Form 8962 2020

What is the Form 8962

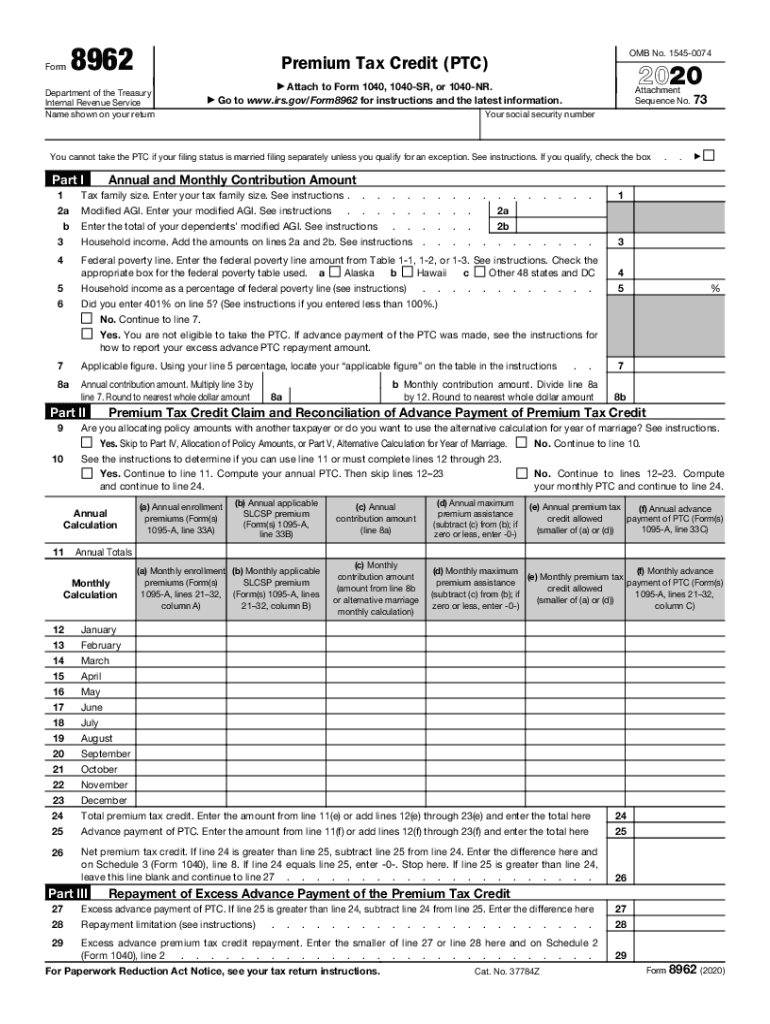

The 2020 Form 8962, also known as the Premium Tax Credit form, is used by individuals to calculate and claim the premium tax credit for health insurance purchased through the Health Insurance Marketplace. This form is essential for taxpayers who have received advance payments of the premium tax credit, allowing them to reconcile those payments with their actual premium tax credit based on their final income for the year.

How to use the Form 8962

To effectively use the Form 8962, taxpayers must gather pertinent information about their health insurance coverage, including the amount of premium tax credit received and their household income. The form requires details such as the number of individuals in the household and their respective incomes. After completing the form, it should be submitted along with the federal tax return to the IRS to ensure proper calculation of the tax credit.

Steps to complete the Form 8962

Completing the 2020 Form 8962 involves several key steps:

- Gather necessary documents, including Form 1095-A, which provides details about the health insurance coverage.

- Fill out Part I to report the annual premium tax credit and any advance payments received.

- Complete Part II to calculate the premium tax credit based on your household income and family size.

- Review the calculations for accuracy before submitting the form with your tax return.

Legal use of the Form 8962

The legal use of the Form 8962 is governed by IRS regulations. It is crucial for taxpayers to ensure that the information provided is accurate and complete. Misreporting income or failing to reconcile advance payments can lead to penalties or the requirement to repay the premium tax credit. Compliance with the IRS guidelines is essential for the form to be considered valid.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8962. Taxpayers should refer to the IRS instructions for the form, which detail eligibility criteria, the calculation of the premium tax credit, and the reconciliation process. Understanding these guidelines helps ensure that taxpayers accurately report their information and comply with federal tax laws.

Filing Deadlines / Important Dates

For the 2020 tax year, the deadline for filing the Form 8962 is typically April fifteenth of the following year. However, if you file for an extension, you may have until October fifteenth to submit your tax return and the accompanying Form 8962. It is important to keep track of these deadlines to avoid penalties and ensure timely processing of your tax return.

Quick guide on how to complete form 8962

Accomplish Form 8962 effortlessly on any gadget

Web-based document management has become favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without waiting. Handle Form 8962 on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Form 8962 effortlessly

- Find Form 8962 and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just moments and holds the same legal validity as a traditional ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes necessitating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 8962 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8962

Create this form in 5 minutes!

How to create an eSignature for the form 8962

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the 2020 form 8962 used for?

The 2020 form 8962 is primarily used to calculate the premium tax credit for health insurance purchased through the Health Insurance Marketplace. It helps individuals determine their eligibility for financial assistance based on their household income and size. Understanding how to fill out the 2020 form 8962 is crucial for accurate tax filing.

-

How can airSlate SignNow help with the 2020 form 8962?

airSlate SignNow provides a user-friendly platform to securely send and eSign your 2020 form 8962. The solution makes it easy to collect signatures from clients or tax preparers, streamlining the process. By using airSlate SignNow, you can efficiently manage your documentation related to the 2020 form 8962.

-

Is there a cost associated with using airSlate SignNow for the 2020 form 8962?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, including those who need to manage the 2020 form 8962. You can choose from various subscription options, including monthly and annual plans. This flexibility allows you to find a pricing plan that works best for you.

-

What features does airSlate SignNow offer for signing the 2020 form 8962?

airSlate SignNow offers features such as electronic signatures, customizable templates, and secure cloud storage specifically suited for the 2020 form 8962. You can track the status of your documents, set reminders for signers, and access the signed forms anytime, ensuring a seamless signing experience. These features improve efficiency and compliance.

-

Can I integrate airSlate SignNow with other software for managing my 2020 form 8962?

Yes, airSlate SignNow supports integrations with various third-party applications to help you manage the 2020 form 8962 efficiently. You can connect it with popular software like CRMs, accounting platforms, and document management systems. This seamless integration helps streamline your workflow and minimizes data entry efforts.

-

What benefits does airSlate SignNow provide for businesses dealing with the 2020 form 8962?

With airSlate SignNow, businesses receive the benefit of a cost-effective solution for managing their 2020 form 8962 processes. The platform enhances collaboration by allowing multiple signers to review and sign documents quickly. This speeds up the workflow and improves overall efficiency across your organization.

-

Is airSlate SignNow secure for handling sensitive information like the 2020 form 8962?

Absolutely! airSlate SignNow employs robust security measures to protect sensitive information associated with the 2020 form 8962. The platform uses encryption, secure data storage, and complies with industry standards to ensure that your documents are safe and secure throughout the signing process.

Get more for Form 8962

- Fillable online pprbd code study form pikes peak

- Va form 21p 8416 medical expense report

- S a and i 2644 oklahoma state auditor ampamp inspector form

- Stone bank volunteer fire department in oconomowoc wi form

- Sos home form

- Report of addiction treatment north dakota department dot nd form

- Pennsylvania emergency permit re issuance form

- Title xix medical transportation reimbursement form dss sd

Find out other Form 8962

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template