IRS E File Signature Authorization for Form 1120 S Internal 2020

Understanding the IRS E-file Signature Authorization for Form 1120 S

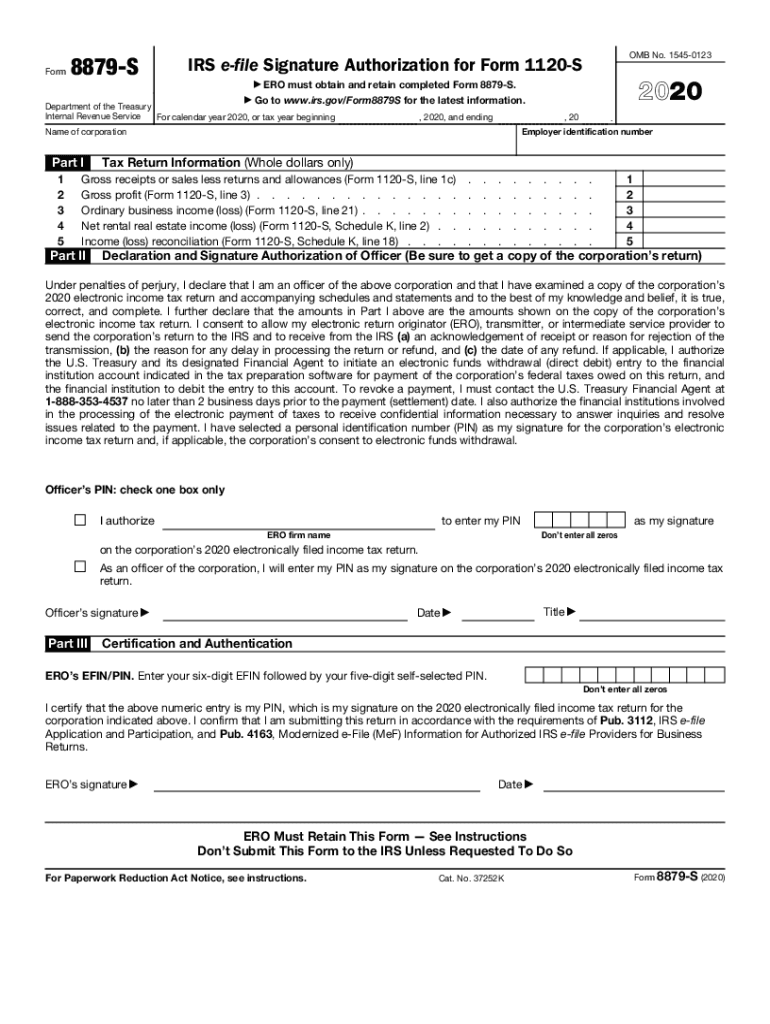

The IRS E-file Signature Authorization for Form 1120 S is a crucial document for S corporations filing their federal tax returns electronically. This form allows the corporation to authorize an electronic return originator (ERO) to file the return on its behalf. By using this authorization, the corporation can streamline its filing process while ensuring compliance with IRS regulations. It is essential for the signer to understand the implications of this authorization, as it binds the corporation to the accuracy and truthfulness of the information submitted electronically.

Steps to Complete the IRS E-file Signature Authorization for Form 1120 S

Completing the IRS E-file Signature Authorization for Form 1120 S involves several key steps. First, the corporation must gather necessary information, including the names and Social Security numbers of the signers. Next, the form should be filled out accurately, ensuring that all required fields are completed. After filling out the form, the authorized signers must provide their signatures, which can be done electronically using a reliable e-signature platform. Finally, the completed form should be submitted alongside the electronic tax return to the IRS.

Legal Use of the IRS E-file Signature Authorization for Form 1120 S

The legal validity of the IRS E-file Signature Authorization for Form 1120 S is supported by federal regulations governing electronic signatures. Under the ESIGN Act and UETA, electronic signatures are recognized as legally binding, provided they meet specific criteria. This means that when the form is signed electronically through a compliant platform, it holds the same weight as a traditional handwritten signature. Corporations must ensure that their e-signature solution adheres to these legal standards to maintain the integrity of their filings.

Filing Deadlines for the IRS E-file Signature Authorization

Filing deadlines for the IRS E-file Signature Authorization for Form 1120 S align with the deadlines for submitting the corporate tax return. Generally, S corporations must file their tax returns by the fifteenth day of the third month following the end of their tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is crucial for corporations to ensure that the authorization form is completed and submitted in a timely manner to avoid penalties and ensure compliance with IRS regulations.

Required Documents for IRS E-file Signature Authorization

To complete the IRS E-file Signature Authorization for Form 1120 S, several documents are required. These typically include the corporation's tax identification number, the names and Social Security numbers of the authorized signers, and any previous tax return documents that may be relevant. Having these documents ready can facilitate a smoother completion process and ensure that all necessary information is accurately captured on the form.

Examples of Using the IRS E-file Signature Authorization for Form 1120 S

Examples of using the IRS E-file Signature Authorization for Form 1120 S can include various scenarios, such as a small business filing its first tax return or an established corporation transitioning to electronic filing. In both cases, the authorization simplifies the process by allowing an ERO to submit the return on behalf of the corporation. This can be particularly beneficial for businesses that may not have the resources or expertise to navigate the complexities of tax filing independently.

Quick guide on how to complete irs e file signature authorization for form 1120 s internal

Finalize IRS E file Signature Authorization For Form 1120 S Internal with ease on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage IRS E file Signature Authorization For Form 1120 S Internal on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

Steps to modify and electronically sign IRS E file Signature Authorization For Form 1120 S Internal effortlessly

- Find IRS E file Signature Authorization For Form 1120 S Internal and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize crucial sections of the documents or redact sensitive information using tools specially provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign IRS E file Signature Authorization For Form 1120 S Internal while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs e file signature authorization for form 1120 s internal

Create this form in 5 minutes!

How to create an eSignature for the irs e file signature authorization for form 1120 s internal

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 2017 form 8879 IRS federal e file signature authorization?

The 2017 form 8879 IRS federal e file signature authorization is a document that allows taxpayers to authorize an income tax return to be electronically filed. This form ensures that the taxpayer's electronic signature complies with IRS standards, facilitating a smoother filing process.

-

How does airSlate SignNow help with the 2017 form 8879 IRS federal e file signature authorization?

airSlate SignNow provides an intuitive platform for businesses to easily prepare and eSign the 2017 form 8879 IRS federal e file signature authorization. With advanced tracking features, users can ensure that their authorization is securely processed and stored.

-

Is airSlate SignNow cost-effective for handling the 2017 form 8879 IRS federal e file signature authorization?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for managing the 2017 form 8879 IRS federal e file signature authorization. Businesses can save time and resources while ensuring compliance with IRS e-filing regulations.

-

What features does airSlate SignNow offer for eSigning the 2017 form 8879 IRS federal e file signature authorization?

airSlate SignNow includes features like customizable templates, in-person signing, and advanced security options for eSigning the 2017 form 8879 IRS federal e file signature authorization. These features enhance the user experience and ensure that documents are signed legally and securely.

-

Can I integrate airSlate SignNow with other software for the 2017 form 8879 IRS federal e file signature authorization?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing users to efficiently manage the 2017 form 8879 IRS federal e file signature authorization from their preferred platforms. This connectivity streamlines the workflow and boosts productivity.

-

What are the benefits of using airSlate SignNow for the 2017 form 8879 IRS federal e file signature authorization?

By using airSlate SignNow for the 2017 form 8879 IRS federal e file signature authorization, businesses benefit from increased efficiency, reduced paperwork, and enhanced security. This solution simplifies the e-signing process, allowing users to focus on what matters most—growing their business.

-

How secure is airSlate SignNow for signing the 2017 form 8879 IRS federal e file signature authorization?

Security is a top priority for airSlate SignNow. The platform employs industry-standard encryption protocols and secure access controls, ensuring that the integrity of the 2017 form 8879 IRS federal e file signature authorization is maintained throughout the signing process.

Get more for IRS E file Signature Authorization For Form 1120 S Internal

- Wyoming lien form

- Intent lien form 497432143

- Wyoming quitclaim deed form

- Warranty deed from individual to individual wyoming form

- Wyoming quitclaim form

- Wyoming warranty deed form

- Warranty deed to child reserving a life estate in the parents wyoming form

- Discovery interrogatories from plaintiff to defendant with production requests wyoming form

Find out other IRS E file Signature Authorization For Form 1120 S Internal

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile