PDF Form 8453 EO Internal Revenue Service 2020-2026

What is IRS Form 8453?

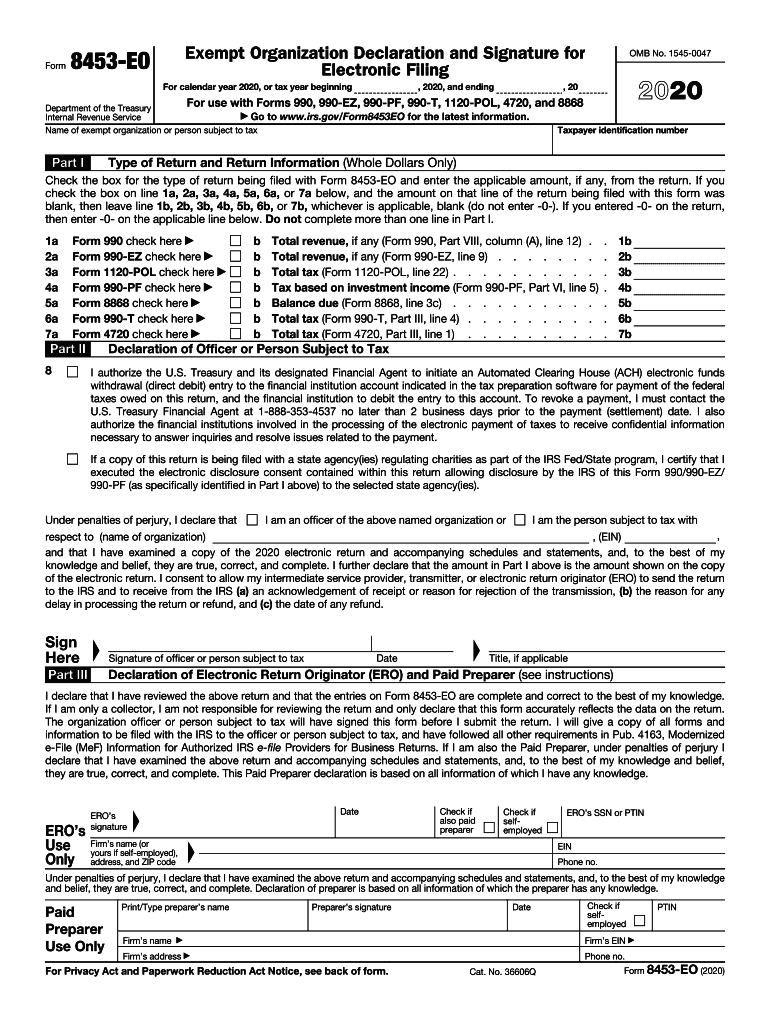

IRS Form 8453, also known as the Declaration for Electronic Filing, is a crucial document used by taxpayers who file their tax returns electronically. This form serves as a declaration that the taxpayer has reviewed and approved the electronic submission of their tax return. By signing Form 8453, the taxpayer confirms that the information provided is accurate and complete. It is particularly important for those who are filing certain types of returns, such as those involving electronic signatures or specific attachments.

How to Use IRS Form 8453

To effectively use IRS Form 8453, taxpayers should first ensure they have completed their electronic tax return. After filling out the electronic form, they must print and sign Form 8453. This signed form should then be sent to the IRS along with any required supporting documents. It is essential to keep a copy of the signed form for personal records. The form acts as a bridge between the electronic submission and the IRS, providing necessary verification of the taxpayer's identity and consent.

Steps to Complete IRS Form 8453

Completing IRS Form 8453 involves several straightforward steps:

- Gather necessary information, including your Social Security number, tax return details, and any applicable attachments.

- Fill out the electronic version of your tax return using your preferred tax software.

- Print IRS Form 8453 after completing your electronic tax return.

- Sign and date the form, ensuring that all information is accurate.

- Submit the signed form to the IRS along with any required documents, either by mail or electronically, as specified by your tax software.

Legal Use of IRS Form 8453

IRS Form 8453 is legally binding when filled out and signed correctly. The form must be submitted in accordance with IRS regulations to ensure compliance. It is important to understand that signing this form electronically does not diminish its legal validity. The IRS recognizes electronic signatures as valid under the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Therefore, using a reliable eSignature solution can enhance the security and legality of the submission process.

Key Elements of IRS Form 8453

IRS Form 8453 contains several key elements that are essential for its validity:

- Taxpayer Information: This includes your name, address, and Social Security number.

- Tax Return Details: Information regarding the type of return being filed and the tax year.

- Signature Section: A space for the taxpayer's signature and date, confirming the accuracy of the information.

- Declaration Statement: A statement affirming that the taxpayer has reviewed the electronic return and supports its submission.

Form Submission Methods

IRS Form 8453 can be submitted through various methods, depending on how the taxpayer chooses to file their return:

- Online Submission: If filing electronically, the form can often be submitted directly through the tax software used.

- Mail: For those who prefer traditional methods, the signed form can be mailed to the appropriate IRS address as specified in the filing instructions.

- In-Person: Some taxpayers may choose to deliver the form in person at their local IRS office, although this is less common.

Quick guide on how to complete pdf form 8453 eo internal revenue service

Easily Prepare PDF Form 8453 EO Internal Revenue Service on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle PDF Form 8453 EO Internal Revenue Service on any platform using airSlate SignNow's applications for Android or iOS, and streamline any document-related procedure today.

Steps to Modify and eSign PDF Form 8453 EO Internal Revenue Service with Ease

- Locate PDF Form 8453 EO Internal Revenue Service and select Get Form to begin.

- Utilize the tools provided to finalize your document.

- Highlight essential sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sending your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign PDF Form 8453 EO Internal Revenue Service to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form 8453 eo internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the pdf form 8453 eo internal revenue service

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the IRS Form 8453?

The IRS Form 8453 is a declaration form used by taxpayers filing electronically. It authorizes the e-filing of specific tax forms and confirms the accuracy of the submitted data. airSlate SignNow simplifies the process of e-signing and submitting IRS Form 8453 for your convenience.

-

How can airSlate SignNow help with IRS Form 8453?

airSlate SignNow provides a seamless platform for electronically signing IRS Form 8453. With its user-friendly interface, you can easily fill out and e-sign the form, ensuring compliance and quick submission. This saves time and minimizes errors in your tax filing process.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8453?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective. You'll find various plans that include features like unlimited e-signatures, document management, and personalized workflows, all of which can enhance your IRS Form 8453 processing.

-

Can I integrate airSlate SignNow with other software for IRS Form 8453?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax preparation software, making it easy to handle IRS Form 8453. By integrating with tools you already use, you can streamline your document workflows and enhance efficiency.

-

What are the benefits of using airSlate SignNow for IRS Form 8453?

Using airSlate SignNow for IRS Form 8453 provides numerous benefits, including enhanced security, faster processing, and ease of use. Electronic signatures are legally binding, allowing for a quicker turnaround in securing approvals on your tax forms.

-

Is airSlate SignNow compliant with IRS requirements for Form 8453?

Yes, airSlate SignNow is compliant with IRS e-filing requirements, ensuring your IRS Form 8453 is processed correctly. Our platform adheres to all necessary regulations, providing peace of mind when electronically submitting your tax documents.

-

How secure is my information when using airSlate SignNow for IRS Form 8453?

airSlate SignNow prioritizes security, employing encryption and secure cloud storage to protect your information when processing IRS Form 8453. Our platform meets industry standards, ensuring that your sensitive tax data remains confidential and safe.

Get more for PDF Form 8453 EO Internal Revenue Service

- Contract for sale and purchase of real estate with no broker for residential home sale agreement wisconsin form

- Buyers home inspection checklist wisconsin form

- Sellers information for appraiser provided to buyer wisconsin

- Wi agreement form

- Option to purchase addendum to residential lease lease or rent to own wisconsin form

- Wisconsin prenuptial premarital agreement with financial statements wisconsin form

- Wisconsin prenuptial premarital agreement without financial statements wisconsin form

- Mandat de protection future form

Find out other PDF Form 8453 EO Internal Revenue Service

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online