Form 8453 EO Exempt Organization Declaration and Signature for Electronic Filing 2016

What is the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

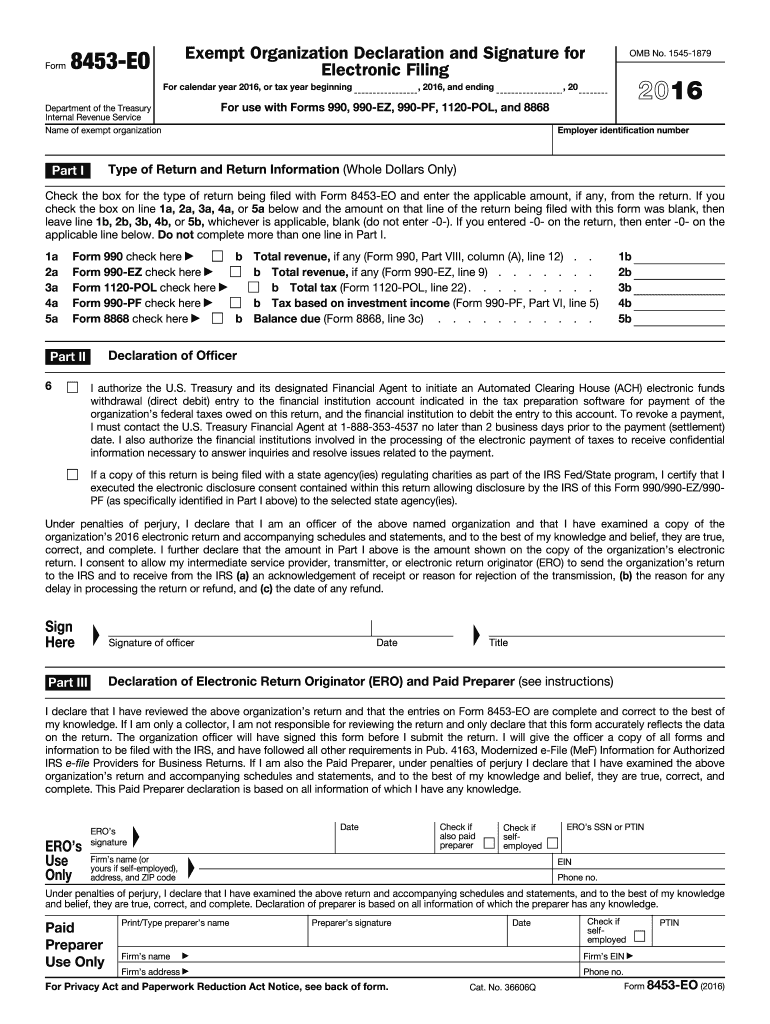

The Form 8453 EO Exempt Organization Declaration and Signature for Electronic Filing is a crucial document for exempt organizations in the United States. This form serves as a declaration that the electronic submission of tax returns is accurate and complete. It is specifically designed for organizations that file their returns electronically, ensuring compliance with IRS regulations. By signing this form, the authorized representative of the organization affirms that all information provided is true and that the organization is eligible for tax-exempt status under the relevant sections of the Internal Revenue Code.

Steps to complete the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

Completing the Form 8453 EO involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the organization, including its legal name, Employer Identification Number (EIN), and address. Next, ensure that the electronic return is prepared and ready for submission. Once the return is complete, the authorized representative must review the information carefully. After verification, the representative will sign the form electronically, confirming their authority to act on behalf of the organization. Finally, submit the signed form along with the electronic return to the IRS.

Legal use of the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

The legal use of the Form 8453 EO is essential for maintaining compliance with IRS regulations regarding electronic filing. This form acts as a formal declaration that the organization’s electronic tax return is accurate and complete. To ensure its legal standing, organizations must adhere to the requirements set forth by the IRS, including proper signature protocols. The form's electronic signature is considered valid under the Electronic Signatures in Global and National Commerce (ESIGN) Act, provided that it meets specific criteria. Organizations should also retain a copy of the signed form for their records, as it may be required for future audits or inquiries.

How to obtain the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

The Form 8453 EO can be obtained directly from the IRS website or through tax preparation software that supports electronic filing for exempt organizations. It is essential to ensure that you are using the most current version of the form, as updates may occur annually. Organizations may also consult with tax professionals to obtain the form and receive guidance on its proper use. Once acquired, the form can be filled out electronically, streamlining the filing process.

IRS Guidelines

The IRS provides specific guidelines for the use of the Form 8453 EO. These guidelines outline the eligibility criteria for organizations wishing to file electronically, as well as the necessary steps for completing and submitting the form. Organizations must ensure they meet all requirements for tax-exempt status and follow the IRS instructions carefully to avoid penalties. The IRS also emphasizes the importance of maintaining accurate records and documentation related to the electronic filing process, including copies of the signed form.

Form Submission Methods (Online / Mail / In-Person)

The Form 8453 EO must be submitted electronically alongside the organization’s tax return. While the form itself is not mailed or submitted in person, it is essential to ensure that the electronic submission is completed through an IRS-approved e-filing system. Organizations should verify that their electronic filing method complies with IRS standards. Retaining a copy of the signed form for internal records is advisable, as it may be requested during audits or by the IRS.

Quick guide on how to complete 2016 form 8453 eo exempt organization declaration and signature for electronic filing

Finalize Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing effortlessly on any device

The management of online documents has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing with ease

- Find Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing and click Get Form to commence.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you would prefer to send your form—via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate the printing of new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 8453 eo exempt organization declaration and signature for electronic filing

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 8453 eo exempt organization declaration and signature for electronic filing

How to generate an eSignature for the 2016 Form 8453 Eo Exempt Organization Declaration And Signature For Electronic Filing online

How to make an eSignature for your 2016 Form 8453 Eo Exempt Organization Declaration And Signature For Electronic Filing in Chrome

How to generate an eSignature for putting it on the 2016 Form 8453 Eo Exempt Organization Declaration And Signature For Electronic Filing in Gmail

How to create an electronic signature for the 2016 Form 8453 Eo Exempt Organization Declaration And Signature For Electronic Filing straight from your smart phone

How to make an eSignature for the 2016 Form 8453 Eo Exempt Organization Declaration And Signature For Electronic Filing on iOS devices

How to generate an eSignature for the 2016 Form 8453 Eo Exempt Organization Declaration And Signature For Electronic Filing on Android devices

People also ask

-

What is the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing?

The Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing is a document used by exempt organizations to authorize the electronic submission of their tax returns. This form certifies that the organization has reviewed the electronic filing and confirms the accuracy of the information included. Utilizing airSlate SignNow, you can easily sign and submit this form electronically, simplifying the filing process.

-

How does airSlate SignNow simplify the process of using Form 8453 EO?

airSlate SignNow offers a user-friendly platform to electronically sign the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing. Our solution allows you to manage document workflows, send reminders, and securely store signed forms. This streamlines the filing process, ensuring faster and more efficient submissions.

-

What are the benefits of using airSlate SignNow for Form 8453 EO?

Using airSlate SignNow for your Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing offers numerous advantages, including reduced paperwork and faster processing times. Our platform ensures compliance with tax regulations while providing a secure environment for sensitive information. Additionally, the tracking feature allows you to monitor the status of your submissions.

-

Are there any costs associated with using airSlate SignNow for Form 8453 EO?

airSlate SignNow provides cost-effective pricing plans that cater to various organizational needs, including the use of Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing. You can choose from multiple subscription options based on the volume of documents you need to manage, making it affordable for all types of businesses.

-

Can I integrate airSlate SignNow with other software for filing Form 8453 EO?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software to enhance your workflow when dealing with Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing. This integration allows for automatic data transfer and eliminates redundant data entry, making your filing process even more efficient.

-

Is it safe to use airSlate SignNow for submitting Form 8453 EO?

Absolutely! airSlate SignNow employs advanced encryption and security measures to ensure your Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing is kept secure. We comply with industry standards for data privacy and protection, allowing you to file your documents with confidence.

-

How can I get support if I encounter issues with Form 8453 EO on airSlate SignNow?

Our support team is readily available to assist you with any issues related to the Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing on airSlate SignNow. You can signNow out via live chat, email, or access our comprehensive support resources on the website, ensuring you receive timely help whenever you need it.

Get more for Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

Find out other Form 8453 EO Exempt Organization Declaration And Signature For Electronic Filing

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online