Form 1120S IRS Gov 2012

What is the Form 1120S IRS gov

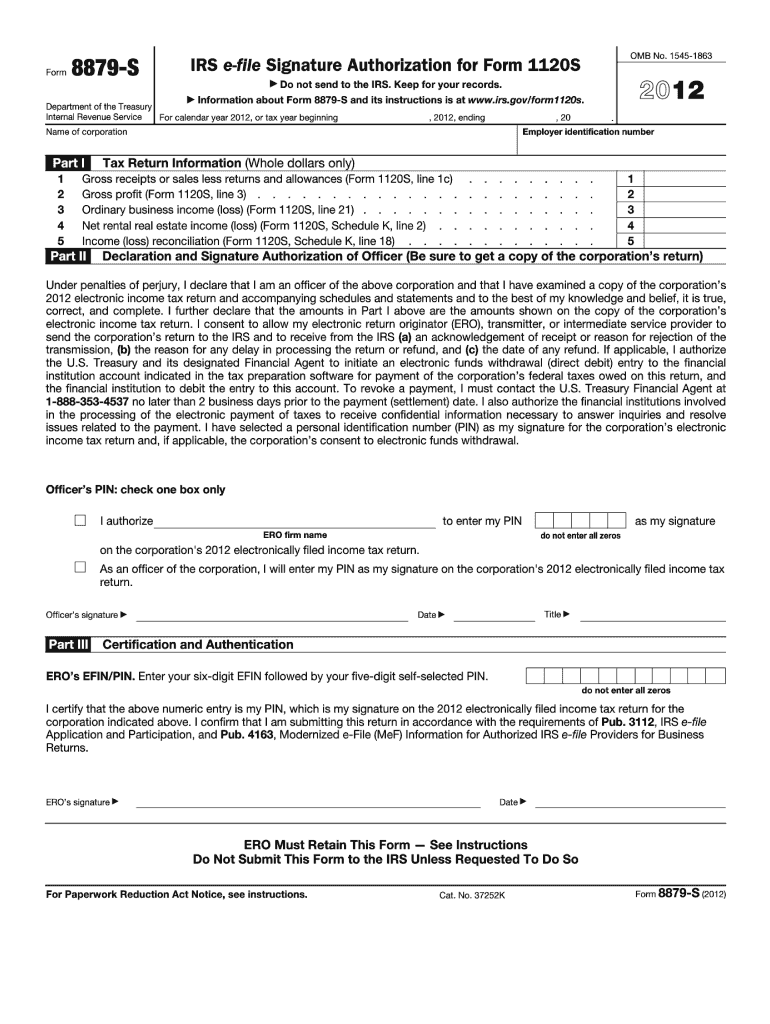

The Form 1120S is a tax return specifically designed for S corporations in the United States. This form is filed with the IRS to report income, deductions, gains, losses, and other relevant financial information. Unlike traditional corporations, S corporations pass their income, losses, deductions, and credits through to their shareholders, which means that the corporation itself typically does not pay federal income tax. Instead, shareholders report this information on their personal tax returns. Understanding the Form 1120S is essential for S corporations to ensure compliance with federal tax regulations.

How to use the Form 1120S IRS gov

Using the Form 1120S involves several steps to ensure accurate reporting of your S corporation's financial activities. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, complete the form by accurately entering your corporation's financial information in the respective sections. It's important to ensure that all calculations are correct, as errors can lead to penalties or delays in processing. Finally, submit the completed form to the IRS by the designated deadline, ensuring that you keep a copy for your records.

Steps to complete the Form 1120S IRS gov

Completing the Form 1120S requires careful attention to detail. Follow these steps for successful completion:

- Gather financial documents, including income statements and balance sheets.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income in the appropriate section, detailing all revenue generated during the tax year.

- List deductions, ensuring to include all eligible expenses that can reduce taxable income.

- Complete the Schedule K-1 for each shareholder, detailing their share of income, deductions, and credits.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 1120S IRS gov

The Form 1120S is legally binding when filed correctly and in accordance with IRS regulations. It is crucial for S corporations to adhere to the legal requirements associated with this form, including timely submission and accurate reporting of financial information. Failure to comply with these regulations can result in penalties, including fines and potential loss of S corporation status. Utilizing electronic filing methods can enhance the security and efficiency of the submission process, provided that the eSignature meets legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120S are critical for compliance. Generally, the form must be filed by the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means a deadline of March 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable for corporations to mark these dates on their calendars to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120S can be submitted through several methods, providing flexibility for S corporations. The primary methods include:

- Online Filing: Many businesses opt for electronic filing through IRS-approved software, which can streamline the process and reduce errors.

- Mail Submission: Corporations can also print and mail the completed form to the appropriate IRS address based on their location.

- In-Person Filing: While less common, some businesses may choose to file in person at designated IRS offices, though this method may require an appointment.

Quick guide on how to complete form 1120s irsgov

Complete Form 1120S IRS gov effortlessly on any device

Managing documents online has gained popularity among companies and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Form 1120S IRS gov on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign Form 1120S IRS gov without effort

- Obtain Form 1120S IRS gov and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Modify and eSign Form 1120S IRS gov and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120s irsgov

Create this form in 5 minutes!

How to create an eSignature for the form 1120s irsgov

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is Form 1120S IRS gov, and why is it important?

Form 1120S IRS gov is the tax form used by S corporations to report income, deductions, and credits. Filing this form is essential for S corporations to ensure compliance with IRS regulations and accurately calculate shareholders' tax obligations.

-

How can airSlate SignNow assist with completing Form 1120S IRS gov?

airSlate SignNow makes it easy to fill out and eSign Form 1120S IRS gov online. Our platform provides templates and tools to streamline the signing process, ensuring your documents are completed quickly and securely.

-

What features does airSlate SignNow offer for managing Form 1120S IRS gov?

With airSlate SignNow, you can access features like document templates, real-time collaboration, and automatic reminders to keep your Form 1120S IRS gov organized. Additionally, our user-friendly interface simplifies the entire eSigning process.

-

Is airSlate SignNow a cost-effective solution for handling Form 1120S IRS gov?

Yes, airSlate SignNow offers competitive pricing tailored to businesses of all sizes. Our cost-effective solution allows you to manage Form 1120S IRS gov without breaking the bank, providing excellent value for your investment.

-

Can I integrate airSlate SignNow with other tools for Form 1120S IRS gov?

Absolutely! airSlate SignNow supports integrations with various applications, enabling you to seamlessly connect your workflow for managing Form 1120S IRS gov. Whether you use accounting software or document management systems, we’ve got you covered.

-

What benefits does eSigning Form 1120S IRS gov with airSlate SignNow provide?

eSigning Form 1120S IRS gov with airSlate SignNow offers numerous benefits, including faster processing times, enhanced security, and reduced paperwork. This streamlined approach helps you focus on your business while ensuring compliance with IRS requirements.

-

Is there customer support available for issues related to Form 1120S IRS gov?

Yes, airSlate SignNow provides robust customer support to assist with any questions or issues regarding Form 1120S IRS gov. Our team is available through various channels to ensure you have the help you need when navigating the eSigning process.

Get more for Form 1120S IRS gov

- Conditional waiver and release of lien upon progress payment iowa form

- Notice non compliance 497304990 form

- Iowa 3 day notice form

- Iowa notice form

- 30 day notice to terminate month to month lease residential from landlord to tenant iowa form

- Iowa 30 day form

- 10 day notice to terminate week to week lease for residential from landlord to tenant iowa form

- 3 day notice to pay rent or lease terminated for nonresidential or commercial property iowa form

Find out other Form 1120S IRS gov

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation