Form 8453 EO Exempt Organization Declaration and Signature for Electronic Filing 2012

What is the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

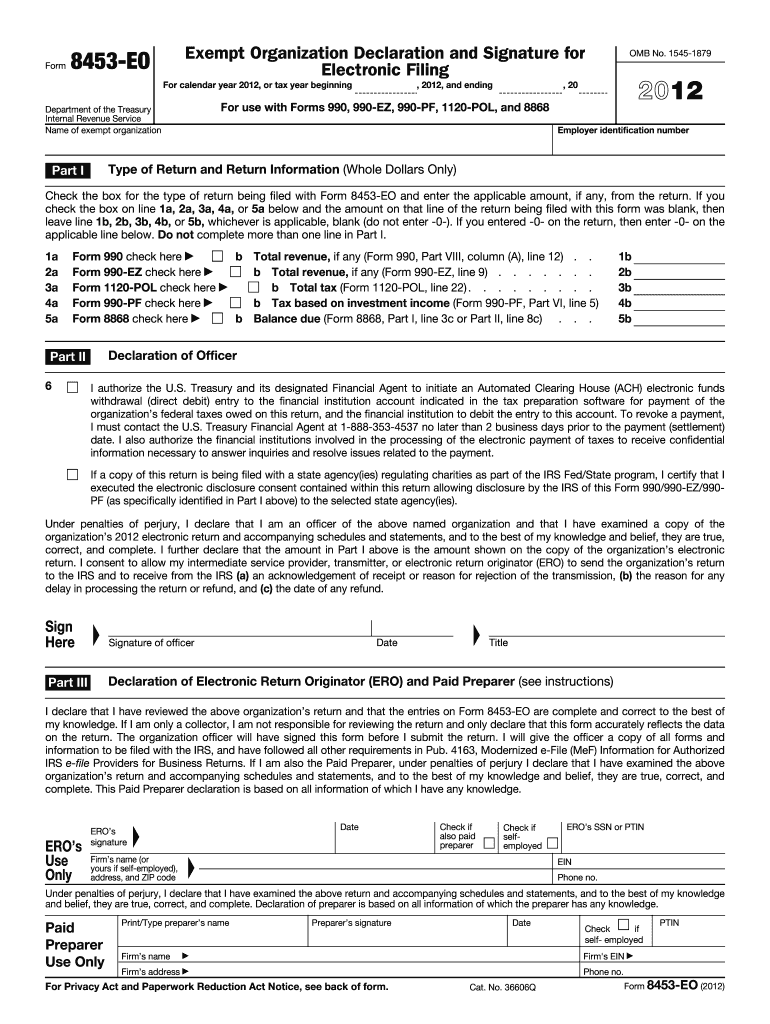

The Form 8453 EO Exempt Organization Declaration and Signature for Electronic Filing is a crucial document used by exempt organizations when submitting their electronic tax returns to the IRS. This form serves as a declaration that the organization is authorized to file electronically and that the information provided is accurate and complete. It is specifically designed for organizations that are exempt from federal income tax under section 501(c) of the Internal Revenue Code. The form must be signed by an authorized individual, typically an officer or director, to validate the electronic submission.

Steps to Complete the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

Completing the Form 8453 EO involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including the organization’s name, Employer Identification Number (EIN), and the name of the authorized signer. Next, fill out the form with the required details, ensuring that all entries are accurate. After completing the form, the authorized individual must sign it electronically. Finally, submit the form alongside the electronic tax return to the IRS. It is essential to retain a copy of the signed form for your records.

Legal Use of the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

The legal use of the Form 8453 EO is governed by various regulations that ensure the validity of electronic signatures. Under the Electronic Signatures in Global and National Commerce Act (ESIGN), the form is considered legally binding when signed electronically, provided that the signer has consented to use electronic records. Additionally, compliance with the Uniform Electronic Transactions Act (UETA) is necessary to ensure that the electronic submission is recognized by state laws. Organizations must ensure that they follow these legal frameworks to maintain the integrity of their electronic filings.

IRS Guidelines for the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

The IRS provides specific guidelines for the use of Form 8453 EO. Organizations must ensure that they are eligible to file electronically and that they meet all requirements outlined in IRS publications. The form must be submitted in conjunction with the electronic tax return, and it is crucial to follow the IRS instructions carefully to avoid delays or penalties. Organizations should also be aware of any updates or changes to the guidelines that may affect their filing process.

Filing Deadlines for the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

Filing deadlines for the Form 8453 EO coincide with the deadlines for submitting the associated electronic tax return. Generally, exempt organizations must file their returns by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this typically means a May 15 deadline. It is important for organizations to be aware of these deadlines to ensure timely submissions and to avoid penalties for late filing.

Required Documents for the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

When preparing to file the Form 8453 EO, organizations should have several documents on hand. These include the organization’s Employer Identification Number (EIN), financial statements, and any other supporting documentation related to the electronic tax return. Ensuring that all required documents are complete and accurate will facilitate a smoother filing process and help prevent any issues with the IRS.

Quick guide on how to complete 2012 form 8453 eo exempt organization declaration and signature for electronic filing

Complete Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing effortlessly on any device

The management of documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents promptly without delays. Manage Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing effortlessly

- Obtain Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing and click Get Form to begin.

- Utilize the features we offer to submit your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiresome form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 8453 eo exempt organization declaration and signature for electronic filing

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 8453 eo exempt organization declaration and signature for electronic filing

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing?

Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing is a form used by tax-exempt organizations to electronically sign and submit their tax returns. This form simplifies the filing process by allowing organizations to declare their income and expenses efficiently. airSlate SignNow provides an easy way to handle this electronic filing process.

-

How does airSlate SignNow simplify the completion of Form 8453 EO?

airSlate SignNow simplifies the completion of Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing by providing user-friendly templates and intuitive signing workflows. You can easily fill out required fields and add electronic signatures, making the process straightforward and efficient. This minimizes the chances of errors and ensures compliance with IRS requirements.

-

What are the pricing options for using airSlate SignNow for Form 8453 EO?

airSlate SignNow offers various pricing plans suitable for different organizational needs, ensuring access to Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing at a cost-effective rate. You can choose from monthly or annual billing options, with features scaling according to your requirements. Visit our pricing page for detailed information on each plan.

-

What features does airSlate SignNow offer for managing Form 8453 EO?

airSlate SignNow provides several features tailored for managing Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing, including document templates, eSignature capabilities, and secure storage. With our platform, you can track the status of your submissions, collaborate with team members, and ensure that all filings are completed on time and accurately.

-

Are there integrations available for airSlate SignNow when filing Form 8453 EO?

Yes, airSlate SignNow integrates seamlessly with popular accounting and tax software, enhancing your ability to file Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing. These integrations streamline data transfer and ensure that you have all necessary information at your fingertips. This keeps your workflow efficient and helps reduce time spent on paperwork.

-

How secure is the information when using airSlate SignNow for Form 8453 EO?

The security of your information is a top priority for airSlate SignNow. We implement advanced encryption protocols and comply with industry standards to protect your data while you complete and file Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing. Our platform is designed to keep your sensitive information safe throughout the entire process.

-

Can I track the status of my Form 8453 EO submission through airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing submissions in real-time. You will receive notifications on progress updates and confirmation once the filing is completed, ensuring you stay informed throughout the process.

Get more for Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

- District of columbia general 497301759 form

- Small business accounting package district of columbia form

- Company employment policies and procedures package district of columbia form

- Dc child form

- Newly divorced individuals package district of columbia form

- Dc statutory form

- Contractors forms package district of columbia

- Power of attorney for sale of motor vehicle district of columbia form

Find out other Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT