Bir Form 2307Withholding TaxValue Added Tax 2018-2026

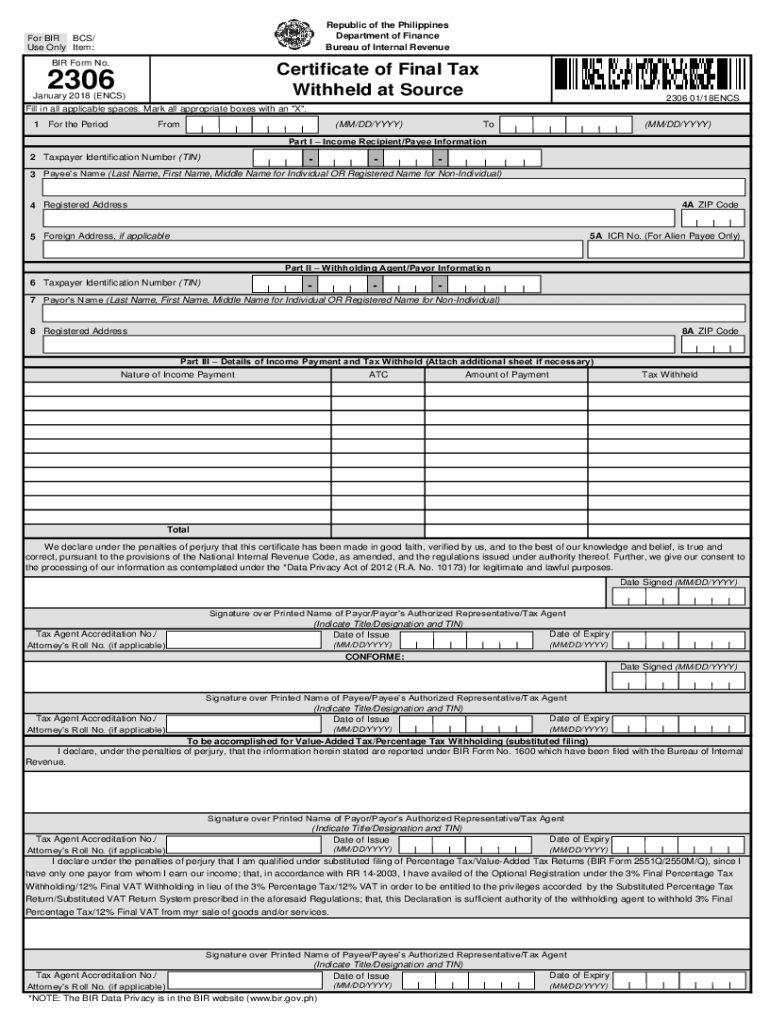

Understanding the 2306 Bir Form

The 2306 Bir Form is a crucial document used in the Philippines for tax purposes, specifically relating to withholding tax and value-added tax (VAT). This form is essential for businesses and individuals who need to report and remit taxes withheld from payments made to employees or service providers. The form ensures compliance with tax regulations and helps maintain accurate financial records.

Steps to Complete the 2306 Bir Form

Completing the 2306 Bir Form involves several key steps:

- Gather necessary information, including taxpayer identification numbers and details of the payments made.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total amount of withholding tax based on the applicable rates.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate tax authority, either online or via mail.

Legal Use of the 2306 Bir Form

The 2306 Bir Form is legally binding when completed and submitted according to the guidelines set by the Bureau of Internal Revenue (BIR). It is important to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or legal issues. Utilizing a reliable platform for electronic submission can enhance security and compliance, making the process smoother and more efficient.

Filing Deadlines and Important Dates

Timely filing of the 2306 Bir Form is critical to avoid penalties. Generally, the form must be submitted within a specified period after the withholding occurs. It is advisable to check the BIR's official schedule for specific deadlines, as these can vary based on the type of taxpayer and the nature of the payments. Keeping track of these dates ensures compliance and helps maintain good standing with tax authorities.

Required Documents for Submission

When submitting the 2306 Bir Form, certain documents are typically required to support the information provided. These may include:

- Proof of payment or transaction records.

- Taxpayer identification numbers for both the withholding agent and the payee.

- Any relevant contracts or agreements related to the payments.

Having these documents ready can facilitate a smoother submission process and help in case of audits or inquiries from tax authorities.

Examples of Using the 2306 Bir Form

The 2306 Bir Form is commonly used in various scenarios, such as:

- Employers withholding tax from employee salaries.

- Businesses making payments to contractors or freelancers.

- Entities involved in real estate transactions where withholding tax applies.

Understanding these examples can help taxpayers recognize situations where the form is necessary, ensuring compliance with tax obligations.

Quick guide on how to complete bir form 2307withholding taxvalue added tax

Prepare Bir Form 2307Withholding TaxValue Added Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Bir Form 2307Withholding TaxValue Added Tax on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to amend and electronically sign Bir Form 2307Withholding TaxValue Added Tax with ease

- Find Bir Form 2307Withholding TaxValue Added Tax and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, invite link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Bir Form 2307Withholding TaxValue Added Tax and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bir form 2307withholding taxvalue added tax

Create this form in 5 minutes!

How to create an eSignature for the bir form 2307withholding taxvalue added tax

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the 2306 bir form and who needs it?

The 2306 bir form is a tax declaration document required by specific businesses in Turkey. It provides crucial financial information to tax authorities and helps in proper compliance. Understanding how to fill out the 2306 bir form accurately can save time and prevent penalties.

-

How can airSlate SignNow assist with the 2306 bir form?

airSlate SignNow streamlines the process of filling and signing the 2306 bir form by providing easy-to-use electronic signature solutions. Users can quickly upload their forms, secure necessary signatures, and share documents with stakeholders. This improvement in efficiency ensures a smoother tax filing process.

-

Is there any cost associated with using airSlate SignNow for the 2306 bir form?

Yes, airSlate SignNow offers a subscription model with various pricing plans tailored to different business needs, including handling the 2306 bir form. The investment can be justified by the time saved and enhanced compliance with tax regulations. Free trials are also available to assess the service before committing financially.

-

What features does airSlate SignNow provide for managing documents like the 2306 bir form?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage for managing documents like the 2306 bir form. These tools enhance collaboration and ensure that all necessary signatures are obtained efficiently. Additionally, users can track the status of their documents in real-time.

-

Can I integrate airSlate SignNow with other tools for managing the 2306 bir form?

Yes, airSlate SignNow offers integration capabilities with a range of applications like Google Drive, Dropbox, and CRM systems. This allows users to manage their 2306 bir form and other documents seamlessly within their existing workflows. Integrations enhance productivity and reduce data silos.

-

What are the benefits of using airSlate SignNow for the 2306 bir form over traditional methods?

Using airSlate SignNow for the 2306 bir form offers several benefits, including faster processing times, reduced paper use, and easier document retrieval. Electronic signatures provide legal validity while enhancing workflow efficiency. By minimizing manual work, businesses can focus more on strategic tasks.

-

Is airSlate SignNow secure for handling the 2306 bir form?

Absolutely! airSlate SignNow employs top-tier security measures, including encryption and secure servers, to protect users' data when handling sensitive documents such as the 2306 bir form. Compliance with leading industry standards ensures that your information remains private and secure.

Get more for Bir Form 2307Withholding TaxValue Added Tax

- Fillable online 50 129 application for 1 d 1 open space form

- Form 50 285 ampquotlessees affidavit motor vehicle use other than

- Form 1099 r form 1099 r

- Form 50 114 a ampquotresidence homestead exemption affidavitsampquot texas

- Form 50 144 ampquotbusiness personal property rendition of taxable property

- Form st 11 commonwealth of virginia sales and use tax certificate of exemption

- Oic individual doubtful collectibility package offer in compromise individual doubtful collectibility package 625515001 form

- Virginia department of taxation form np 1 sales and use tax exemption

Find out other Bir Form 2307Withholding TaxValue Added Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors