8879 S Form 2015

What is the 8879 S Form

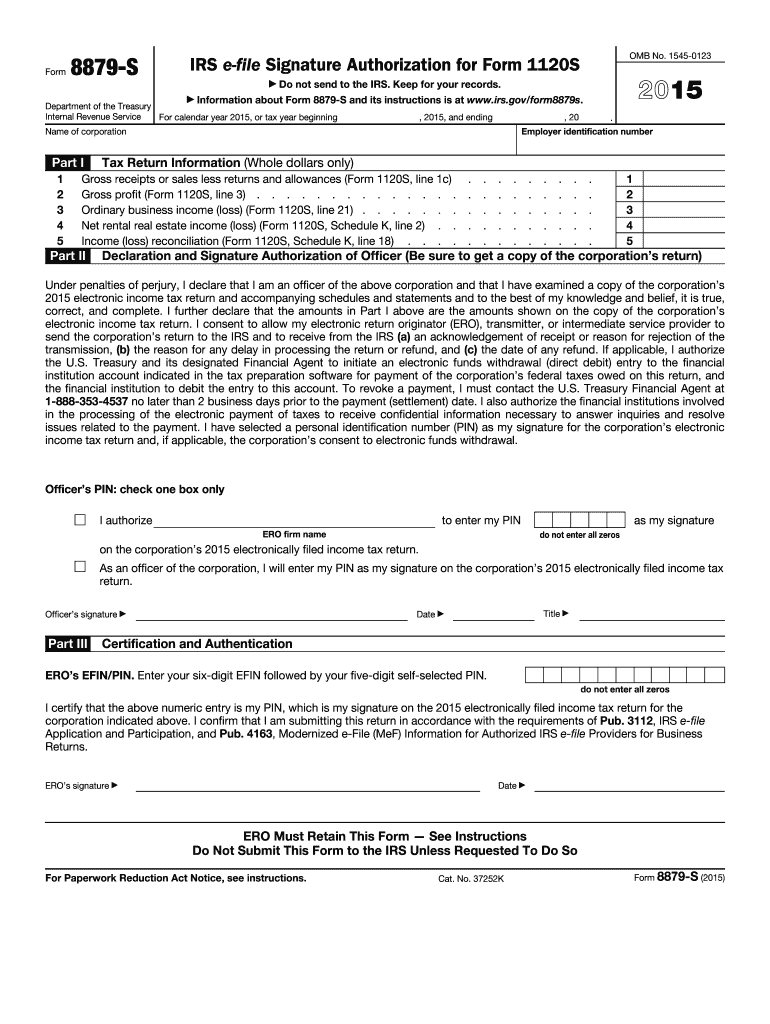

The 8879 S Form, also known as the IRS e-file Signature Authorization for an S Corporation, is a crucial document used by S corporations to authorize e-filing of their tax returns. This form allows the corporation to electronically sign and submit their tax return to the IRS, streamlining the filing process. It serves as a declaration that the information provided in the tax return is accurate and complete, ensuring compliance with IRS regulations.

How to use the 8879 S Form

To use the 8879 S Form, an authorized officer of the S corporation must complete the form after preparing the tax return. This includes entering the corporation's details, such as the Employer Identification Number (EIN) and the tax year. Once the form is filled out, the officer must sign it, which can be done electronically if using an e-filing system. This signature confirms the corporation's consent to electronically file the tax return.

Steps to complete the 8879 S Form

Completing the 8879 S Form involves several key steps:

- Gather necessary information, including the corporation's EIN and tax return details.

- Fill in the required fields on the form, ensuring accuracy in all entries.

- Have the authorized officer review the completed form.

- Sign the form electronically or in ink, depending on the filing method.

- Submit the form along with the e-filed tax return to the IRS.

Legal use of the 8879 S Form

The legal use of the 8879 S Form is governed by IRS regulations. By signing this form, the authorized officer certifies that the information provided in the tax return is true and correct. The form must be retained for three years from the date of filing, as it may be requested during an audit. Adhering to the legal requirements ensures that the e-filing process is valid and that the corporation remains compliant with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 8879 S Form coincide with the tax deadlines for S corporations. Generally, S corporations must file their tax returns by the fifteenth day of the third month after the end of their tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is essential to file the 8879 S Form and the associated tax return by this date to avoid penalties and interest on late filings.

Who Issues the Form

The 8879 S Form is issued by the Internal Revenue Service (IRS). It is specifically designed for S corporations that choose to e-file their tax returns. The IRS provides this form to facilitate the electronic filing process and to ensure that corporations can authorize their tax returns securely and efficiently.

Quick guide on how to complete 8879 s 2015 form

Complete 8879 S Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your files swiftly without delays. Manage 8879 S Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign 8879 S Form with ease

- Obtain 8879 S Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign 8879 S Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8879 s 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 8879 s 2015 form

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the 8879 S Form and why is it important?

The 8879 S Form is a crucial document that authorizes the electronic filing of S Corporation tax returns. Understanding its significance will ensure compliance with IRS regulations and streamline tax season for businesses. Using airSlate SignNow, you can effortlessly create and eSign the 8879 S Form online, minimizing paperwork and saving time.

-

How can airSlate SignNow help with the 8879 S Form process?

airSlate SignNow simplifies the process of handling the 8879 S Form by allowing users to create, send, and eSign documents securely online. Our platform ensures that your forms are completed accurately and filed on time. Additionally, you can track the status of your 8879 S Form in real-time, enhancing your workflow efficiency.

-

What are the pricing options for using airSlate SignNow for the 8879 S Form?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the efficient handling of the 8879 S Form, ensuring you get value for your investment. You can choose a plan that fits your budget and requirements, making it a cost-effective solution for eSigning tax documents.

-

Is airSlate SignNow secure for signing the 8879 S Form?

Yes, airSlate SignNow prioritizes security to protect your sensitive information when signing the 8879 S Form. Our platform utilizes advanced encryption and complies with strict data protection regulations. This ensures that your documents are secure, and your eSignatures are valid and legal.

-

Can I integrate airSlate SignNow with other software for the 8879 S Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to incorporate the 8879 S Form into your existing workflow. This integration facilitates document transfer and eSigning directly within your preferred applications, enhancing productivity.

-

What features does airSlate SignNow offer for managing the 8879 S Form?

airSlate SignNow provides a variety of features designed to simplify the management of the 8879 S Form. These include customizable templates, automated reminders, and real-time collaboration tools. Our user-friendly interface allows you to manage documents efficiently, ensuring a smooth eSigning experience.

-

How does eSigning the 8879 S Form save time?

eSigning the 8879 S Form through airSlate SignNow signNowly reduces the time required compared to traditional signing methods. You can complete the signing process from anywhere, at any time, without the need for printing or mailing documents. This convenience helps streamline your tax preparation process.

Get more for 8879 S Form

- Renovation contractor package hawaii form

- Concrete mason contractor package hawaii form

- Demolition contractor package hawaii form

- Security contractor package hawaii form

- Insulation contractor package hawaii form

- Paving contractor package hawaii form

- Site work contractor package hawaii form

- Siding contractor package hawaii form

Find out other 8879 S Form

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form