Schedule M 3 Form 1065 Irs 2015

What is the Schedule M-3 Form 1065 IRS

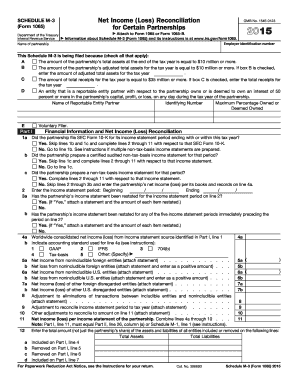

The Schedule M-3 Form 1065 is a tax form used by partnerships to provide detailed information about their income, deductions, and other tax-related items. This form is required by the IRS for partnerships with total assets exceeding ten million dollars. The Schedule M-3 enhances transparency and allows the IRS to better understand the financial activities of larger partnerships. It includes various sections that require detailed reporting, ensuring that the partnership’s financial data is accurately represented.

How to use the Schedule M-3 Form 1065 IRS

Using the Schedule M-3 Form 1065 involves several steps. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form by providing accurate figures for each required section, such as income, deductions, and tax credits. It is important to follow the instructions carefully to avoid errors that could lead to penalties. After completing the form, ensure that it is signed by an authorized partner before submission to the IRS.

Steps to complete the Schedule M-3 Form 1065 IRS

Completing the Schedule M-3 Form 1065 involves a systematic approach:

- Review the IRS guidelines for the Schedule M-3 to understand the requirements.

- Collect all relevant financial data, including income, expenses, and asset information.

- Fill out the form section by section, ensuring all figures are accurate and reflect the partnership's financial situation.

- Double-check the calculations and ensure that all necessary schedules and attachments are included.

- Sign the form and retain a copy for your records before submitting it to the IRS.

Legal use of the Schedule M-3 Form 1065 IRS

The Schedule M-3 Form 1065 is legally binding when completed and submitted correctly. It must be signed by an authorized partner, affirming that the information provided is accurate and complete. The IRS requires this form to ensure compliance with tax laws, and failure to file it correctly can result in penalties. Therefore, it is essential to adhere to all legal requirements when using this form.

Filing Deadlines / Important Dates

The filing deadline for the Schedule M-3 Form 1065 typically coincides with the partnership's tax return due date, which is usually March 15 for calendar year partnerships. If additional time is needed, partnerships can file for an extension, allowing them to submit the form by September 15. It is crucial to be aware of these deadlines to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

Partnerships can submit the Schedule M-3 Form 1065 electronically or by mail. Electronic filing is encouraged for faster processing and confirmation from the IRS. If filing by mail, ensure that the form is sent to the correct IRS address based on the partnership's location. In-person submission is typically not available for this form, as the IRS recommends electronic or mail options.

Quick guide on how to complete 2015 schedule m 3 form 1065 irs

Effortlessly Prepare Schedule M 3 Form 1065 Irs on Any Device

Digital document handling has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any holdups. Manage Schedule M 3 Form 1065 Irs on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Edit and Electronically Sign Schedule M 3 Form 1065 Irs with Ease

- Locate Schedule M 3 Form 1065 Irs and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Schedule M 3 Form 1065 Irs to ensure effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 schedule m 3 form 1065 irs

Create this form in 5 minutes!

How to create an eSignature for the 2015 schedule m 3 form 1065 irs

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Schedule M 3 Form 1065 IRS used for?

The Schedule M 3 Form 1065 IRS is used by partnerships to provide a detailed reconciliation of income and deductions. This form helps the IRS understand the differences between financial accounting income and tax income. By completing this form accurately, partnerships can ensure compliance with tax regulations.

-

How can airSlate SignNow assist with the Schedule M 3 Form 1065 IRS?

airSlate SignNow simplifies the process of completing and eSigning the Schedule M 3 Form 1065 IRS. Our platform allows users to easily create, edit, and send the necessary documents for eSignature, ensuring that all requirements are met efficiently. This streamlines the preparation process for partnerships filing their taxes.

-

Is there a cost associated with using airSlate SignNow for Schedule M 3 Form 1065 IRS?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on the features you require, you can choose a plan that fits your budget while ensuring you have access to tools necessary for handling the Schedule M 3 Form 1065 IRS efficiently.

-

What features does airSlate SignNow offer for completing the Schedule M 3 Form 1065 IRS?

airSlate SignNow provides features like customizable templates, secure eSigning, and real-time tracking for the Schedule M 3 Form 1065 IRS. These tools help you manage your documents effectively, making it easy to collaborate with partners and ensure timely submissions. The intuitive interface makes it user-friendly for all experience levels.

-

Can I integrate airSlate SignNow with other software to manage Schedule M 3 Form 1065 IRS?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, allowing you to manage the Schedule M 3 Form 1065 IRS alongside your other business processes. This integration helps streamline workflows and ensures that all your documents are synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the Schedule M 3 Form 1065 IRS?

Using airSlate SignNow for the Schedule M 3 Form 1065 IRS offers several benefits, including increased efficiency, enhanced security, and reduced errors. By digitizing your document management process, you can save time and minimize the risk of mistakes that can lead to compliance issues. Our platform also provides secure storage for all your important documents.

-

Is there customer support available for questions related to Schedule M 3 Form 1065 IRS?

Yes, airSlate SignNow offers dedicated customer support to assist with any questions regarding the Schedule M 3 Form 1065 IRS. Our knowledgeable team is available to help you navigate the platform and ensure that you’re using all features effectively for your tax needs.

Get more for Schedule M 3 Form 1065 Irs

Find out other Schedule M 3 Form 1065 Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors