Schedule M 3 2018

What is the Schedule M-3?

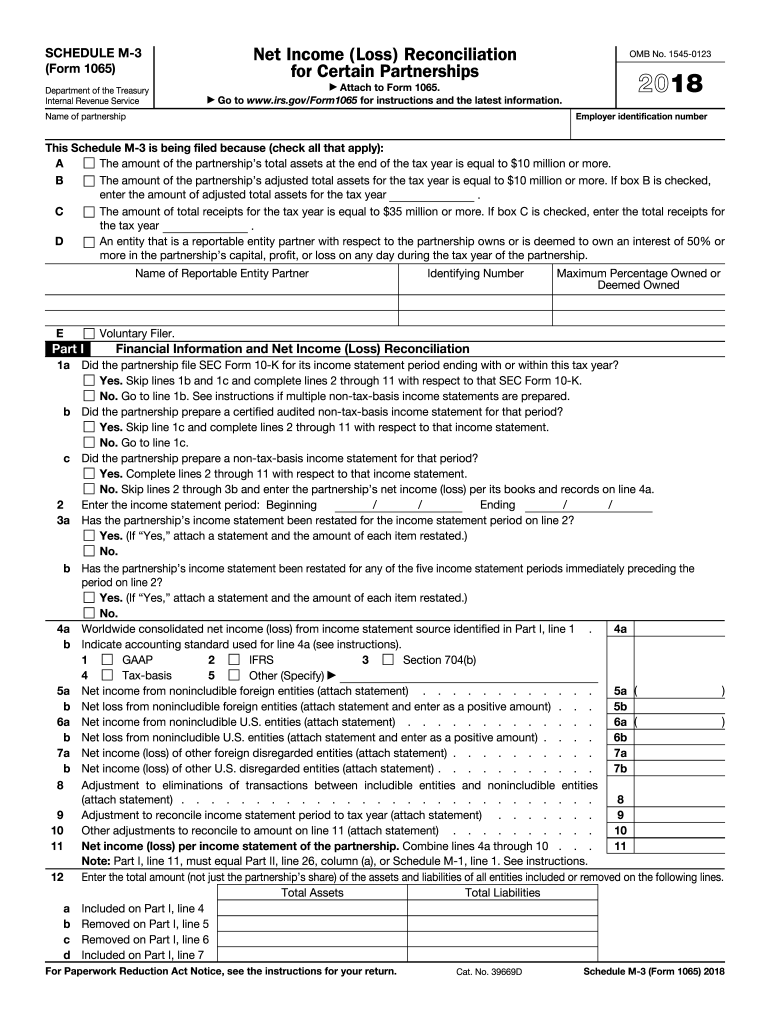

The Schedule M-3 is an IRS form designed for partnerships and corporations to report their financial information in a detailed manner. It is primarily used to reconcile financial accounting income with taxable income, ensuring transparency and compliance with tax regulations. This form is particularly relevant for larger entities that have complex financial structures, as it provides a comprehensive overview of income, deductions, and other tax-related items.

How to use the Schedule M-3

Using the Schedule M-3 involves several steps that ensure accurate reporting of financial data. Taxpayers must first gather their financial statements and relevant tax documents. Once the necessary information is compiled, the form can be filled out by following the instructions provided by the IRS. It is essential to ensure that all figures are consistent with the entity's financial records to avoid discrepancies during audits.

Steps to complete the Schedule M-3

Completing the Schedule M-3 requires careful attention to detail. Here are the key steps:

- Gather financial statements, including balance sheets and income statements.

- Review the entity's tax return to ensure all relevant data is included.

- Fill out Part I, which focuses on income and deductions.

- Complete Part II, which requires reconciliation of financial statements with tax reporting.

- Finalize Part III, where additional disclosures and explanations are provided.

- Review the completed form for accuracy before submission.

Legal use of the Schedule M-3

The Schedule M-3 must be used in accordance with IRS regulations to ensure its legal validity. It serves as a formal declaration of the entity's financial status and tax obligations. Failure to complete the form correctly or to submit it on time can lead to penalties. Entities must ensure compliance with all relevant tax laws and guidelines to avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule M-3 are aligned with the entity's tax return due dates. Typically, partnerships and corporations must file their returns by the fifteenth day of the third month following the end of their tax year. It is crucial to be aware of these deadlines to avoid late filing penalties. Extensions may be available, but they must be requested in advance.

Required Documents

To complete the Schedule M-3 accurately, several documents are necessary:

- Financial statements (balance sheet and income statement).

- Prior year tax returns for reference.

- Documentation of any adjustments or reconciliations made.

- Supporting documents for deductions and credits claimed.

Form Submission Methods

Entities can submit the Schedule M-3 through various methods. The most common ways include:

- Online submission via IRS e-file, which is efficient and secure.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, though this is less common.

Quick guide on how to complete 2017 3 form 2018 2019

Prepare Schedule M 3 effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Schedule M 3 on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Schedule M 3 without hassle

- Obtain Schedule M 3 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Modify and eSign Schedule M 3 to ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 3 form 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the 2017 3 form 2018 2019

How to make an eSignature for the 2017 3 Form 2018 2019 online

How to create an electronic signature for your 2017 3 Form 2018 2019 in Chrome

How to create an electronic signature for signing the 2017 3 Form 2018 2019 in Gmail

How to generate an electronic signature for the 2017 3 Form 2018 2019 from your smart phone

How to generate an eSignature for the 2017 3 Form 2018 2019 on iOS

How to make an eSignature for the 2017 3 Form 2018 2019 on Android

People also ask

-

What is the form m 3 used for?

The form m 3 is typically utilized for reporting certain financial information to regulatory authorities. It is essential for businesses to understand the requirements for this form so that they can ensure compliance. airSlate SignNow offers features that simplify the completion and submission of this form, making the process more efficient.

-

How does airSlate SignNow help with form m 3 submissions?

airSlate SignNow streamlines the process of filling out and eSigning the form m 3. Our platform allows users to create templates, manage documents seamlessly, and ensure timely submissions. By leveraging our services, businesses can minimize errors and enhance their filing workflow for this important form.

-

What pricing options are available for airSlate SignNow regarding form m 3?

airSlate SignNow offers various pricing tiers tailored to different business needs, ensuring that all customers can find a plan that suits their budget. Each plan includes features that support the management of vital documents like the form m 3. To get detailed pricing information, visit our website or contact our sales team.

-

Can I integrate airSlate SignNow with other applications for handling form m 3?

Yes, airSlate SignNow allows integration with various applications to enhance your workflow efficiency when dealing with form m 3. This includes cloud storage services, CRM software, and project management tools. These integrations help centralize your document handling process, making it easier to manage forms like the form m 3.

-

What are the main benefits of using airSlate SignNow for form m 3?

Using airSlate SignNow for the form m 3 offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for sensitive documents. Our platform makes it simple to obtain electronic signatures, track document status, and maintain compliance. Embracing our solution can streamline your overall document management process.

-

Is there a trial period for using airSlate SignNow with form m 3?

Absolutely! airSlate SignNow typically offers a trial period that allows businesses to experience the platform's features related to the form m 3 without any commitment. This trial gives users the opportunity to assess the ease of use, functionality, and effectiveness of our document management and eSigning capabilities.

-

How secure is airSlate SignNow for handling form m 3?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents, including the form m 3. Our platform adheres to industry standards, ensuring both data privacy and integrity. Users can confidently manage and sign their important forms, knowing their information is safe.

Get more for Schedule M 3

- Statement date citimortgage form

- Cashiers check template form

- An automated personal financial statement form national bank

- Content form 22020786

- Personal financial form fulton bank

- Uniform residential loan application new tripoli bank newtripolibank

- Uniform managed care

- Subrogation questionnaire form

Find out other Schedule M 3

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word