W7 PDF Form

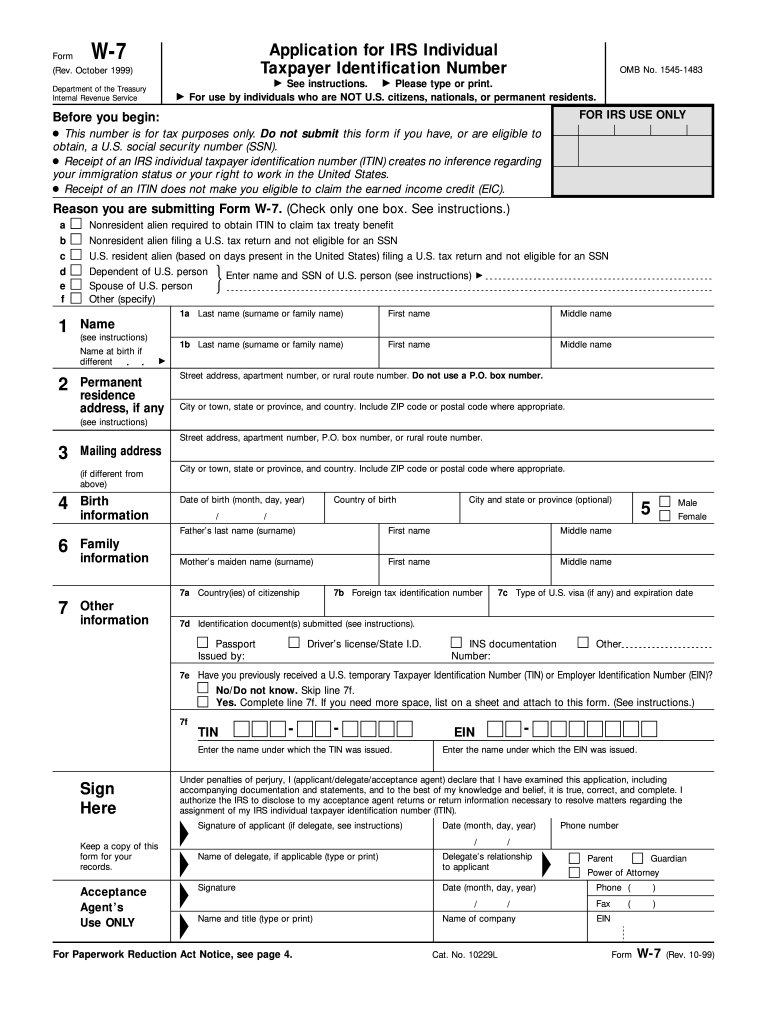

What is the W-7 form?

The W-7 form, officially known as the Application for IRS Individual Taxpayer Identification Number (ITIN), is a crucial document for individuals who need to file taxes in the United States but do not have a Social Security Number (SSN). This form is primarily used by non-resident aliens, their spouses, and dependents who are not eligible for an SSN. The W-7 form allows these individuals to obtain an ITIN, which is essential for tax reporting purposes.

Steps to complete the W-7 form

Completing the W-7 form involves several important steps to ensure accurate submission. Begin by gathering necessary documentation, including proof of identity and foreign status, such as a passport or national identification card. Next, fill out the W-7 form accurately, providing personal information such as your name, mailing address, and reason for needing an ITIN. Be sure to check the instructions carefully to avoid common errors. Once completed, submit the form along with your tax return or other required documents to the IRS.

Required documents for the W-7 form

When applying for an ITIN using the W-7 form, specific documents are required to verify your identity and foreign status. Acceptable documents include:

- A valid passport

- A national identification card

- A U.S. driver's license

- A birth certificate

- Other government-issued identification with a photo

It is important to provide original documents or certified copies, as the IRS does not accept photocopies. Ensure that all documents are current and clearly legible.

Filing deadlines for the W-7 form

Understanding the filing deadlines for the W-7 form is essential for compliance. Generally, the W-7 form must be submitted with your tax return. For most taxpayers, the deadline for filing is April 15 of each year. If you are applying for an ITIN outside of tax season, you can submit the form at any time, but it is recommended to do so in advance of filing your tax return to avoid delays in processing.

Legal use of the W-7 form

The W-7 form is legally recognized by the IRS as the official application for an ITIN. It is important to use the form correctly to avoid penalties or delays in processing. The form must be filled out accurately and submitted with the required documentation. Compliance with IRS guidelines ensures that the ITIN is issued for legitimate tax purposes, which is essential for maintaining good standing with tax authorities.

Form submission methods

The W-7 form can be submitted through various methods, including:

- By mail: Send the completed form along with your tax return to the appropriate IRS address.

- In-person: You can apply at designated IRS Taxpayer Assistance Centers, where staff can assist you with the process.

- Through an Acceptance Agent: Authorized individuals or entities can help you complete and submit the form.

Choosing the right submission method can help ensure that your application is processed efficiently.

Quick guide on how to complete itin w7 fillable form

Complete W7 Pdf effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage W7 Pdf on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign W7 Pdf with ease

- Find W7 Pdf and click Get Form to begin.

- Take advantage of the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign W7 Pdf while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Where can I get help to fill my W7 (and other tax forms) and apply for the ITIN as a non-US citizen living outside the US?

It really depends where you are. In many countries there are “certified acceptance agents” who are authorized by the IRS to assist in obtaining ITINs and other matters. They tend to be accountants and other tax professionals.Otherwise, depending upon what you need, there is some material available on the IRS’ website.

-

How do I apply for the W7 (ITIN) form as an international student in the USA?

Your US university should have an International Students Office that will answer this kind of question for you and assist you.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

Create this form in 5 minutes!

How to create an eSignature for the itin w7 fillable form

How to generate an electronic signature for the Itin W7 Fillable Form online

How to make an electronic signature for the Itin W7 Fillable Form in Chrome

How to create an eSignature for signing the Itin W7 Fillable Form in Gmail

How to make an electronic signature for the Itin W7 Fillable Form straight from your mobile device

How to make an eSignature for the Itin W7 Fillable Form on iOS

How to make an eSignature for the Itin W7 Fillable Form on Android

People also ask

-

What is a W7 Pdf and how is it used?

A W7 Pdf is a form used by individuals who need to apply for an Individual Taxpayer Identification Number (ITIN) in the United States. This form can be easily downloaded, filled out, and submitted electronically using airSlate SignNow, ensuring a smooth and efficient application process.

-

How can airSlate SignNow help with W7 Pdf forms?

AirSlate SignNow simplifies the process of managing W7 Pdf forms by allowing users to fill, sign, and send documents securely online. With its user-friendly interface, you can easily navigate through the form-filling process, ensuring that all required fields are completed accurately.

-

Is there a cost to use airSlate SignNow for W7 Pdf documents?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for managing W7 Pdf forms. You can select a plan that suits your requirements, with options for individual users or teams, and even enjoy a free trial to explore its features.

-

What features does airSlate SignNow offer for W7 Pdf processing?

AirSlate SignNow provides advanced features for W7 Pdf processing, including eSignature capabilities, document templates, and real-time tracking. These features ensure that your W7 Pdf forms are processed quickly and efficiently, reducing delays in your application.

-

Are there any integrations available for managing W7 Pdf forms with airSlate SignNow?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, including Google Drive, Dropbox, and Microsoft Office, allowing you to manage your W7 Pdf forms directly from your preferred platforms. This integration streamlines your workflow, saving you time and effort.

-

Can I collaborate with others on W7 Pdf documents using airSlate SignNow?

Yes, airSlate SignNow enables collaboration on W7 Pdf documents by allowing multiple users to access and edit the form simultaneously. This feature is particularly beneficial for teams working together on tax-related documents, ensuring everyone stays on the same page.

-

What security measures are in place for W7 Pdf forms on airSlate SignNow?

AirSlate SignNow prioritizes security for all documents, including W7 Pdf forms, by employing industry-standard encryption and secure data storage. You can rest assured that your sensitive information is protected throughout the signing and submission process.

Get more for W7 Pdf

Find out other W7 Pdf

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later