Form 982 Rev December Reduction of Tax Attributes Due to Discharge of Indebtedness and Section 1082 Basis Adjustment 2013

What is the Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment

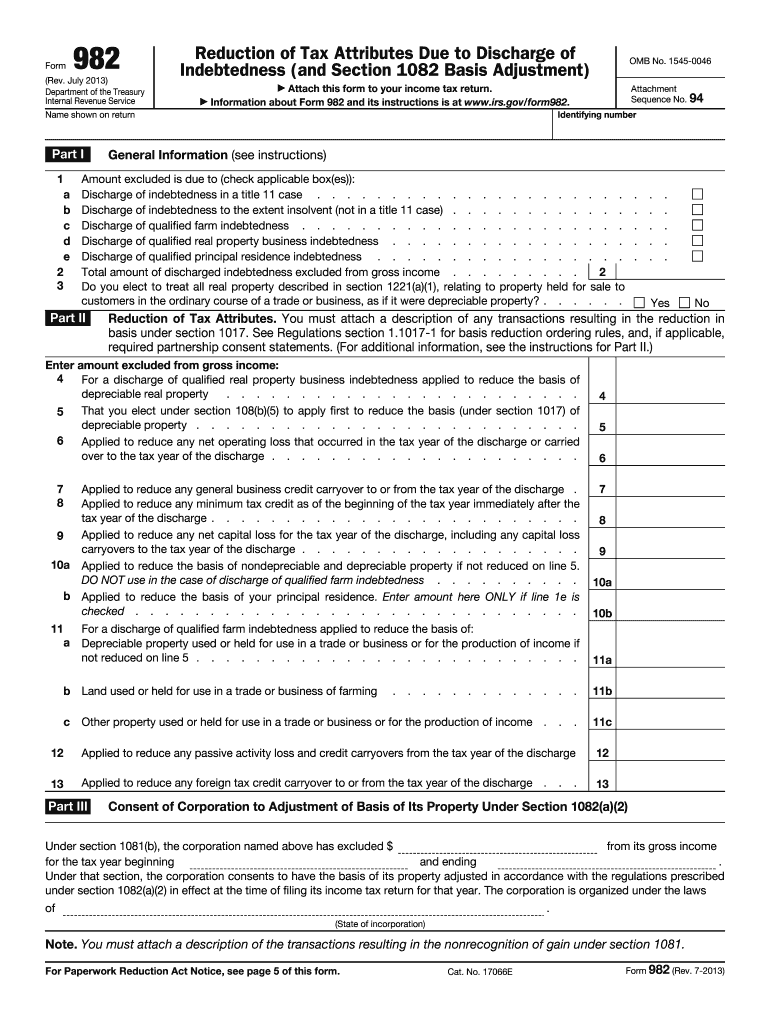

The Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment is a tax form used by individuals and businesses to report the reduction of tax attributes due to the discharge of indebtedness. This form is particularly relevant when a taxpayer has had debt forgiven or discharged, which can affect their tax liabilities. The form allows taxpayers to adjust their basis in property as required under Section 1082 of the Internal Revenue Code, ensuring compliance with IRS regulations.

Steps to complete the Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment

Completing the Form 982 involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including details of the discharged debt and any associated property.

- Fill out the form: Provide accurate information in the required sections, ensuring all data reflects your financial situation accurately.

- Review for accuracy: Double-check all entries to avoid mistakes that could lead to delays or penalties.

- Sign and date the form: Ensure that the form is signed and dated appropriately before submission.

How to obtain the Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment

The Form 982 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure that you are using the most current version of the form, as updates may occur annually. Additionally, some tax professionals may provide copies of the form as part of their services.

Legal use of the Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment

The legal use of Form 982 is governed by IRS regulations. Taxpayers must ensure that the information provided is accurate and complete to avoid potential legal issues. The form must be filed in accordance with the IRS guidelines, and any adjustments made to tax attributes must comply with applicable tax laws. Failure to adhere to these regulations can result in penalties or audits by the IRS.

Key elements of the Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment

Key elements of Form 982 include:

- Identification of the taxpayer: This includes the taxpayer's name, address, and taxpayer identification number.

- Details of the discharged debt: Information about the nature and amount of the debt that has been forgiven.

- Adjustments to tax attributes: The specific tax attributes that are being reduced as a result of the discharge.

- Signature and date: Required to validate the form and attest to the accuracy of the information provided.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of Form 982. Taxpayers should refer to the IRS instructions for the form, which outline the eligibility criteria, necessary documentation, and filing procedures. It is crucial to stay informed about any changes in IRS regulations that may affect the use of this form, ensuring compliance and accurate reporting.

Quick guide on how to complete form 982 rev december 2017 reduction of tax attributes due to discharge of indebtedness and section 1082 basis adjustment

Finalize Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment on any platform using airSlate SignNow's Android or iOS apps and enhance any document-centric process today.

The easiest way to modify and eSign Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment without any hassle

- Find Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Formulate your signature with the Sign tool, which takes mere seconds and carries the exact same legal weight as a traditional handwritten signature.

- Review all the details and click the Done button to store your changes.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 982 rev december 2017 reduction of tax attributes due to discharge of indebtedness and section 1082 basis adjustment

Create this form in 5 minutes!

How to create an eSignature for the form 982 rev december 2017 reduction of tax attributes due to discharge of indebtedness and section 1082 basis adjustment

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness?

Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness is a crucial tax form used by taxpayers to report reductions in tax attributes due to the discharge of indebtedness. This form allows individuals and businesses to effectively manage their tax liabilities by adjusting their basis in properties. Proper use of this form is essential to ensure compliance with IRS regulations.

-

How does airSlate SignNow facilitate the signing of Form 982 Rev December?

airSlate SignNow streamlines the process of signing Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness by offering an easy-to-use platform for digital signatures. Users can upload the form, invite signers, and track the signing process in real time, ensuring that all parties have completed their obligations efficiently. This saves time and increases the accuracy of document handling.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including options for solo users and teams. Each plan is designed to provide access to essential features such as eSignature, document templates, and secure storage, enabling users to manage documents like Form 982 Rev December effectively. You can visit our pricing page for detailed information on our packages.

-

Does airSlate SignNow integrate with other software for managing Form 982 Rev December?

Yes, airSlate SignNow seamlessly integrates with numerous applications, including accounting and tax software, to help users manage Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness. These integrations ensure a smooth workflow, allowing users to sync their documents and data effortlessly. This interoperability enhances productivity and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents such as Form 982 Rev December provides signNow benefits, including speed, convenience, and security. The platform ensures your documents are signed and stored securely, reducing the risk of fraud and misinformation. Additionally, the ease of tracking and managing documents leads to increased compliance with tax regulations.

-

Is it easy to access and fill out Form 982 Rev December on airSlate SignNow?

Absolutely! airSlate SignNow makes it simple to access and fill out Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness. The user-friendly interface allows individuals to input required information either manually or through pre-saved templates, making the process faster and more efficient for everyone involved.

-

Can multiple users sign Form 982 Rev December simultaneously on airSlate SignNow?

Yes, airSlate SignNow allows multiple users to eSign Form 982 Rev December efficiently. This feature is particularly beneficial for businesses and organizations that require signatures from various stakeholders. The platform notifies all signers and tracks progress, ensuring that all necessary approvals are obtained in a timely manner.

Get more for Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment

Find out other Form 982 Rev December Reduction Of Tax Attributes Due To Discharge Of Indebtedness and Section 1082 Basis Adjustment

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation