Schedule M 3 Form 1065 Irs 2015

What is the Schedule M-3 Form 1065 IRS

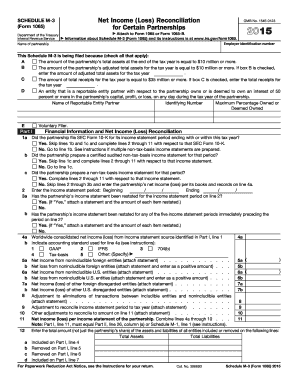

The Schedule M-3 Form 1065 is a tax form used by partnerships to provide detailed information about their income, deductions, and other tax-related items. This form is required by the IRS for partnerships with total assets exceeding ten million dollars. The Schedule M-3 enhances transparency and allows the IRS to better understand the financial activities of larger partnerships. It includes various sections that require detailed reporting, ensuring that the partnership’s financial data is accurately represented.

How to use the Schedule M-3 Form 1065 IRS

Using the Schedule M-3 Form 1065 involves several steps. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form by providing accurate figures for each required section, such as income, deductions, and tax credits. It is important to follow the instructions carefully to avoid errors that could lead to penalties. After completing the form, ensure that it is signed by an authorized partner before submission to the IRS.

Steps to complete the Schedule M-3 Form 1065 IRS

Completing the Schedule M-3 Form 1065 involves a systematic approach:

- Review the IRS guidelines for the Schedule M-3 to understand the requirements.

- Collect all relevant financial data, including income, expenses, and asset information.

- Fill out the form section by section, ensuring all figures are accurate and reflect the partnership's financial situation.

- Double-check the calculations and ensure that all necessary schedules and attachments are included.

- Sign the form and retain a copy for your records before submitting it to the IRS.

Legal use of the Schedule M-3 Form 1065 IRS

The Schedule M-3 Form 1065 is legally binding when completed and submitted correctly. It must be signed by an authorized partner, affirming that the information provided is accurate and complete. The IRS requires this form to ensure compliance with tax laws, and failure to file it correctly can result in penalties. Therefore, it is essential to adhere to all legal requirements when using this form.

Filing Deadlines / Important Dates

The filing deadline for the Schedule M-3 Form 1065 typically coincides with the partnership's tax return due date, which is usually March 15 for calendar year partnerships. If additional time is needed, partnerships can file for an extension, allowing them to submit the form by September 15. It is crucial to be aware of these deadlines to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

Partnerships can submit the Schedule M-3 Form 1065 electronically or by mail. Electronic filing is encouraged for faster processing and confirmation from the IRS. If filing by mail, ensure that the form is sent to the correct IRS address based on the partnership's location. In-person submission is typically not available for this form, as the IRS recommends electronic or mail options.

Quick guide on how to complete 2015 schedule m 3 form 1065 irs

Effortlessly Prepare Schedule M 3 Form 1065 Irs on Any Device

Digital document handling has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any holdups. Manage Schedule M 3 Form 1065 Irs on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Edit and Electronically Sign Schedule M 3 Form 1065 Irs with Ease

- Locate Schedule M 3 Form 1065 Irs and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Schedule M 3 Form 1065 Irs to ensure effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 schedule m 3 form 1065 irs

Create this form in 5 minutes!

How to create an eSignature for the 2015 schedule m 3 form 1065 irs

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Schedule M 3 Form 1065 IRS and why is it important?

The Schedule M 3 Form 1065 IRS is a supplemental form used by partnerships to reconcile income and deductions reported on their tax returns. It provides detailed financial information that can help the IRS accurately assess a partnership's tax situation, making it crucial for compliance and accurate reporting.

-

How can airSlate SignNow help with the Schedule M 3 Form 1065 IRS?

airSlate SignNow offers a streamlined solution to help businesses easily eSign and send the Schedule M 3 Form 1065 IRS. With our document management platform, you can quickly prepare, sign, and securely share your tax documents, ensuring timely submissions to the IRS.

-

Is airSlate SignNow cost-effective for filing Schedule M 3 Form 1065 IRS?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling the Schedule M 3 Form 1065 IRS. Our pricing plans are affordable and cater to different needs, allowing you to manage your eSigning and documentation processes without breaking the bank.

-

Can I integrate airSlate SignNow with my current accounting software for the Schedule M 3 Form 1065 IRS?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting software solutions, simplifying the process of preparing the Schedule M 3 Form 1065 IRS. This integration ensures you can easily manage your documents and eSignatures directly from your preferred accounting tools.

-

What features does airSlate SignNow provide for managing the Schedule M 3 Form 1065 IRS?

airSlate SignNow includes features such as templates, reminders, and tracking tools to assist you in managing the Schedule M 3 Form 1065 IRS efficiently. These features enhance your workflow, ensuring you never miss an important deadline while keeping you organized.

-

Is electronic signing of the Schedule M 3 Form 1065 IRS legally recognized?

Yes, electronic signing of the Schedule M 3 Form 1065 IRS is legally recognized in the United States. airSlate SignNow complies with all federal regulations, ensuring that your electronically signed documents are valid and secure.

-

How does airSlate SignNow ensure the security of documents like the Schedule M 3 Form 1065 IRS?

airSlate SignNow prioritizes document security by implementing advanced encryption and secure storage protocols. When managing sensitive documents like the Schedule M 3 Form 1065 IRS, you can trust that your information remains confidential and protected from unauthorized access.

Get more for Schedule M 3 Form 1065 Irs

- Clone town survey form

- Tom bosley so we had life death illness everything form

- Gmp subject access form 815 b2014b greater manchester police

- Forest school medical information form together we grow manorfarm inf bucks sch

- Toddington village hall booking form and hire agreement dumbletonvillagehall org

- A form p45 from your previous employer hand it to your present employer

- Application for firearms importexport permit saps form 311 southafrica newyork

- Spirit of adriana rajotte scholarship application form

Find out other Schedule M 3 Form 1065 Irs

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA