Kenton County Form Qcc1 2015-2026

What is the Kenton County Form Qcc1

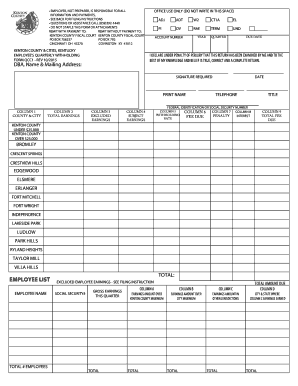

The Kenton County Form Qcc1 is a specific document used for quarterly withholding in Kentucky. This form is essential for employers who need to report and remit state income tax withheld from employee wages. It serves as a record of the amounts withheld and ensures compliance with state tax regulations. Understanding the purpose of this form is crucial for businesses operating within Kenton County and helps maintain accurate tax records.

How to use the Kenton County Form Qcc1

Using the Kenton County Form Qcc1 involves several steps to ensure accurate completion and submission. First, gather all necessary employee information, including names, Social Security numbers, and the amount withheld for each employee. Next, fill out the form with this data, ensuring that all entries are accurate. Once completed, the form can be submitted either electronically or via mail, depending on the preferred method of filing. Familiarity with the form's layout and requirements will streamline the process.

Steps to complete the Kenton County Form Qcc1

Completing the Kenton County Form Qcc1 requires careful attention to detail. Follow these steps:

- Collect employee wage information and tax withholding amounts.

- Enter the employer's identification details at the top of the form.

- Document each employee's information, including their total wages and the amount withheld.

- Review the completed form for accuracy to prevent errors.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Kenton County Form Qcc1

The Kenton County Form Qcc1 must be used in accordance with Kentucky state tax laws. Employers are legally required to withhold state income tax from employee wages and report this information accurately. Failure to use the form correctly can lead to penalties, including fines or audits. It is important for employers to understand their obligations under state law to ensure compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Kenton County Form Qcc1 are critical to ensure timely compliance. Typically, the form must be submitted quarterly, with specific due dates established by the Kentucky Department of Revenue. Employers should keep track of these dates to avoid late fees and penalties. Marking the deadlines on a calendar can help maintain compliance throughout the year.

Form Submission Methods (Online / Mail / In-Person)

The Kenton County Form Qcc1 can be submitted through various methods. Employers have the option to file online through the Kentucky Department of Revenue's website, which offers a convenient and efficient way to submit forms. Alternatively, the form can be mailed to the appropriate tax office or submitted in person. Understanding these submission methods allows employers to choose the most suitable option for their needs.

Quick guide on how to complete kenton county form qcc1 2020

Finish Kenton County Form Qcc1 effortlessly on any device

Web-based document organization has become favored by enterprises and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the resources essential to create, modify, and eSign your documents swiftly without delays. Handle Kenton County Form Qcc1 on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Kenton County Form Qcc1 with ease

- Obtain Kenton County Form Qcc1 and then select Get Form to commence.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that intention.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors necessitating reprinting of new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you choose. Modify and eSign Kenton County Form Qcc1 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kenton county form qcc1 2020

Create this form in 5 minutes!

How to create an eSignature for the kenton county form qcc1 2020

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the ky form quarterly withholding?

The ky form quarterly withholding is a tax form used by employers in Kentucky to report their withholding tax liabilities. It helps businesses ensure compliance with state tax regulations and accurately report employee earnings. Understanding this form is crucial for maintaining proper tax records and avoiding penalties.

-

How can airSlate SignNow help with the ky form quarterly withholding?

airSlate SignNow provides a seamless platform for electronically signing and managing the ky form quarterly withholding. With easy document sharing and eSigning capabilities, businesses can complete their tax forms efficiently and securely. This streamlines the process, helping you meet your filing deadlines with confidence.

-

Is there a cost associated with using airSlate SignNow for ky form quarterly withholding?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the management of documents like the ky form quarterly withholding. Choose a plan that aligns with your business size and volume for optimal value.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as document templates, eSigning, secure storage, and tracking capabilities for tax documents like the ky form quarterly withholding. These features empower users to streamline their workflow and ensure that all necessary paperwork is handled efficiently. Additionally, the platform's user-friendly interface makes navigation easy for all users.

-

Can I integrate airSlate SignNow with other tools for payroll management?

Absolutely! airSlate SignNow offers integrations with various payroll and accounting software, allowing for a smoother process when handling the ky form quarterly withholding. These integrations enable automatic data transfer, reducing manual entry errors and saving time. Explore the available integrations to find the best fit for your business.

-

What are the benefits of using airSlate SignNow for ky form quarterly withholding?

Using airSlate SignNow for your ky form quarterly withholding simplifies the eSigning process and document management. Businesses can reduce paperwork, enhance security, and maintain organization while ensuring compliance with state regulations. This efficient solution ultimately saves time and resources, allowing you to focus more on growing your business.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes the security of your documents, including the ky form quarterly withholding. The platform uses encryption and complies with industry-standard security protocols to protect sensitive information. With robust access controls and audit trails, you can trust that your data remains safe and accessible only to authorized personnel.

Get more for Kenton County Form Qcc1

Find out other Kenton County Form Qcc1

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document