Schedule M 3 for 1065 Form 2010

What is the Schedule M-3 For 1065 Form

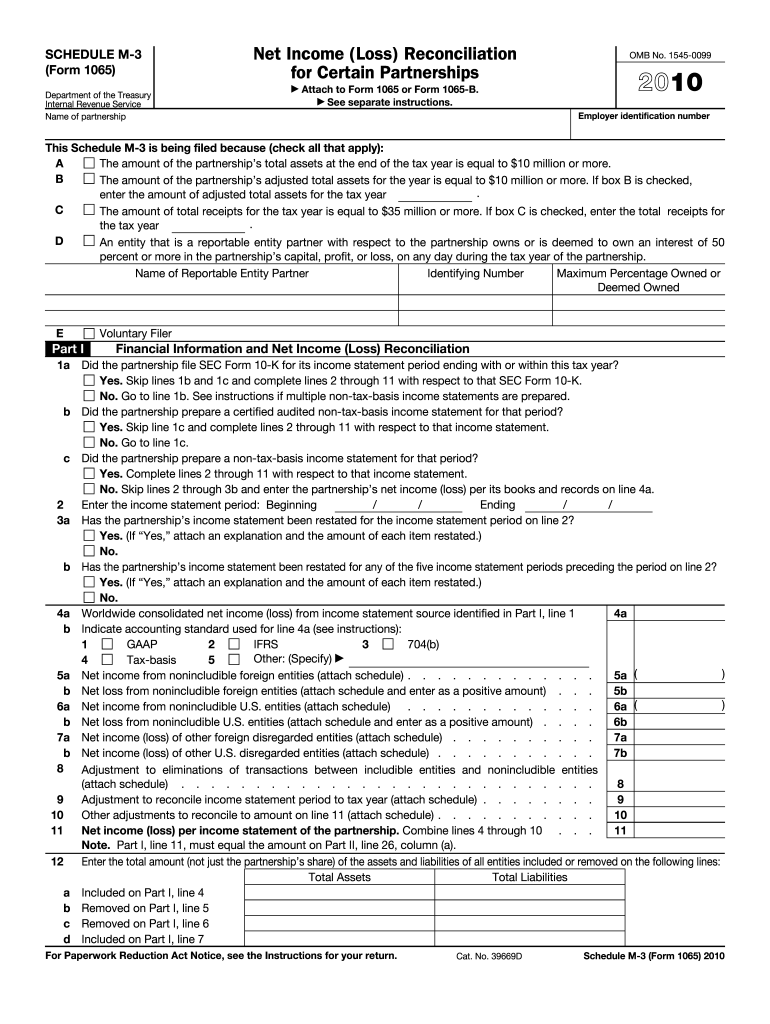

The Schedule M-3 for Form 1065 is a tax form used by partnerships to report their financial information to the Internal Revenue Service (IRS). This form is specifically designed for larger partnerships that have total assets of ten million dollars or more. It provides a detailed reconciliation of income, deductions, and other tax-related information, ensuring compliance with IRS regulations. The Schedule M-3 is essential for accurately reporting the partnership's financial activities and ensuring transparency in tax reporting.

How to use the Schedule M-3 For 1065 Form

Using the Schedule M-3 for Form 1065 involves several steps to ensure accurate completion. First, gather all necessary financial records, including income statements and balance sheets. Next, fill out the form by providing detailed information about the partnership's income, deductions, and any adjustments. It is crucial to follow the IRS instructions closely to avoid errors. Once completed, the form must be submitted along with the main Form 1065 by the filing deadline. Utilizing digital tools can streamline this process, making it easier to complete and eSign the form securely.

Steps to complete the Schedule M-3 For 1065 Form

Completing the Schedule M-3 for Form 1065 involves a series of methodical steps:

- Gather all relevant financial documents, including prior year tax returns, income statements, and balance sheets.

- Begin filling out the form by entering the partnership's identifying information at the top.

- Provide details about the partnership's income, including ordinary business income and other sources.

- List all deductions and adjustments, ensuring that each entry is supported by appropriate documentation.

- Review the completed form for accuracy, ensuring all calculations are correct and all necessary information is included.

- Submit the Schedule M-3 along with Form 1065 by the specified deadline, either electronically or via mail.

Legal use of the Schedule M-3 For 1065 Form

The legal use of the Schedule M-3 for Form 1065 is governed by IRS regulations. To be considered valid, the form must be accurately completed and submitted by the partnership's tax filing deadline. Electronic signatures are permissible, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. It is essential for partnerships to retain copies of submitted forms and any supporting documentation for future reference, as these may be required in case of an audit.

Filing Deadlines / Important Dates

The filing deadline for the Schedule M-3 for Form 1065 typically aligns with the due date for the partnership's tax return. For most partnerships, this date is March 15 for calendar year filers. However, if the partnership has a fiscal year, the deadline will be the 15th day of the third month following the end of the fiscal year. Extensions may be requested, but it is important to file the Schedule M-3 on time to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Schedule M-3 for Form 1065 can be submitted in several ways. Partnerships can file electronically using IRS-approved software, which often simplifies the process and reduces the risk of errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submissions are generally not accepted, as the IRS encourages electronic filing for efficiency. It is important to follow the submission guidelines provided by the IRS to ensure proper processing.

Quick guide on how to complete 2010 schedule m 3 for 1065 form

Complete Schedule M 3 For 1065 Form effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Schedule M 3 For 1065 Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Schedule M 3 For 1065 Form with ease

- Find Schedule M 3 For 1065 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Alter and eSign Schedule M 3 For 1065 Form to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 schedule m 3 for 1065 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 schedule m 3 for 1065 form

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Schedule M 3 For 1065 Form?

The Schedule M 3 For 1065 Form is a tax form used by partnerships to report their income, deductions, and other tax-related information. It provides a detailed breakdown of the partnership's financial activities, ensuring compliance with IRS requirements. By effectively completing this form, businesses can streamline their tax reporting process.

-

How does airSlate SignNow assist with the Schedule M 3 For 1065 Form?

airSlate SignNow simplifies the process of preparing and eSigning the Schedule M 3 For 1065 Form. Our platform allows you to easily upload, fill, and sign your forms securely. This digital solution reduces errors and enhances efficiency, helping you stay organized during tax season.

-

What are the key features of airSlate SignNow for tax forms like Schedule M 3 For 1065?

Key features of airSlate SignNow include customizable templates, secure cloud storage, and automated workflows. These tools allow users to create, manage, and sign the Schedule M 3 For 1065 Form effortlessly. With our platform, you can enhance productivity and ensure accuracy.

-

Is airSlate SignNow cost-effective for submitting Schedule M 3 For 1065 Forms?

Yes, airSlate SignNow offers a cost-effective solution for submitting the Schedule M 3 For 1065 Form. Our pricing plans are designed to cater to businesses of all sizes, ensuring affordability without compromising on features. By utilizing our platform, you can save time and resources on document management.

-

Can I integrate airSlate SignNow with other accounting software for Schedule M 3 For 1065?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software platforms, making it easy to manage the Schedule M 3 For 1065 Form. This integration allows for automatic data population, reducing manual entry and the risk of errors, thus streamlining your overall tax preparation process.

-

What are the benefits of using airSlate SignNow for tax forms like Schedule M 3 For 1065?

Using airSlate SignNow for the Schedule M 3 For 1065 Form provides several benefits, including enhanced security, ease of access, and improved collaboration. Our platform ensures that your sensitive information is safe while allowing multiple users to review and sign documents efficiently. This collaborative approach helps speed up the tax filing process.

-

How secure is airSlate SignNow when handling Schedule M 3 For 1065 Forms?

airSlate SignNow prioritizes security, implementing advanced encryption and secure access controls for all documents, including the Schedule M 3 For 1065 Form. Our platform complies with industry standards and regulations, ensuring that your sensitive tax information is protected at all times.

Get more for Schedule M 3 For 1065 Form

- Mercedes benz bursary form

- Khanyisa nursing college online application 2021 form

- Open capitec account online application form

- Tshwane south college online application 2021 form

- Uif forms 15783650

- Department of labour forms

- Elangeni college online application for 2021 form

- Vuselela college online application for 2021 form

Find out other Schedule M 3 For 1065 Form

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe