airSlate SignNow with other applications for the 8962 form 2021 printable?

Yes, airSlate SignNow can be integrated with various applications to enhance your workflow with the 8962 form 2021 printable. This includes CRM systems, productivity tools, and more. Our integrations allow for seamless data transfer and collaboration across platforms.

-

What are the benefits of using airSlate SignNow for tax documents like the 8962 form 2021 printable?

The benefits of using airSlate SignNow for tax documents like the 8962 form 2021 printable include increased efficiency, enhanced security, and improved organization. Our platform also provides reminder features to help you track deadlines. This ensures you never miss an important filing due date.

Get more for Get and Sign 8962 Form

- Hi 10 day form

- Terminate lease tenant 497304432 form

- Hi 10 day 497304433 form

- 120 day notice to terminate month to month lease where demolition or conversion contemplated residential ll to tenant hawaii form

- 5 day notice 497304435 form

- 5 day notice to pay rent or lease terminates nonresidential or commercial hawaii form

- Assignment of mortgage by individual mortgage holder hawaii form

- Assignment of mortgage by corporate mortgage holder hawaii form

Find out other Get and Sign 8962 Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe