Foreign Tax Status Declaration Form Entities 1 2 Macquarie 2018-2026

Understanding the Foreign Tax Status Declaration Form Entities

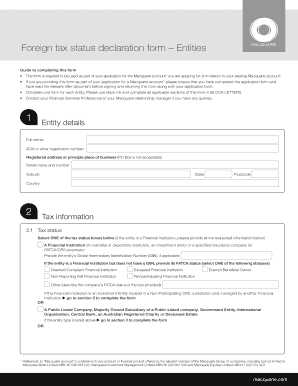

The Foreign Tax Status Declaration Form is essential for entities that need to declare their foreign tax status to comply with U.S. tax regulations. This form helps determine eligibility for tax benefits and exemptions under various tax treaties. It is particularly relevant for businesses engaged in international operations or those receiving income from foreign sources. The form requires detailed information about the entity's tax status, ownership structure, and foreign income sources to ensure accurate reporting.

Steps to Complete the Foreign Tax Status Declaration Form

Completing the Foreign Tax Status Declaration Form involves several key steps:

- Gather necessary documentation, including tax identification numbers and details of foreign income.

- Fill out the form accurately, providing all required information about the entity's foreign tax status.

- Review the form for completeness and accuracy to avoid delays or penalties.

- Submit the form electronically or via mail, depending on the preferred submission method.

Legal Use of the Foreign Tax Status Declaration Form

The Foreign Tax Status Declaration Form is legally binding when completed correctly. It must comply with IRS regulations and relevant tax laws to be considered valid. Entities must ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions, including penalties or audits. Utilizing a reliable eSignature platform can enhance the form's legitimacy by providing a digital certificate and ensuring compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN).

Key Elements of the Foreign Tax Status Declaration Form

Several key elements are crucial for the Foreign Tax Status Declaration Form:

- Entity Information: This includes the legal name, address, and tax identification number of the entity.

- Foreign Income Details: Entities must disclose all sources of foreign income and any applicable tax treaties.

- Tax Status Declaration: A clear statement regarding the entity's tax status and eligibility for benefits.

- Signature: The form must be signed by an authorized representative of the entity, confirming the accuracy of the information provided.

IRS Guidelines for the Foreign Tax Status Declaration Form

The IRS provides specific guidelines for completing and submitting the Foreign Tax Status Declaration Form. These guidelines outline the eligibility criteria for various tax benefits, required documentation, and filing deadlines. It is important for entities to familiarize themselves with these guidelines to ensure compliance and avoid potential penalties. Keeping abreast of any changes in IRS regulations can also help maintain proper filing practices.

Filing Deadlines and Important Dates

Entities must adhere to specific filing deadlines for the Foreign Tax Status Declaration Form to avoid penalties. Generally, the form should be submitted by the due date of the entity's tax return. It is advisable to mark important dates on a calendar and set reminders to ensure timely submission. Failure to submit the form by the deadline may result in loss of tax benefits or additional penalties imposed by the IRS.

Quick guide on how to complete foreign tax status declaration form entities 1 2 macquarie

Easily prepare Foreign Tax Status Declaration Form Entities 1 2 Macquarie on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely archive it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly and without any hold-ups. Manage Foreign Tax Status Declaration Form Entities 1 2 Macquarie on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to edit and electronically sign Foreign Tax Status Declaration Form Entities 1 2 Macquarie effortlessly

- Obtain Foreign Tax Status Declaration Form Entities 1 2 Macquarie and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Foreign Tax Status Declaration Form Entities 1 2 Macquarie while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the foreign tax status declaration form entities 1 2 macquarie

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What are tax declaration entities and how do they work with airSlate SignNow?

Tax declaration entities are organizations responsible for filing tax returns on behalf of individuals or businesses. With airSlate SignNow, these entities can easily create, send, and eSign essential documents, ensuring compliance and efficiency in the tax filing process.

-

How can airSlate SignNow improve the efficiency of tax declaration entities?

airSlate SignNow streamlines the document management process for tax declaration entities by allowing users to prepare, send, and eSign documents quickly. This reduces paperwork, minimizes errors, and accelerates the workflow, ultimately saving time and costs associated with tax preparations.

-

What pricing plans are available for tax declaration entities using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored for businesses, including tax declaration entities. Plans can be customized based on the number of users and features required, providing an economical solution for managing tax-related documents efficiently.

-

Are there any specific features of airSlate SignNow that benefit tax declaration entities?

Yes, airSlate SignNow includes features such as document templates, automated workflows, and advanced security measures that benefit tax declaration entities. These tools ensure that the document signing process is not only secure but also enhances productivity, allowing for faster turnarounds.

-

Can airSlate SignNow integrate with other software commonly used by tax declaration entities?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting and financial software that tax declaration entities commonly use. This integration simplifies data transfer and reduces duplicate entry, enhancing overall efficiency in managing tax documents.

-

How does airSlate SignNow ensure the security of documents for tax declaration entities?

airSlate SignNow employs advanced security protocols to protect documents for tax declaration entities. Features such as encryption, secure access controls, and audit trails keep sensitive information safe while ensuring compliance with legal standards.

-

Is it easy to onboard staff from tax declaration entities on airSlate SignNow?

Yes, onboarding staff from tax declaration entities on airSlate SignNow is user-friendly and straightforward. The platform provides tutorials and customer support to help new users quickly adapt to the system, enabling them to start managing tax documents efficiently in no time.

Get more for Foreign Tax Status Declaration Form Entities 1 2 Macquarie

- How to complete a ampquotdo it yourselfampquot divorce in pennsylvania form

- If you do not leave any type none and delete the fields form

- With links to web based paternity statutes and resources for new jersey form

- How to file a complaint in the superior court of nj courts form

- State of new york in assembly new york state senate form

- Certification of non military service nj courts form

- The plaintiff named above has filed a lawsuit against you in the superior court of new jersey form

- On or before of each year form

Find out other Foreign Tax Status Declaration Form Entities 1 2 Macquarie

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF