F2555ez Fillable Form 2013

What is the F2555ez Fillable Form

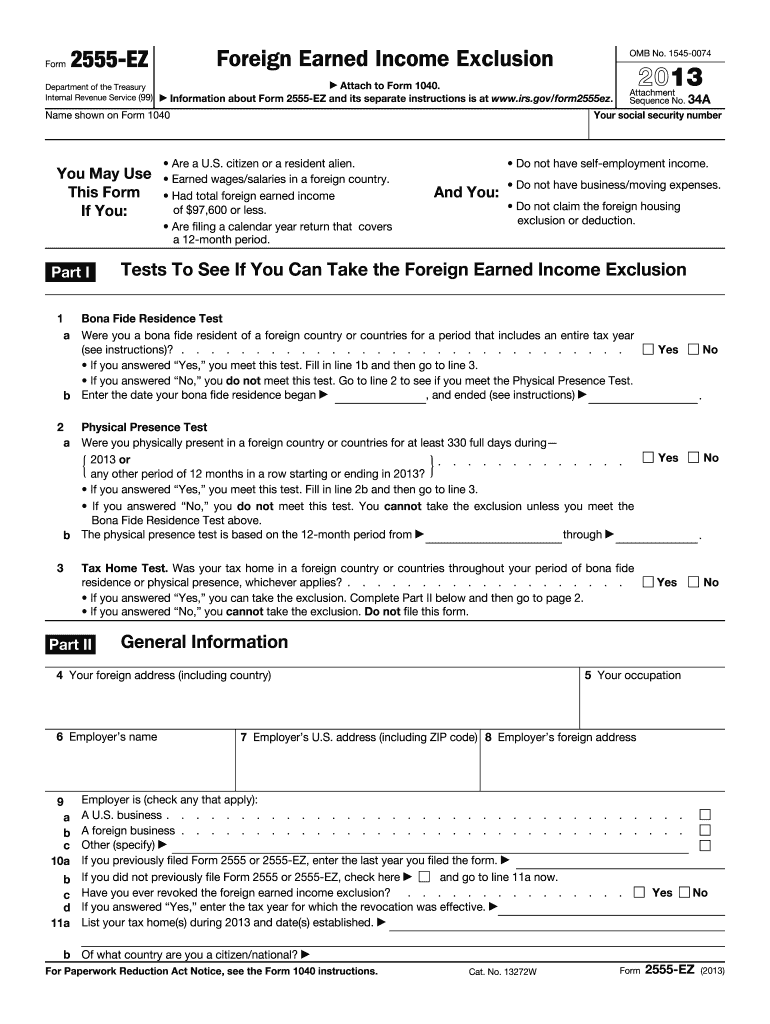

The F2555ez Fillable Form is a simplified tax form used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This form allows eligible taxpayers to exclude a certain amount of their foreign-earned income from U.S. taxation, thereby reducing their overall tax liability. It is specifically designed for individuals who meet the requirements of either the bona fide residence test or the physical presence test. The F2555ez is a streamlined version of the more comprehensive Form 2555, making it easier for qualifying taxpayers to complete their filings.

How to use the F2555ez Fillable Form

Using the F2555ez Fillable Form involves several straightforward steps. First, ensure that you meet the eligibility criteria for claiming the Foreign Earned Income Exclusion. Next, download the fillable form from a reliable source. Once you have the form, you can enter your personal information, including your name, address, and Social Security number. Additionally, you will need to provide details about your foreign income and the countries where you earned it. After filling out the form, review it for accuracy and completeness before submitting it to the IRS.

Steps to complete the F2555ez Fillable Form

Completing the F2555ez Fillable Form involves a series of clear steps:

- Download the F2555ez Fillable Form from a reputable source.

- Fill in your personal details, including your name and contact information.

- Indicate your foreign earned income and the countries where it was earned.

- Complete any additional sections relevant to your specific tax situation.

- Review the filled form for any errors or missing information.

- Save the completed form securely on your device.

- Submit the form electronically or by mail to the IRS, following the guidelines provided for your filing method.

Legal use of the F2555ez Fillable Form

The legal use of the F2555ez Fillable Form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted by the appropriate deadline. Taxpayers must ensure that they qualify for the Foreign Earned Income Exclusion based on their residency status or physical presence in a foreign country. Failure to comply with IRS requirements can result in penalties or the denial of the exclusion, making it crucial to understand the legal implications of using this form.

Eligibility Criteria

To qualify for the F2555ez Fillable Form, taxpayers must meet specific eligibility criteria. These include:

- Being a U.S. citizen or resident alien.

- Having foreign earned income that meets the minimum threshold set by the IRS.

- Meeting either the bona fide residence test or the physical presence test.

- Not claiming the Foreign Housing Exclusion or Deduction.

It is essential to review these criteria carefully to ensure that you are eligible to use the F2555ez Fillable Form for your tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the F2555ez Fillable Form align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their federal income tax returns by April 15. However, if you are living abroad, you may qualify for an automatic extension, allowing you to file until June 15. It is crucial to stay informed about any changes to these deadlines, as they can vary from year to year. Filing on time helps avoid penalties and ensures compliance with tax regulations.

Quick guide on how to complete f2555ez fillable form 2013

Effortlessly Prepare F2555ez Fillable Form on Any Device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the right form and securely maintain it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and without delay. Manage F2555ez Fillable Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign F2555ez Fillable Form with Ease

- Locate F2555ez Fillable Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click the Done button to save your updates.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign F2555ez Fillable Form and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f2555ez fillable form 2013

Create this form in 5 minutes!

How to create an eSignature for the f2555ez fillable form 2013

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the F2555ez Fillable Form?

The F2555ez Fillable Form is a simplified tax form used by U.S. citizens and resident aliens to report foreign earned income. This form allows users to claim the foreign earned income exclusion and the housing exclusion. By utilizing the F2555ez Fillable Form, taxpayers can streamline the process and ensure compliance with IRS regulations.

-

How can I access the F2555ez Fillable Form with airSlate SignNow?

You can easily access the F2555ez Fillable Form by signing up for airSlate SignNow's intuitive platform. Once registered, simply search for the form in our document library, and you can fill it out directly online. Our solution enables you to fill, sign, and send the form with a few simple clicks.

-

Is there a cost associated with using the F2555ez Fillable Form on airSlate SignNow?

Yes, there is a subscription fee for using the airSlate SignNow platform, which includes access to the F2555ez Fillable Form. The pricing is transparent, offering various plans that suit different business needs. This cost-effective solution is designed to provide value through efficiency and ease of use.

-

What features does the airSlate SignNow platform offer for the F2555ez Fillable Form?

The airSlate SignNow platform offers several features for the F2555ez Fillable Form, including eSignature capabilities, customizable templates, and real-time collaboration. Users can edit the form directly, invite others to sign, and track the document status seamlessly. These features enhance the efficiency of handling your tax documents.

-

Can I integrate airSlate SignNow with other applications while using the F2555ez Fillable Form?

Absolutely! airSlate SignNow supports integrations with various applications, such as Google Drive, Dropbox, and CRM systems. This allows users to easily import and export the F2555ez Fillable Form, streamlining the workflow. Integration helps manage documentation more effectively across different platforms.

-

What are the benefits of using the F2555ez Fillable Form with airSlate SignNow?

Using the F2555ez Fillable Form with airSlate SignNow provides several benefits including enhanced efficiency, reduced paperwork, and improved compliance. The ability to eSign and store documents securely ensures that your data is safe and accessible. Additionally, our user-friendly interface makes tax filing less stressful.

-

Is the F2555ez Fillable Form easy to fill out on airSlate SignNow?

Yes, the F2555ez Fillable Form is designed to be user-friendly on the airSlate SignNow platform. Our fillable format allows users to enter information easily and accurately. Helpful prompts guide users through each section, reducing the chances of errors.

Get more for F2555ez Fillable Form

- Fillable online physician assistant site visit form fax

- Cr 0100ap 061020 form

- Marijuana finding of form

- Dr 0104 2019 colorado individual income tax form

- 3 total additions from page 2 schedule c line 1d form

- January 31 following the end of the tax year form

- Request change of administrator in tsc or myconnect form

- Sales and use tax affidavit of gift of motor vehicle ri dmv form

Find out other F2555ez Fillable Form

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document