Paycheck Dp0002 Form 2010

What is the Paycheck Dp0002 Form

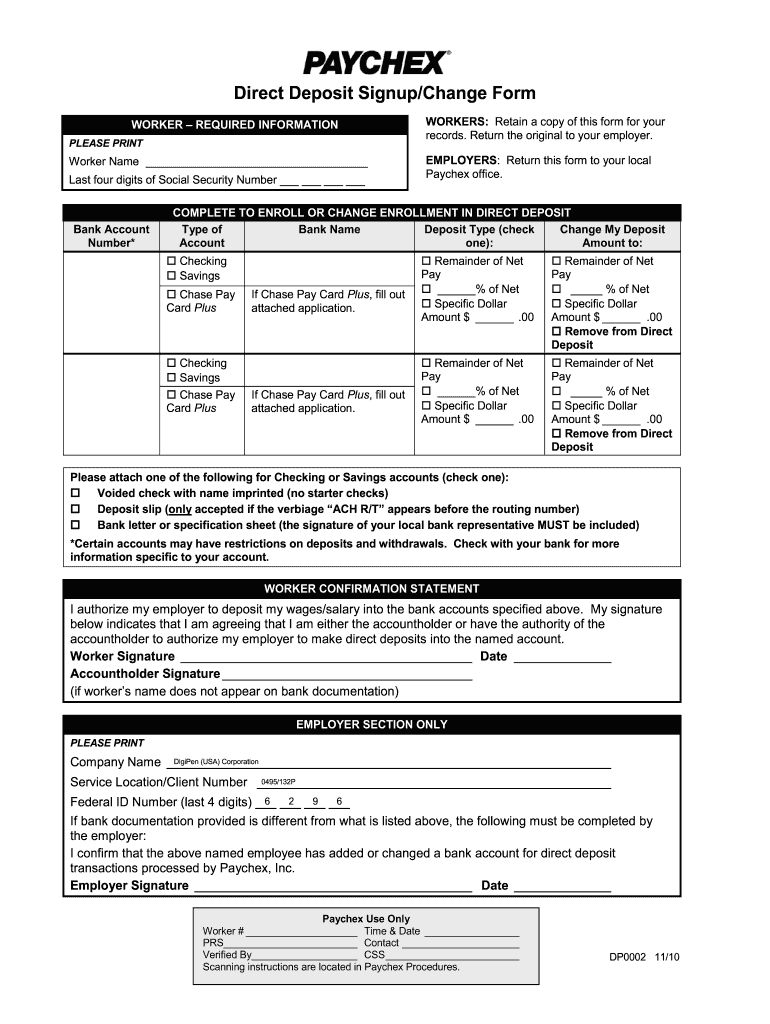

The Paycheck Dp0002 Form is a document used primarily by employers in the United States to provide employees with a detailed breakdown of their earnings and deductions for a specific pay period. This form is essential for ensuring transparency in payroll processing and helps employees understand their compensation, including gross pay, taxes withheld, and other deductions such as health insurance or retirement contributions. It serves as a record for both the employer and the employee, facilitating accurate financial tracking and compliance with federal and state regulations.

How to use the Paycheck Dp0002 Form

Using the Paycheck Dp0002 Form involves several straightforward steps. First, employers must ensure that all required information is accurately filled out, including employee details, pay period dates, and the breakdown of earnings and deductions. Once completed, the form should be distributed to employees, either in paper or electronic format. Employees can review the form to confirm the accuracy of their earnings and deductions. If discrepancies are found, they should communicate with their employer for resolution. This form can also serve as a reference for tax preparation and financial planning.

Steps to complete the Paycheck Dp0002 Form

Completing the Paycheck Dp0002 Form requires attention to detail. Here are the steps to follow:

- Gather necessary employee information, including name, address, and Social Security number.

- Input the pay period dates to specify the timeframe for which the earnings are calculated.

- Detail the gross pay earned during the pay period, including regular hours, overtime, and bonuses.

- List all deductions, such as federal and state taxes, Social Security, Medicare, and any other withholdings.

- Calculate the net pay by subtracting total deductions from gross pay.

- Review the form for accuracy and completeness before distribution.

Legal use of the Paycheck Dp0002 Form

The Paycheck Dp0002 Form is legally binding when it meets specific requirements set forth by federal and state laws. Employers must ensure compliance with the Fair Labor Standards Act (FLSA) and other relevant regulations that govern payroll practices. Providing this form to employees is not only a best practice but also a legal obligation in many jurisdictions. Accurate completion of the form helps protect both the employer and employee by providing a clear record of earnings and deductions, which can be crucial in the event of disputes or audits.

Key elements of the Paycheck Dp0002 Form

Several key elements must be included in the Paycheck Dp0002 Form to ensure its effectiveness and compliance. These elements include:

- Employee Information: Full name, address, and Social Security number.

- Pay Period: Start and end dates of the pay period.

- Gross Pay: Total earnings before deductions.

- Deductions: Itemized list of all deductions, including taxes and benefits.

- Net Pay: Amount the employee takes home after deductions.

Who Issues the Paycheck Dp0002 Form

The Paycheck Dp0002 Form is typically issued by employers or payroll departments within organizations. It is the responsibility of the employer to ensure that the form is prepared accurately and distributed to employees in a timely manner. Depending on the size and structure of the business, payroll processing may be handled internally or outsourced to a third-party payroll service. Regardless of the method, the employer remains accountable for the accuracy and compliance of the information provided on the form.

Quick guide on how to complete paycheck dp0002 form

Complete Paycheck Dp0002 Form effortlessly on any device

Web-based document management has gained popularity among organizations and individuals alike. It serves as a flawless environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Paycheck Dp0002 Form on any device with the airSlate SignNow apps available for Android or iOS and enhance any document-driven process today.

The optimal method to modify and electronically sign Paycheck Dp0002 Form effortlessly

- Find Paycheck Dp0002 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassles of missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you choose. Edit and electronically sign Paycheck Dp0002 Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct paycheck dp0002 form

Create this form in 5 minutes!

How to create an eSignature for the paycheck dp0002 form

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is the Paycheck Dp0002 Form?

The Paycheck Dp0002 Form is a document that serves as an official statement of an individual's earnings and deductions. It is essential for employees who need to track their income and for businesses to meet payroll reporting requirements. Understanding this form can help ensure accurate financial management.

-

How can I use airSlate SignNow to eSign my Paycheck Dp0002 Form?

With airSlate SignNow, you can easily upload your Paycheck Dp0002 Form and send it out for electronic signatures. Our platform provides a user-friendly interface that allows you to track the signing process in real-time. This streamlines documentation management and enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for the Paycheck Dp0002 Form?

airSlate SignNow offers competitive pricing plans that can fit various business needs when using it for the Paycheck Dp0002 Form. We provide flexible options, including monthly and annual subscriptions, so you can choose what works best for you. Contact our sales team for more detailed pricing information.

-

What features does airSlate SignNow offer for managing the Paycheck Dp0002 Form?

airSlate SignNow comes equipped with features like customizable templates, bulk sending, and advanced security measures to protect your Paycheck Dp0002 Form. Additionally, our platform supports integration with other software solutions, enhancing your workflow. These features help streamline the signing process.

-

How does airSlate SignNow ensure the security of my Paycheck Dp0002 Form?

Security is a top priority at airSlate SignNow. We use industry-standard encryption and secure data storage practices to protect your Paycheck Dp0002 Form. Plus, our authentication features ensure that only authorized users can access sensitive information.

-

Can I integrate airSlate SignNow with other business tools for my Paycheck Dp0002 Form?

Yes, airSlate SignNow offers seamless integration with a variety of business applications, making it easy to manage your Paycheck Dp0002 Form alongside your other workflows. Integrating with tools like CRM software and document management systems can enhance productivity and collaboration across teams.

-

What are the benefits of using airSlate SignNow for my Paycheck Dp0002 Form?

By using airSlate SignNow for your Paycheck Dp0002 Form, you gain benefits such as faster turnaround times, reduced paper usage, and improved accuracy in document management. Our solution helps you streamline operations and stay organized, ultimately enhancing your business's efficiency.

Get more for Paycheck Dp0002 Form

- Dissolution packet form

- Trust amendment form for amending a revocable trust

- State of arkansas hereinafter referred to as the trustor and the trustee form

- Is an individual residing at form

- The trustors are married and the parents of the following living child form

- On this the day of before me form

- Trusts and estates studylibnet form

- Estate planning update the illinois transfer on death form

Find out other Paycheck Dp0002 Form

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy