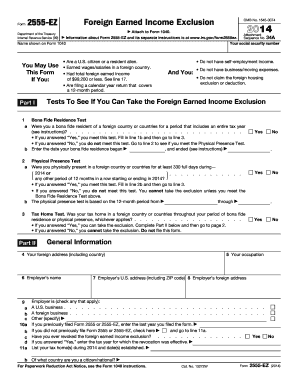

Form 2555 EZ Foreign Earned Income Exclusion IRS 2014

What is the Form 2555 EZ Foreign Earned Income Exclusion IRS

The Form 2555 EZ is a simplified version of the Form 2555 used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This form allows eligible taxpayers to exclude a specific amount of their foreign earned income from U.S. taxation, provided they meet certain criteria. The primary purpose of this form is to alleviate the tax burden on individuals who earn income while living and working abroad, thereby encouraging Americans to work internationally without facing double taxation.

Eligibility Criteria

To qualify for the Foreign Earned Income Exclusion using Form 2555 EZ, taxpayers must meet specific eligibility requirements. These include:

- The taxpayer must have foreign earned income.

- The taxpayer must have a tax home in a foreign country.

- The taxpayer must meet either the bona fide residence test or the physical presence test.

- The taxpayer's foreign earned income must not exceed a certain threshold set by the IRS.

Understanding these criteria is essential for determining if one can effectively utilize this form to reduce their taxable income.

Steps to Complete the Form 2555 EZ Foreign Earned Income Exclusion IRS

Completing Form 2555 EZ involves several straightforward steps:

- Gather necessary documentation, including proof of foreign earned income and residency.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your foreign earned income in the designated section.

- Claim the exclusion amount based on your eligibility and the IRS guidelines.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return by the appropriate deadline.

Following these steps ensures that taxpayers can accurately claim their foreign earned income exclusion, maximizing their potential tax benefits.

How to Obtain the Form 2555 EZ Foreign Earned Income Exclusion IRS

Taxpayers can obtain Form 2555 EZ from the IRS website or through various tax preparation software. The form is available in a downloadable PDF format, which can be printed and filled out manually. Additionally, tax professionals can provide this form as part of their services. It is important to ensure that you are using the most current version of the form to comply with IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for Form 2555 EZ typically align with the standard tax return deadlines. Generally, U.S. citizens and resident aliens must file their tax returns by April fifteenth. However, if you reside outside the United States, you may qualify for an automatic two-month extension, pushing the deadline to June fifteenth. It is crucial to stay informed about any changes to these dates, as they can vary from year to year.

Required Documents

When preparing to file Form 2555 EZ, taxpayers should gather several key documents to support their claims:

- Proof of foreign earned income, such as pay stubs or contracts.

- Documentation establishing a tax home in a foreign country, like rental agreements or utility bills.

- Evidence supporting the bona fide residence or physical presence tests, such as travel itineraries or residency permits.

Having these documents ready can streamline the filing process and ensure compliance with IRS requirements.

Create this form in 5 minutes or less

Find and fill out the correct form 2555 ez foreign earned income exclusion irs

Create this form in 5 minutes!

How to create an eSignature for the form 2555 ez foreign earned income exclusion irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2555 EZ Foreign Earned Income Exclusion IRS?

The Form 2555 EZ Foreign Earned Income Exclusion IRS is a simplified version of the standard Form 2555, allowing eligible U.S. citizens and resident aliens to exclude a certain amount of foreign earned income from their taxable income. This form is designed for individuals who meet specific criteria, making it easier to claim the foreign earned income exclusion.

-

How can airSlate SignNow help with the Form 2555 EZ Foreign Earned Income Exclusion IRS?

airSlate SignNow provides a user-friendly platform for electronically signing and sending documents, including the Form 2555 EZ Foreign Earned Income Exclusion IRS. With our solution, you can streamline the process of submitting your tax forms, ensuring that they are completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for Form 2555 EZ?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. Our cost-effective solution ensures that you can manage your Form 2555 EZ Foreign Earned Income Exclusion IRS submissions without breaking the bank, providing great value for your investment.

-

Are there any features specifically for handling tax documents like Form 2555 EZ?

Yes, airSlate SignNow includes features tailored for tax documents, such as customizable templates, secure storage, and easy sharing options. These features make it simple to manage your Form 2555 EZ Foreign Earned Income Exclusion IRS and other important tax forms, ensuring compliance and organization.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software and platforms, allowing you to seamlessly manage your Form 2555 EZ Foreign Earned Income Exclusion IRS alongside your other financial documents. This integration enhances your workflow and ensures that all your tax-related tasks are streamlined.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents, including the Form 2555 EZ Foreign Earned Income Exclusion IRS, provides numerous benefits such as enhanced security, ease of use, and time savings. Our platform allows you to eSign documents quickly and securely, reducing the hassle of traditional paper-based processes.

-

Is airSlate SignNow compliant with IRS regulations for tax documents?

Yes, airSlate SignNow is designed to comply with IRS regulations for electronic signatures and document submissions. When handling your Form 2555 EZ Foreign Earned Income Exclusion IRS, you can trust that our platform meets the necessary legal standards for secure and valid electronic transactions.

Get more for Form 2555 EZ Foreign Earned Income Exclusion IRS

- Adr waiver form

- Corporate office 1541 wilshire blvd 550 los angeles ca 90017 form

- Tronox tort claims trust claim form category a

- Affidavit physical presence parentage form

- Debtor s statement form

- Non individuals filing form

- How to file a chapter 13 skeleton bankruptcy pro se may 2015 form

- Please use this form to request administrative records from the

Find out other Form 2555 EZ Foreign Earned Income Exclusion IRS

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF