Form 982 2017

What is the Form 982

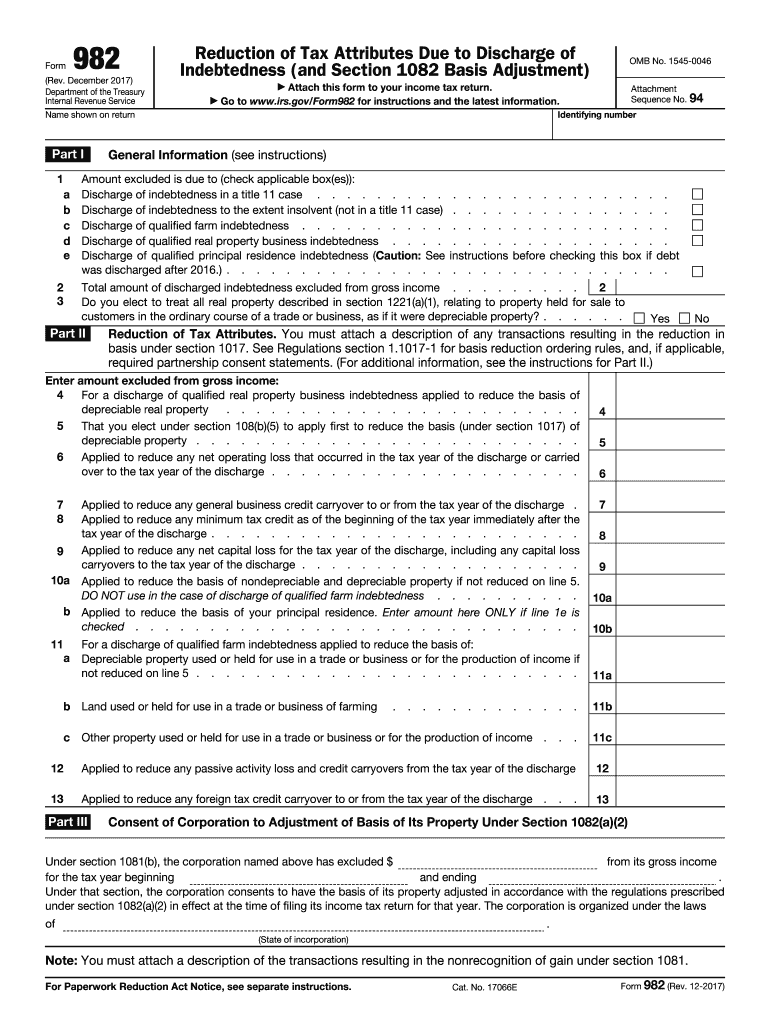

The Form 982, also known as the Reduction of Tax Attributes Due to Discharge of Indebtedness, is a document utilized primarily in the context of tax reporting in the United States. This form is essential for taxpayers who have had their debts forgiven or discharged, as it allows them to reduce certain tax attributes that may be affected by the cancellation of debt income. Understanding the purpose of Form 982 is crucial for ensuring compliance with IRS regulations and accurately reporting financial changes resulting from debt discharge.

How to use the Form 982

Using Form 982 involves several steps that ensure accurate reporting of discharged debt. Taxpayers must first determine if they qualify for the form based on their financial situation. If eligible, they will need to fill out the form to reflect the reduction of tax attributes. This includes specifying the amount of debt discharged and the corresponding tax attributes that will be reduced. Proper completion of the form is necessary to avoid potential tax liabilities associated with canceled debt income.

Steps to complete the Form 982

Completing Form 982 requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, including any notices of debt cancellation.

- Determine the amount of debt that has been discharged.

- Identify the tax attributes that will be reduced, such as net operating losses or credits.

- Fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors before submission.

Legal use of the Form 982

The legal use of Form 982 is governed by IRS guidelines, which stipulate that taxpayers must accurately report any discharged debt. Failure to properly use the form can result in penalties or additional taxes owed. It is important for individuals to understand their rights and responsibilities when dealing with canceled debt and to utilize Form 982 to maintain compliance with tax laws. Consulting with a tax professional may also be beneficial to ensure correct usage.

Key elements of the Form 982

Several key elements must be included when completing Form 982:

- Name and Social Security Number: This identifies the taxpayer.

- Amount of Debt Discharged: Clearly state the total amount of debt that has been forgiven.

- Reduction of Tax Attributes: Specify which attributes are being reduced and by how much.

- Signature: The form must be signed and dated to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for Form 982 typically align with the tax return deadlines. Taxpayers must submit the form by the due date of their tax return for the year in which the debt was discharged. It is crucial to keep track of these dates to avoid late filing penalties. Additionally, if an extension is filed for the tax return, the deadline for Form 982 may also be extended, but this must be confirmed with IRS guidelines.

Quick guide on how to complete form 982 2017

Complete Form 982 effortlessly on any gadget

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal eco-conscious substitute to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without hassle. Manage Form 982 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to edit and eSign Form 982 without difficulty

- Obtain Form 982 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing out new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device of your choice. Modify and eSign Form 982 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 982 2017

Create this form in 5 minutes!

How to create an eSignature for the form 982 2017

How to create an eSignature for your Form 982 2017 in the online mode

How to create an electronic signature for the Form 982 2017 in Chrome

How to generate an electronic signature for signing the Form 982 2017 in Gmail

How to create an eSignature for the Form 982 2017 straight from your smartphone

How to make an eSignature for the Form 982 2017 on iOS devices

How to make an eSignature for the Form 982 2017 on Android

People also ask

-

What is Form 982 and how does airSlate SignNow help with it?

Form 982 is a tax form used to claim a reduction in tax attributes due to discharge of indebtedness. airSlate SignNow simplifies the process of completing and eSigning Form 982 by providing users with an intuitive platform to fill out, send, and securely sign documents online.

-

Can I store my completed Form 982 in airSlate SignNow?

Yes, airSlate SignNow offers secure cloud storage for all your completed documents, including Form 982. This means you can easily access, manage, and retrieve your completed forms anytime, ensuring that your important tax documents are always at your fingertips.

-

Is airSlate SignNow cost-effective for filing Form 982?

Absolutely! airSlate SignNow provides a cost-effective solution for businesses and individuals who need to manage their Form 982 filings. With competitive pricing plans, you can enjoy the benefits of electronic signatures and document management without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 982?

airSlate SignNow offers a range of features perfect for managing Form 982, including customizable templates, bulk sending options, and advanced tracking capabilities. These features streamline the eSigning process, making it easy to get your Form 982 completed and submitted on time.

-

Can I integrate airSlate SignNow with other software for Form 982 processing?

Yes, airSlate SignNow seamlessly integrates with various platforms, allowing for efficient processing of Form 982. Whether you're using CRM software or cloud storage services, you can easily connect airSlate SignNow to enhance your document workflow.

-

How secure is airSlate SignNow for eSigning Form 982?

airSlate SignNow prioritizes the security of your documents, including Form 982. The platform employs industry-standard encryption and complies with regulations to ensure that your eSigned documents are safe and secure from unauthorized access.

-

Can I use airSlate SignNow on mobile devices for Form 982?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to fill out and eSign Form 982 on the go. Whether you're using a smartphone or tablet, you can access all the platform's features conveniently from your device.

Get more for Form 982

- Certificate indian blood 2014 form

- Form 1099 sf

- New york city department of education authorization for sipp expenditure form

- Wasdyyyy form

- Form mo 99misc instructions 2010

- Non employee travel reimbursement form ncgia ucsb

- Non employee remission information form marquette university marquette

- Rastafarian certificate form

Find out other Form 982

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors