Form 2555 EZ Foreign Earned Income Exclusion Irs 2000

What is the Form 2555 EZ Foreign Earned Income Exclusion IRS

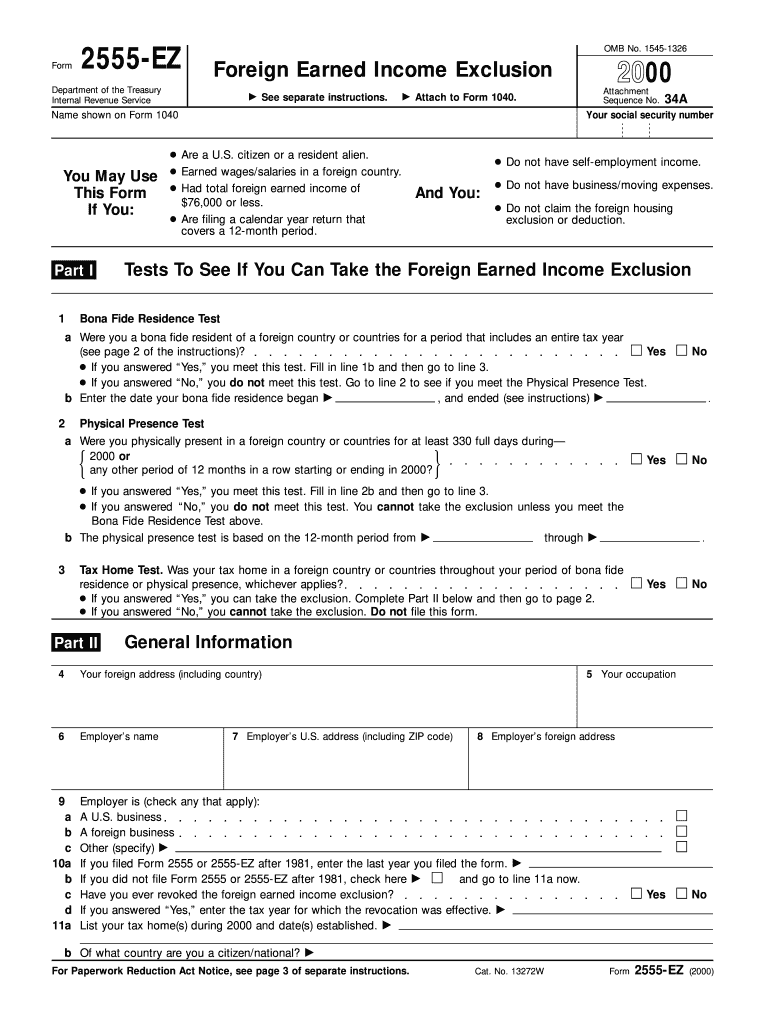

The Form 2555 EZ is a simplified version of the Form 2555, used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This exclusion allows eligible taxpayers to exclude a certain amount of their foreign earned income from U.S. taxation. To qualify, individuals must meet specific criteria, including passing the physical presence test or the bona fide residence test. The form is designed to streamline the process for those who meet the requirements and have a straightforward tax situation.

How to use the Form 2555 EZ Foreign Earned Income Exclusion IRS

To use the Form 2555 EZ, taxpayers must first ensure they meet the eligibility requirements. Once confirmed, they can download the form from the IRS website or obtain it through tax preparation software. The form requires basic information about the taxpayer, including their foreign address and the amount of foreign earned income. After filling out the necessary sections, the completed form should be attached to the taxpayer's annual income tax return and submitted to the IRS.

Steps to complete the Form 2555 EZ Foreign Earned Income Exclusion IRS

Completing the Form 2555 EZ involves several key steps:

- Gather necessary documentation, including proof of foreign residency and income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Provide details about your foreign earned income, including the total amount earned during the tax year.

- Indicate the foreign country where the income was earned and confirm eligibility for the exclusion.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the Form 2555 EZ, taxpayers must meet specific eligibility criteria. These include:

- Being a U.S. citizen or resident alien.

- Having foreign earned income that does not exceed the exclusion limit.

- Meeting either the physical presence test or the bona fide residence test.

- Not claiming the foreign housing exclusion or deduction.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 2555 EZ. Generally, the deadline for filing individual income tax returns is April 15. However, taxpayers living abroad may qualify for an automatic extension until June 15. If additional time is needed, a further extension can be requested, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The Form 2555 EZ can be submitted in various ways. Taxpayers can file electronically using tax preparation software that supports the form. Alternatively, it can be printed and mailed to the appropriate IRS address. In-person submissions are generally not available for this form, as the IRS encourages electronic filing for efficiency and security.

Quick guide on how to complete 2000 form 2555 ez foreign earned income exclusion irs

Complete Form 2555 EZ Foreign Earned Income Exclusion Irs effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Form 2555 EZ Foreign Earned Income Exclusion Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to edit and eSign Form 2555 EZ Foreign Earned Income Exclusion Irs with ease

- Find Form 2555 EZ Foreign Earned Income Exclusion Irs and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form 2555 EZ Foreign Earned Income Exclusion Irs and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2000 form 2555 ez foreign earned income exclusion irs

Create this form in 5 minutes!

How to create an eSignature for the 2000 form 2555 ez foreign earned income exclusion irs

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the Form 2555 EZ Foreign Earned Income Exclusion Irs?

The Form 2555 EZ Foreign Earned Income Exclusion Irs allows qualifying U.S. citizens or residents who live abroad to exclude a certain amount of their foreign earned income from U.S. taxation. This simplified version of Form 2555 helps taxpayers avoid the intricacies of filing standard forms, making the process more accessible.

-

Who can use the Form 2555 EZ Foreign Earned Income Exclusion Irs?

To utilize the Form 2555 EZ Foreign Earned Income Exclusion Irs, you must be a U.S. citizen or resident alien who has foreign earned income and meets specific residency requirements. This form is ideal for individuals with simpler foreign income situations, making it easier for them to claim their exclusions.

-

How does airSlate SignNow assist with Form 2555 EZ Foreign Earned Income Exclusion Irs submissions?

airSlate SignNow streamlines the process of signing and sending Form 2555 EZ Foreign Earned Income Exclusion Irs by providing an easy-to-use platform for electronic signatures and documentation. This ensures that users can quickly and securely complete their tax forms without unnecessary delays.

-

What features does airSlate SignNow offer for handling tax documents like Form 2555 EZ Foreign Earned Income Exclusion Irs?

airSlate SignNow offers features like templates, customizable workflows, and secure document storage, making it ideal for managing tax documents like Form 2555 EZ Foreign Earned Income Exclusion Irs. These capabilities ensure that users can efficiently create, sign, and store their tax-related documents.

-

Is there a cost associated with using airSlate SignNow for Form 2555 EZ Foreign Earned Income Exclusion Irs?

Yes, airSlate SignNow operates on a subscription-based pricing model. However, the costs are designed to be economical, especially for individuals and small businesses looking for a reliable solution to handle their Form 2555 EZ Foreign Earned Income Exclusion Irs and other document needs.

-

Can I integrate airSlate SignNow with other tax software for filing Form 2555 EZ Foreign Earned Income Exclusion Irs?

Absolutely! airSlate SignNow offers various integrations with popular tax software to ensure a seamless transition of documents, including the Form 2555 EZ Foreign Earned Income Exclusion Irs. This allows users to efficiently manage all their tax-related activities within one ecosystem.

-

What are the benefits of using airSlate SignNow for Form 2555 EZ Foreign Earned Income Exclusion Irs?

Using airSlate SignNow for Form 2555 EZ Foreign Earned Income Exclusion Irs provides users with an efficient and streamlined process for signing and sending documents. Additionally, the platform enhances document security and compliance, giving users peace of mind during tax season.

Get more for Form 2555 EZ Foreign Earned Income Exclusion Irs

- Legal last will and testament form for divorced person not remarried with minor children colorado

- Legal last will and testament form for domestic partner with adult children colorado

- Legal last will and testament form for a domestic partner with no children colorado

- Colorado last will testament form

- Legal last will and testament form for divorced person not remarried with adult and minor children colorado

- Colorado will create 497300835 form

- Legal last will and testament form for a married person with no children colorado

- Legal last will and testament form for married person with minor children colorado

Find out other Form 2555 EZ Foreign Earned Income Exclusion Irs

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement