Form 1065 Schedule M 3 2020

What is the Form 1065 Schedule M 3

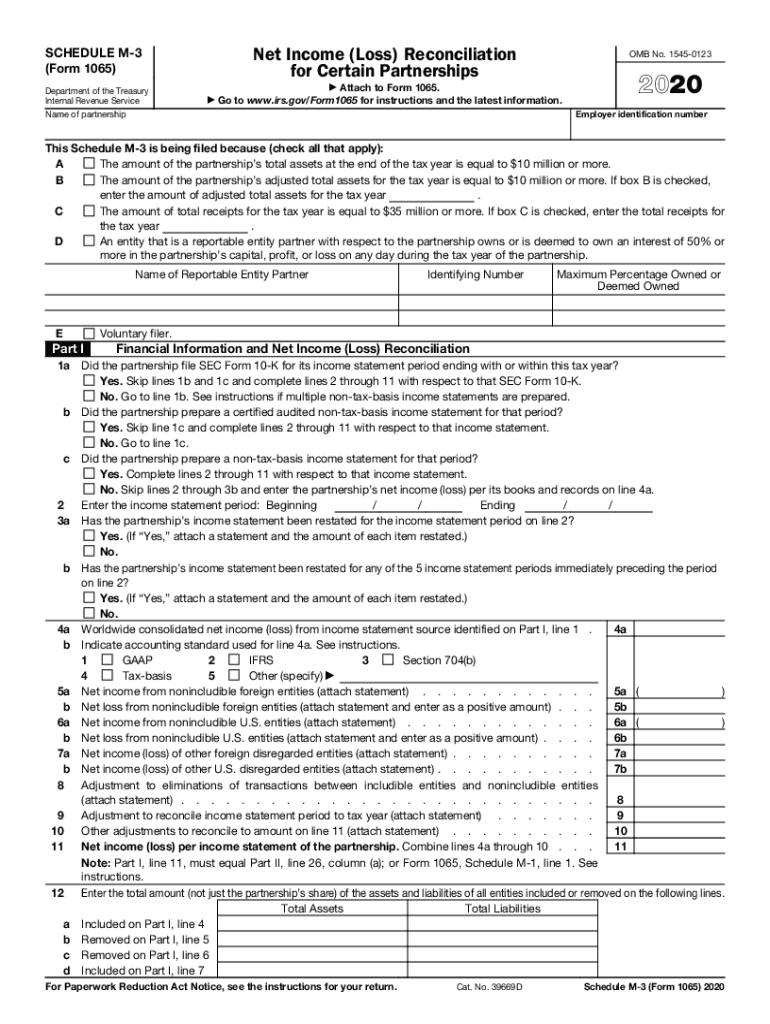

The Form 1065 Schedule M 3 is a tax form used by partnerships to report their income, deductions, and other tax-related information to the Internal Revenue Service (IRS). This form is specifically designed for partnerships that have total assets of ten million dollars or more. The Schedule M 3 provides a detailed reconciliation of income and expenses, ensuring compliance with IRS regulations and facilitating the accurate reporting of financial information.

How to use the Form 1065 Schedule M 3

To effectively use the Form 1065 Schedule M 3, partnerships must gather all necessary financial data, including income statements and balance sheets. The form requires detailed reporting of various income sources, deductions, and credits. Each section of the form must be completed accurately to reflect the partnership's financial activities. It is essential to follow the IRS guidelines closely to ensure that all information is reported correctly, minimizing the risk of errors or penalties.

Steps to complete the Form 1065 Schedule M 3

Completing the Form 1065 Schedule M 3 involves several key steps:

- Gather financial documents: Collect all relevant financial records, including income statements and balance sheets.

- Fill out the form: Begin with the general information section, followed by detailed income and expense reporting.

- Reconcile differences: Use the reconciliation section to address any discrepancies between book income and tax income.

- Review for accuracy: Ensure all entries are accurate and consistent with supporting documentation.

- Submit the form: File the completed form with the IRS by the designated deadline.

Legal use of the Form 1065 Schedule M 3

The legal use of the Form 1065 Schedule M 3 is crucial for partnerships, as it must comply with IRS regulations. This form serves as an official document that reports financial activities and tax obligations. To ensure its legal validity, partnerships must provide accurate information and maintain proper records. Additionally, electronic filing options are available, which can streamline the submission process while adhering to legal standards.

Filing Deadlines / Important Dates

Partnerships must be aware of key filing deadlines for the Form 1065 Schedule M 3. Typically, the form is due on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is usually due by March 15. If additional time is needed, partnerships can file for an extension, but it is essential to submit the extension request before the original deadline.

Penalties for Non-Compliance

Failure to comply with the requirements for the Form 1065 Schedule M 3 can result in significant penalties. The IRS may impose fines for late filing, incorrect information, or failure to file altogether. These penalties can accumulate quickly, making it vital for partnerships to ensure timely and accurate submissions. Understanding the potential consequences of non-compliance can help partnerships prioritize their tax reporting responsibilities.

Quick guide on how to complete form 1065 schedule m 3

Effortlessly Prepare Form 1065 Schedule M 3 on Any Device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without holdups. Manage Form 1065 Schedule M 3 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to alter and eSign Form 1065 Schedule M 3 without hassle

- Obtain Form 1065 Schedule M 3 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using the utilities that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to missing or misplaced files, tedious document searches, and mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1065 Schedule M 3 and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1065 schedule m 3

Create this form in 5 minutes!

How to create an eSignature for the form 1065 schedule m 3

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 2019 m 3?

airSlate SignNow is a leading eSignature solution that simplifies the process of sending and signing documents. In 2019, it introduced signNow features that enhance user experience, making it an ideal choice for businesses seeking efficiency in document management with a focus on the 2019 m 3.

-

What pricing plans does airSlate SignNow offer for the 2019 m 3 solution?

airSlate SignNow offers various pricing plans tailored for businesses looking for flexibility and comprehensiveness in their eSignature solutions. The 2019 m 3 features can be accessed through multiple pricing tiers, catering to different business needs while ensuring cost-effectiveness.

-

What are the key features of the airSlate SignNow 2019 m 3 version?

The 2019 m 3 version of airSlate SignNow includes enhanced mobile compatibility, advanced document tracking, and team collaboration tools. These features are designed to streamline the eSigning process and improve overall productivity for businesses looking for an efficient document management solution.

-

How can airSlate SignNow benefit my business using the 2019 m 3?

Using airSlate SignNow with the 2019 m 3 features can signNowly enhance your business operations by reducing turnaround time for document signing and increasing compliance. This results in higher efficiency, allowing your team to focus on core tasks while managing documents securely.

-

Does airSlate SignNow integrate with other tools while utilizing the 2019 m 3?

Yes, airSlate SignNow offers integrations with various popular applications such as Salesforce, Google Workspace, and Microsoft Office. The 2019 m 3 version ensures seamless connectivity, allowing businesses to enhance their workflows without having to switch between multiple platforms.

-

Is airSlate SignNow secure for document transactions in the 2019 m 3 framework?

Absolutely! airSlate SignNow utilizes industry-standard encryption and security practices to protect your documents. The 2019 m 3 solution prioritizes security, ensuring that all transactions are safe and compliant with legal regulations.

-

Can I customize the signing experience with the airSlate SignNow 2019 m 3?

Yes, the airSlate SignNow platform allows for a high level of customization in the signing experience. With the 2019 m 3 capabilities, users can tailor the signing workflow to fit their specific business needs, enhancing user satisfaction and engagement.

Get more for Form 1065 Schedule M 3

- Cocodoccomform1830421 schedule j form 990schedule j form 990 department of the treasury internal

- 2021 schedule ca 540nr california adjustments nonresidents or part year residents 2021 schedule ca 540nr california adjustments form

- About form 1041 t allocation of estimated tax payments to

- Instructions for form 941 ss 062022internal revenue service

- 2021 form 8453 llc california e file return authorization for limited liability companies 2021 form 8453 llc california e file

- Instructions for form 720 rev september 2022 instructions for form 720 quarterly federal excise tax return

- Business tax forms kettering

- Wwwirsgovpubirs pdf2022 form 1040 es internal revenue service

Find out other Form 1065 Schedule M 3

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement