Form 982 2016

What is the Form 982

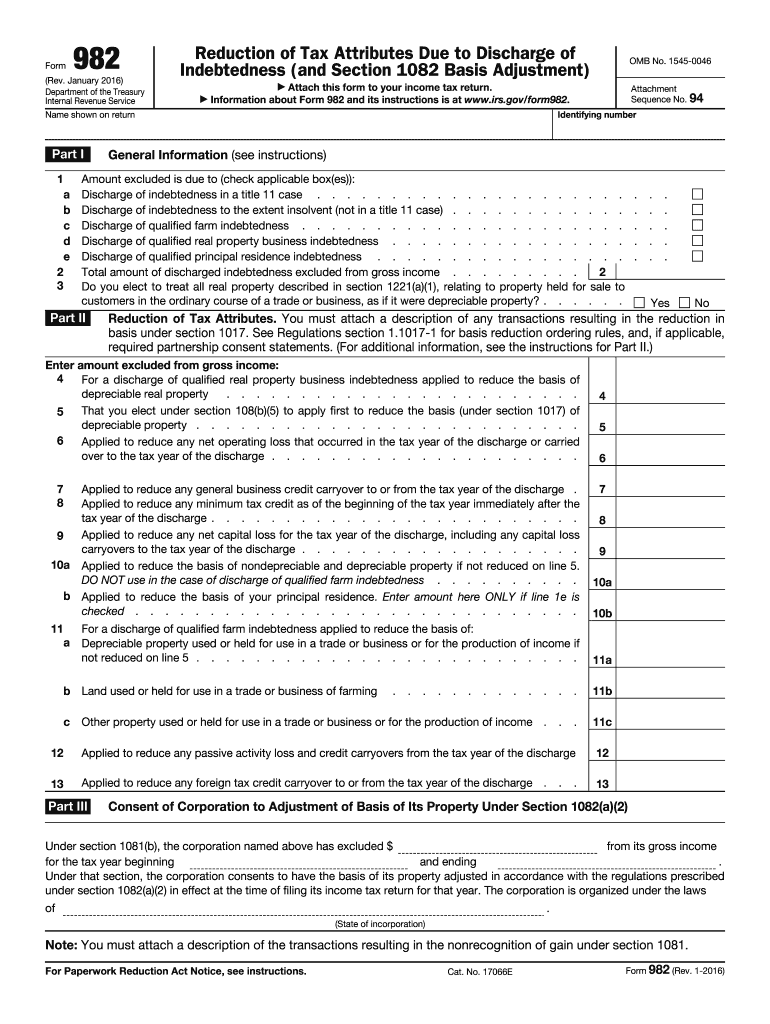

The Form 982 is a tax form used by taxpayers to claim a reduction of tax attributes due to discharge of indebtedness. This form is particularly relevant for individuals and businesses that have experienced debt cancellation, allowing them to exclude certain amounts from their taxable income. By filing Form 982, taxpayers can adjust their tax liabilities accordingly, ensuring compliance with IRS regulations while potentially reducing their overall tax burden.

How to use the Form 982

Using Form 982 involves several key steps. First, gather all necessary financial documents related to the debt cancellation. This includes any notices from creditors regarding the discharge of debt. Next, complete the form by providing accurate information about the amount of debt discharged and the specific tax attributes being reduced. It is crucial to follow the instructions carefully to ensure that the form is filled out correctly. Once completed, the form should be submitted along with your tax return for the year in which the debt was discharged.

Steps to complete the Form 982

Completing Form 982 requires attention to detail. Begin by entering your personal information at the top of the form. Next, indicate the type of discharge you are claiming and the amount. Depending on your situation, you may need to reduce various tax attributes, such as net operating losses or credits. Ensure that you provide accurate figures and check for any required attachments. Finally, review the entire form for accuracy before submitting it with your tax return.

Legal use of the Form 982

Form 982 is legally recognized by the IRS and must be used in accordance with federal tax laws. To ensure its legal validity, taxpayers must accurately report the details of the debt cancellation and adhere to the guidelines set forth by the IRS. Misuse of the form can lead to penalties or audits. Therefore, it is essential to maintain thorough documentation and consult with a tax professional if needed, to ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for Form 982 align with the standard tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If you are claiming a discharge of debt that occurred during the tax year, it is important to file Form 982 with your tax return by this deadline. Extensions may be available, but it is crucial to check the IRS guidelines for specific dates and requirements to avoid penalties.

Who Issues the Form

The Form 982 is issued by the Internal Revenue Service (IRS), the U.S. federal agency responsible for tax collection and enforcement. Taxpayers can obtain the form directly from the IRS website or through various tax preparation software platforms. It is important to ensure that you are using the most current version of the form, as tax laws and requirements may change from year to year.

Quick guide on how to complete form 982 2016

Complete Form 982 effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 982 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Form 982 hassle-free

- Find Form 982 and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Select relevant portions of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Decide how you wish to send your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 982 to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 982 2016

Create this form in 5 minutes!

How to create an eSignature for the form 982 2016

How to create an eSignature for the Form 982 2016 in the online mode

How to generate an electronic signature for the Form 982 2016 in Google Chrome

How to make an electronic signature for putting it on the Form 982 2016 in Gmail

How to make an eSignature for the Form 982 2016 from your smartphone

How to generate an electronic signature for the Form 982 2016 on iOS devices

How to generate an electronic signature for the Form 982 2016 on Android

People also ask

-

What is Form 982 and how is it used in airSlate SignNow?

Form 982 is a crucial IRS form that facilitates the exclusion of canceled debt from taxable income. In airSlate SignNow, you can easily prepare, send, and eSign Form 982, simplifying the process of dealing with tax implications related to debt cancellation. Our platform allows you to manage this document seamlessly, ensuring compliance and efficiency.

-

How does airSlate SignNow simplify the process of completing Form 982?

airSlate SignNow streamlines the completion of Form 982 by providing intuitive document templates and easy fillable fields. With our electronic signature feature, users can quickly sign and send the form, reducing paperwork and turnaround time. This makes it easier for businesses to handle tax documentation efficiently.

-

Are there any costs associated with using Form 982 on airSlate SignNow?

While airSlate SignNow offers several pricing plans, using Form 982 specifically does not incur additional costs beyond the chosen subscription. Our pricing is transparent, allowing businesses to choose the plan that best suits their needs without hidden fees for individual forms like Form 982.

-

What features does airSlate SignNow offer for managing Form 982?

airSlate SignNow provides various features for managing Form 982, including customizable templates, e-signatures, and secure cloud storage. Additionally, users can track document status in real-time, ensuring that all signatures and approvals are completed promptly for tax compliance.

-

Can I integrate airSlate SignNow with other software when working with Form 982?

Yes, airSlate SignNow integrates seamlessly with a wide range of software applications, enhancing the management of Form 982. Whether you use CRM systems or accounting software, our integrations allow for smooth data transfer and improved workflows, making document handling more efficient.

-

What benefits does using airSlate SignNow for Form 982 provide to businesses?

Using airSlate SignNow for Form 982 offers numerous benefits, including increased efficiency, reduced errors, and improved compliance. Our platform's user-friendly interface helps businesses navigate complex tax forms with ease, ensuring that all necessary documentation is completed accurately and on time.

-

Is airSlate SignNow secure for sending sensitive documents like Form 982?

Absolutely, airSlate SignNow prioritizes security for all documents, including Form 982. Our platform employs advanced encryption and compliance with industry standards, ensuring that sensitive information remains protected during transmission and storage.

Get more for Form 982

- Louisiana power of attorney to transfer motor vehicle signed form

- California promissory note in connection with sale of vehicle or automobile form

- Virginia gift deed for individual to individual form

- Montana bill of sale for automobile or vehicle including odometer statement and promissory note form

- Illinois warranty deed from individual to llc form

- Nebraska assignment of contract for deed by seller form

- Connecticut legal last will and testament form for single person with adult and minor children

- Florida final notice of default for past due payments in connection with contract for deed form

Find out other Form 982

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple