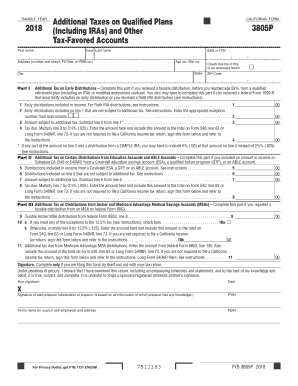

Ftb 3805p 2018

What is the FTB 3805P?

The California 3805P form, also known as the California IRA Tax Opt-Out Form, is a tax document used by individuals to opt out of the California IRA program. This program is designed to provide retirement savings options to employees who do not have access to employer-sponsored retirement plans. By submitting the form, individuals can formally decline participation in the program and ensure that their contributions are not automatically deducted from their paychecks.

How to Use the FTB 3805P

Using the California 3805P form involves a straightforward process. First, download the form from the California Franchise Tax Board's website or obtain it from your employer. Next, fill out the required sections, providing personal information such as your name, address, and Social Security number. Once completed, submit the form to your employer or the designated state agency to ensure your opt-out request is processed. It's important to keep a copy of the submitted form for your records.

Steps to Complete the FTB 3805P

Completing the California 3805P form requires careful attention to detail. Follow these steps:

- Download the form from the California Franchise Tax Board's website.

- Enter your personal information accurately, including your full name and address.

- Provide your Social Security number to verify your identity.

- Read the instructions carefully to ensure you understand the implications of opting out.

- Sign and date the form to confirm your request.

- Submit the completed form to your employer or the appropriate state agency.

Legal Use of the FTB 3805P

The California 3805P form is legally binding when completed and submitted correctly. It complies with state regulations regarding retirement savings programs. By opting out, individuals are exercising their right to choose whether to participate in the California IRA program. It is crucial to ensure that the form is filled out accurately to avoid any legal complications or misunderstandings regarding retirement contributions.

Key Elements of the FTB 3805P

Several key elements are essential for the California 3805P form to be valid:

- Personal Information: Accurate details about the individual opting out, including name and Social Security number.

- Signature: The form must be signed by the individual to confirm their decision.

- Date: The date of signing is necessary to establish the timeline of the opt-out request.

- Submission Method: Clear instructions on how and where to submit the form are vital for processing.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines related to the California 3805P form. Individuals should submit the form as soon as they decide to opt out to ensure that no contributions are deducted from their paychecks. Typically, deadlines align with the start of the tax year or employment initiation. Checking with the California Franchise Tax Board for specific dates is advisable to avoid any complications.

Quick guide on how to complete 2018 ftb 3805p

Complete Ftb 3805p effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Ftb 3805p on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Ftb 3805p effortlessly

- Find Ftb 3805p and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of sending your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Ftb 3805p and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 ftb 3805p

Create this form in 5 minutes!

How to create an eSignature for the 2018 ftb 3805p

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the California 3805P form, and why is it important?

The California 3805P form is essential for businesses operating in California as it ensures compliance with state tax regulations. Understanding this form allows you to efficiently manage your business's documentation and avoid potential legal issues. airSlate SignNow streamlines the completion and submission of the California 3805P form, making it easier for you to focus on other aspects of your business.

-

How can airSlate SignNow help with the California 3805P form?

airSlate SignNow provides an easy-to-use platform for eSigning and managing the California 3805P form. With features like electronic signatures and document templates, you can quickly prepare your forms without the hassle of printing and scanning. Our solution ensures that your documents are securely stored and easily accessible.

-

What are the costs associated with using airSlate SignNow for the California 3805P form?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, starting at an affordable monthly rate. These plans include features specifically designed to facilitate the completion of forms like the California 3805P form. You can choose a plan that best fits your volume of document management and signing requirements.

-

Can I integrate airSlate SignNow with other applications for managing the California 3805P form?

Yes, airSlate SignNow provides seamless integrations with numerous applications such as Google Drive, Dropbox, and more. This enhances your workflow, allowing you to manage the California 3805P form alongside other documents and tools you already use. Integration ensures a smooth document management process that saves you time.

-

What features does airSlate SignNow offer for signing the California 3805P form?

airSlate SignNow includes features like customizable templates, reusable documents, and secure eSigning, specifically geared towards forms like the California 3805P form. You can track the status of your signatures in real-time, making the entire process transparent and efficient. This helps you ensure timely compliance with state regulations.

-

Is airSlate SignNow legally compliant for filing the California 3805P form?

Absolutely, airSlate SignNow complies with all electronic signature laws, including the ESIGN Act and UETA, ensuring that your signed California 3805P form is legally binding. This eliminates any uncertainty about the validity of your documents. Our platform is designed with legal compliance at its core, so you can have peace of mind while conducting business.

-

Can I save my completed California 3805P form for future reference?

Yes, once you complete and eSign the California 3805P form on airSlate SignNow, you can easily save it to your secure account. This allows you to access and download your forms whenever needed. Keeping your documents organized will help you stay prepared for audits and maintain compliance over time.

Get more for Ftb 3805p

Find out other Ftb 3805p

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation