Schedule M 3 Form 1065 IRS Gov Irs 2016

What is the Schedule M-3 Form 1065?

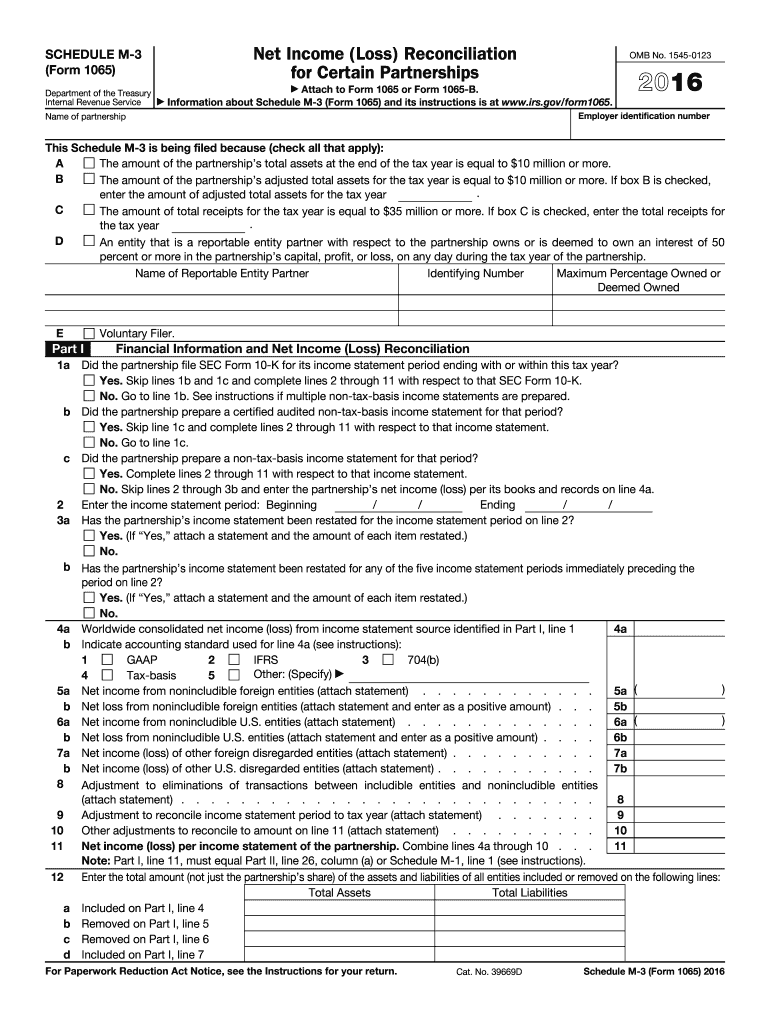

The Schedule M-3 Form 1065 is a tax form used by partnerships to provide a detailed reconciliation of income, deductions, and other tax-related items. This form is required by the IRS for partnerships with total assets of $10 million or more. It serves to enhance transparency and compliance in reporting, ensuring that partnerships accurately disclose their financial activities. The Schedule M-3 includes various sections that require detailed reporting of financial information, making it distinct from the simpler Schedule M-1.

How to use the Schedule M-3 Form 1065

To effectively use the Schedule M-3 Form 1065, partnerships must first gather all necessary financial documentation, including income statements, balance sheets, and tax records. The form consists of three main parts: Part I focuses on the reconciliation of income (loss) for the partnership, Part II addresses the reconciliation of deductions, and Part III requires detailed reporting of specific items. It is essential to follow the instructions provided by the IRS carefully to ensure accurate completion and compliance with tax regulations.

Steps to complete the Schedule M-3 Form 1065

Completing the Schedule M-3 Form 1065 involves several key steps:

- Gather all relevant financial documents, including prior year tax returns and current year financial statements.

- Begin with Part I, where you will reconcile the partnership's total income (loss) with the income reported on the tax return.

- Proceed to Part II to reconcile deductions, ensuring that all deductions claimed are properly documented and justified.

- Complete Part III by providing detailed information on specific items, such as tax credits and other adjustments.

- Review the completed form for accuracy before submitting it with the partnership's Form 1065.

Legal use of the Schedule M-3 Form 1065

The Schedule M-3 Form 1065 is legally required for certain partnerships under IRS regulations. Its use ensures compliance with federal tax laws, as it provides the IRS with a comprehensive view of a partnership's financial activities. Properly completing and filing this form helps to avoid penalties associated with inaccurate reporting or non-compliance. It is important for partnerships to maintain accurate records and consult with tax professionals if needed to ensure legal adherence.

Filing Deadlines / Important Dates

The filing deadline for the Schedule M-3 Form 1065 aligns with the due date for Form 1065, which is typically March 15 for calendar-year partnerships. If additional time is needed, partnerships may file for an extension, allowing for an additional six months. It is crucial to adhere to these deadlines to avoid late filing penalties, which can accumulate over time. Partnerships should mark their calendars and prepare their documentation well in advance of these important dates.

Form Submission Methods

Partnerships can submit the Schedule M-3 Form 1065 in several ways:

- Online: Many tax software programs allow for electronic filing of Form 1065 and its accompanying schedules, including the Schedule M-3.

- Mail: Partnerships may choose to print and mail the completed form to the appropriate IRS address based on their location.

- In-Person: Although less common, partnerships can also deliver their forms directly to an IRS office, ensuring they receive confirmation of submission.

Quick guide on how to complete 2016 schedule m 3 form 1065 irsgov irs

Effortlessly prepare Schedule M 3 Form 1065 IRS gov Irs on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers a wonderful eco-friendly substitute for conventional printed and signed documents, as you can access the suitable form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any hold-ups. Manage Schedule M 3 Form 1065 IRS gov Irs on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The simplest way to edit and eSign Schedule M 3 Form 1065 IRS gov Irs with ease

- Obtain Schedule M 3 Form 1065 IRS gov Irs and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this task.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form searches, or mistakes requiring printed new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule M 3 Form 1065 IRS gov Irs and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 schedule m 3 form 1065 irsgov irs

Create this form in 5 minutes!

How to create an eSignature for the 2016 schedule m 3 form 1065 irsgov irs

How to generate an eSignature for your 2016 Schedule M 3 Form 1065 Irsgov Irs in the online mode

How to make an electronic signature for the 2016 Schedule M 3 Form 1065 Irsgov Irs in Chrome

How to create an eSignature for putting it on the 2016 Schedule M 3 Form 1065 Irsgov Irs in Gmail

How to generate an eSignature for the 2016 Schedule M 3 Form 1065 Irsgov Irs straight from your mobile device

How to create an eSignature for the 2016 Schedule M 3 Form 1065 Irsgov Irs on iOS

How to create an electronic signature for the 2016 Schedule M 3 Form 1065 Irsgov Irs on Android devices

People also ask

-

What is the Schedule M 3 Form 1065 IRS gov Irs?

The Schedule M 3 Form 1065 IRS gov Irs is a tax form required for partnerships to report income, deductions, and other financial information to the IRS. It's a crucial component of the partnership tax return that ensures your reporting is accurate and compliant.

-

How can airSlate SignNow assist with completing the Schedule M 3 Form 1065 IRS gov Irs?

airSlate SignNow offers intuitive templates and eSigning features that streamline the process of preparing and submitting the Schedule M 3 Form 1065 IRS gov Irs. With our platform, you can easily send, sign, and store your documents securely.

-

Is there a cost associated with using airSlate SignNow for the Schedule M 3 Form 1065 IRS gov Irs?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our plans provide a cost-effective solution for managing documents, including the preparation of the Schedule M 3 Form 1065 IRS gov Irs.

-

What features does airSlate SignNow offer for document management related to the Schedule M 3 Form 1065 IRS gov Irs?

airSlate SignNow includes features such as document templates, eSigning, secure storage, and collaborative tools. These features make it easier to manage the Schedule M 3 Form 1065 IRS gov Irs and ensure all parties can access and sign the document seamlessly.

-

Can I integrate airSlate SignNow with other software for managing the Schedule M 3 Form 1065 IRS gov Irs?

Absolutely! airSlate SignNow integrates with various accounting and cloud storage platforms. This means you can easily incorporate the Schedule M 3 Form 1065 IRS gov Irs into your existing workflow and improve efficiency.

-

How does airSlate SignNow ensure the security of my Schedule M 3 Form 1065 IRS gov Irs documents?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption protocols and complies with industry standards to ensure that your Schedule M 3 Form 1065 IRS gov Irs documents are protected and securely stored.

-

What are the benefits of using airSlate SignNow for the Schedule M 3 Form 1065 IRS gov Irs?

Using airSlate SignNow provides numerous benefits including time savings, increased accuracy, and enhanced collaboration. These advantages can signNowly simplify the process of handling the Schedule M 3 Form 1065 IRS gov Irs.

Get more for Schedule M 3 Form 1065 IRS gov Irs

Find out other Schedule M 3 Form 1065 IRS gov Irs

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online