Caution DO NOT Use This Version for Discharge of Indebtedness in Tax Years Beginning After 1993

What is the Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After

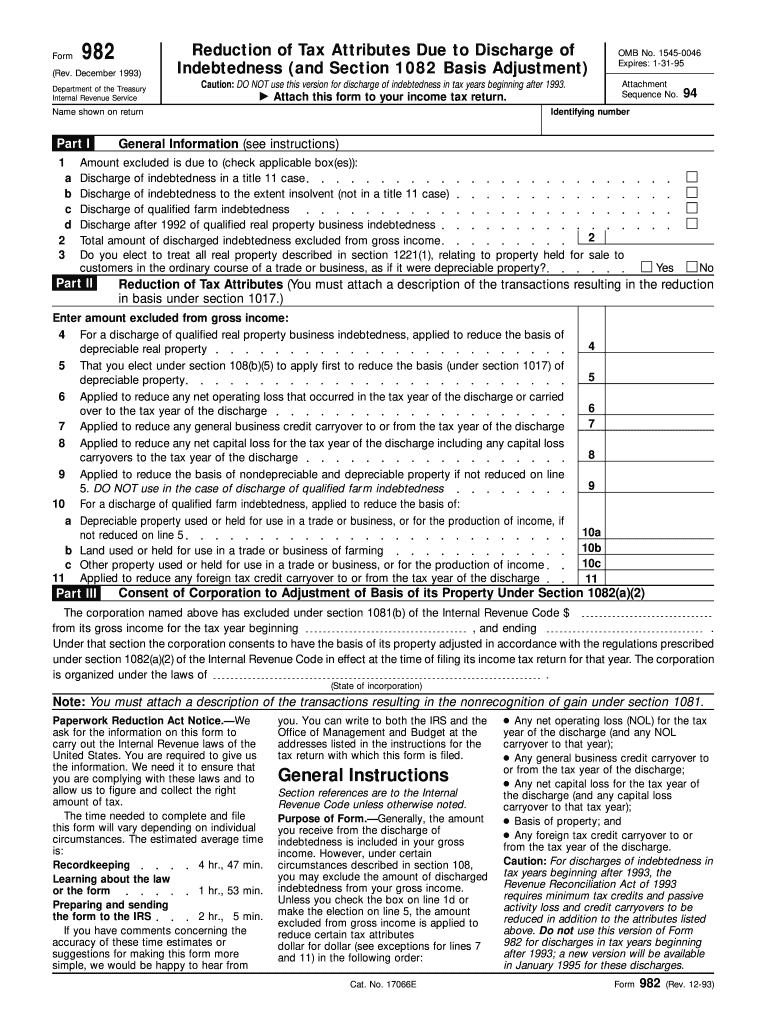

The "Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After" form is a critical tax document used in the United States to report certain types of debt forgiveness. This form is specifically designed to ensure compliance with IRS regulations regarding the discharge of indebtedness. It is essential for taxpayers to understand that using an outdated version of this form may lead to complications or penalties. The form serves as a formal declaration that certain debts have been forgiven, which can have significant tax implications for the individual or business involved.

How to use the Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After

Using the "Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After" form involves several important steps. First, ensure that you have the correct version of the form, as using an outdated version can result in non-compliance with IRS guidelines. Next, fill out the form accurately, providing all required information regarding the debt discharged. After completing the form, it is crucial to retain a copy for your records and submit it according to IRS instructions. This form can be filed electronically or via mail, depending on your preference and the specific requirements of your tax situation.

Steps to complete the Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After

Completing the "Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After" form involves a series of methodical steps:

- Obtain the latest version of the form from the IRS website or a trusted source.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Detail the nature of the debt that has been discharged, including the amount and the reason for the discharge.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

- Keep a copy for your records and submit the form as per IRS guidelines.

Legal use of the Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After

The legal use of the "Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After" form is governed by IRS regulations. It is essential to use the correct form to ensure that the discharge of indebtedness is reported accurately. Failure to comply with IRS requirements can lead to penalties, including fines or additional taxes owed. This form is legally binding when filled out correctly and submitted in accordance with IRS rules. It is advisable to consult a tax professional if there are any uncertainties regarding the form's usage or requirements.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the "Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After" form. Taxpayers must adhere to these guidelines to avoid complications. The IRS outlines the types of debts that can be reported, the necessary documentation required, and the deadlines for submission. It is crucial to stay informed about any updates or changes to these guidelines, as they can affect how the form is completed and submitted. Regularly reviewing IRS publications can help ensure compliance.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the "Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After" form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the IRS. It is essential for taxpayers to understand the importance of submitting the correct form and adhering to all filing deadlines. Non-compliance can lead to legal repercussions and financial burdens that may be difficult to manage.

Quick guide on how to complete caution do not use this version for discharge of indebtedness in tax years beginning after 1993

Complete Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the right template and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After with ease

- Find Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and holds the same legal standing as a handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your document, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct caution do not use this version for discharge of indebtedness in tax years beginning after 1993

Create this form in 5 minutes!

How to create an eSignature for the caution do not use this version for discharge of indebtedness in tax years beginning after 1993

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What should I know about using airSlate SignNow for financial documents?

When using airSlate SignNow, it’s important to remember that you should exercise caution. Specifically, Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After, as it may lead to compliance issues for your business.

-

How does airSlate SignNow ensure my documents are secure?

airSlate SignNow prioritizes document security through advanced encryption and secure cloud storage. However, it's crucial to remember that Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After, which may affect the legality of your documents.

-

What features does airSlate SignNow offer for eSigning?

airSlate SignNow offers a wide range of features including customizable templates, in-person signing, and mobile access. Nonetheless, keep in mind to exercise Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After to avoid potential problems.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to suit businesses of all sizes. Be sure to check the terms, especially regarding documents subjected to Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications like CRM systems and document management solutions. Just remember to exercise caution and DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After for compliance reasons.

-

What are the benefits of using airSlate SignNow for my business?

The main benefits of airSlate SignNow include increased efficiency, enhanced professionalism, and lower operational costs. Always bear in mind that Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After may pose risks to your financial documentation.

-

Is customer support available for airSlate SignNow users?

Yes, airSlate SignNow provides dedicated customer support to assist users with any queries they may have. It’s advisable to clarify concerns around compliance, particularly when Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After is relevant.

Get more for Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After

- 2020 form 4136 credit for federal tax paid on fuels

- 2019 instructions for schedule f internal revenue service form

- Small claims court ronnie fussell clerk of the form

- Building code enforcement addressname change request form

- Doh application form for renewal of license to operate 2020

- Pilotage exemption certificate pec application form maritime nz

- 2019 schedule f instructions form

- The purpose of this form is to request a leave of absence under the family and medical leave act fmla including absences

Find out other Caution DO NOT Use This Version For Discharge Of Indebtedness In Tax Years Beginning After

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online