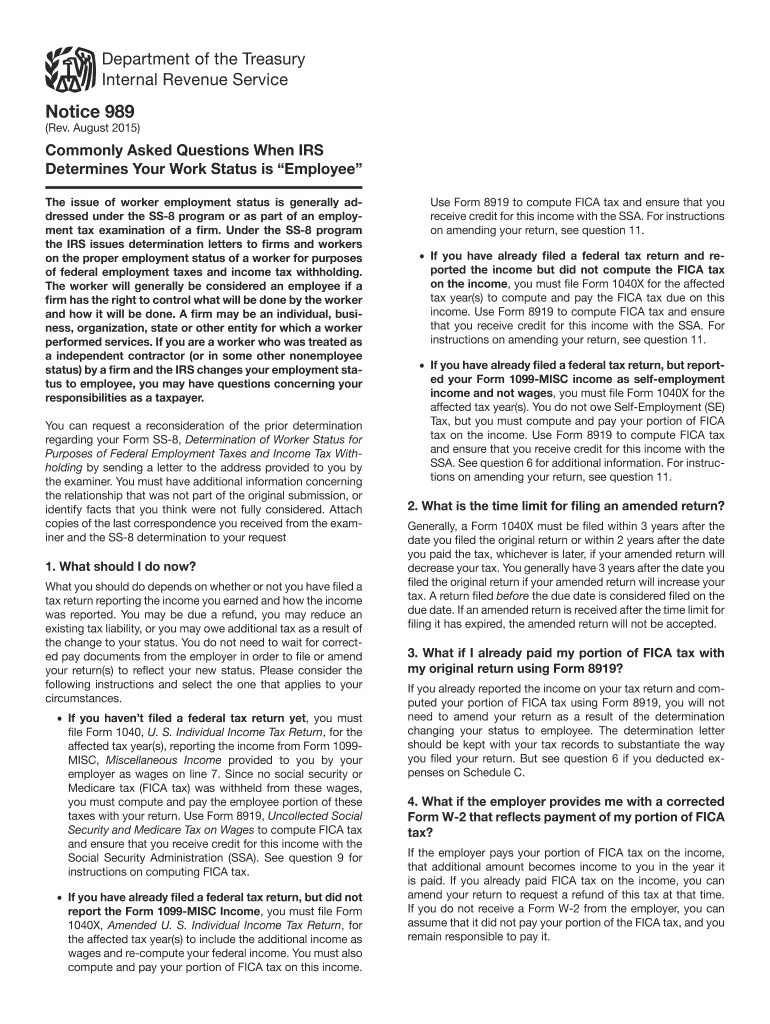

Notice 989 Rev 8 Commonly Asked Questions When IRS Determines Your Work Status is Employee Form

Understanding the 989 Form

The 989 form, also known as Notice 989, is an important document issued by the IRS that helps clarify an individual's employment status. This form is particularly relevant when the IRS determines whether a worker is classified as an employee or an independent contractor. Understanding this classification is crucial as it affects tax obligations, benefits, and legal rights. The 989 form provides guidance on how the IRS makes these determinations and outlines the implications for both workers and employers.

Steps to Complete the 989 Form

Completing the 989 form requires careful attention to detail to ensure accuracy. Here are the key steps:

- Review the instructions provided with the form to understand the requirements.

- Gather necessary information, including personal identification details and employment history.

- Fill out the form accurately, ensuring all sections are completed as required.

- Double-check for any errors or omissions before submission.

- Submit the form according to the guidelines provided, either online or via mail.

Legal Use of the 989 Form

The 989 form is legally recognized and serves as a vital tool in employment classification. It is used to document the IRS's determination regarding a worker's status, which can have significant legal implications. Employers must ensure they comply with the IRS guidelines when using this form to avoid penalties. Proper use of the 989 form helps protect both the employer and employee by clarifying rights and responsibilities under U.S. labor laws.

Common Questions About the 989 Form

Many individuals have questions regarding the 989 form and its implications. Some frequently asked questions include:

- What happens if I disagree with the IRS determination?

- How does the classification affect my taxes?

- Can I appeal the decision made on the 989 form?

- What documentation do I need to provide with the form?

Understanding these aspects can help individuals navigate the complexities of employment status and IRS regulations.

Filing Deadlines for the 989 Form

It is essential to be aware of the filing deadlines associated with the 989 form. Typically, the IRS requires that the form be submitted within a specific timeframe after receiving notice of employment status determination. Missing these deadlines can lead to complications, including potential penalties. Always check the IRS website or consult a tax professional for the most current deadlines related to the 989 form.

Obtaining the 989 Form

The 989 form can be obtained directly from the IRS website or through tax preparation services. It is available in both digital and printable formats, ensuring accessibility for all users. When obtaining the form, ensure you are using the most recent version to comply with current IRS regulations. This helps in ensuring that all necessary updates and changes are reflected in your submission.

Quick guide on how to complete notice 989 rev 8 2015 commonly asked questions when irs determines your work status is employee

Effortlessly Prepare Notice 989 Rev 8 Commonly Asked Questions When IRS Determines Your Work Status Is Employee on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without any delays. Handle Notice 989 Rev 8 Commonly Asked Questions When IRS Determines Your Work Status Is Employee on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Steps to Modify and eSign Notice 989 Rev 8 Commonly Asked Questions When IRS Determines Your Work Status Is Employee with Ease

- Locate Notice 989 Rev 8 Commonly Asked Questions When IRS Determines Your Work Status Is Employee and press Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize important sections of the documents or obscure sensitive data using the features airSlate SignNow specifically provides for these purposes.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for submitting your form: via email, SMS, or invitation link, or download it onto your computer.

Say goodbye to lost or misfiled documents, exhausting form searches, or errors that necessitate new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Notice 989 Rev 8 Commonly Asked Questions When IRS Determines Your Work Status Is Employee to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notice 989 rev 8 2015 commonly asked questions when irs determines your work status is employee

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is a 989 form and why is it important?

A 989 form is a crucial document used in various industries for obtaining necessary authorizations. It plays a signNow role in streamlining processes and ensuring compliance. By integrating a 989 form into your workflow, you can enhance efficiency and reduce processing delays.

-

How does airSlate SignNow simplify the completion of a 989 form?

airSlate SignNow offers an intuitive platform for creating and eSigning your 989 form. With user-friendly features, you can easily fill out, sign, and send the form securely. This saves time and reduces errors compared to traditional paperwork.

-

What are the costs associated with using airSlate SignNow for a 989 form?

Our pricing for airSlate SignNow varies based on the plan you choose, tailored to meet your business needs. We offer transparent pricing, allowing you to use our services for eSigning 989 forms without hidden fees. Free trials are also available to explore our features before committing.

-

Can I integrate airSlate SignNow with other software for managing 989 forms?

Yes, airSlate SignNow seamlessly integrates with a variety of applications to help manage your 989 forms efficiently. This includes CRM systems, cloud storage services, and project management tools. These integrations ensure that you can automate workflows and keep your documents organized.

-

What are the security measures in place for handling a 989 form on airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for handling sensitive documents like a 989 form. We employ encryption protocols, multi-factor authentication, and compliance with industry standards to protect your data. You can trust that your information remains secure while using our platform.

-

How can airSlate SignNow help speed up the approval process of a 989 form?

By using airSlate SignNow, the approval process for a 989 form is accelerated through electronic signatures and real-time tracking. You can send reminders and notifications directly through our platform, reducing the time it takes to obtain necessary approvals. This efficiency enhances overall productivity.

-

Are there templates available for creating a 989 form in airSlate SignNow?

Yes, airSlate SignNow provides customizable templates for creating a 989 form quickly and efficiently. These templates allow you to save time and ensure consistency across your documents. You can easily modify them to suit your specific needs and branding.

Get more for Notice 989 Rev 8 Commonly Asked Questions When IRS Determines Your Work Status Is Employee

Find out other Notice 989 Rev 8 Commonly Asked Questions When IRS Determines Your Work Status Is Employee

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF