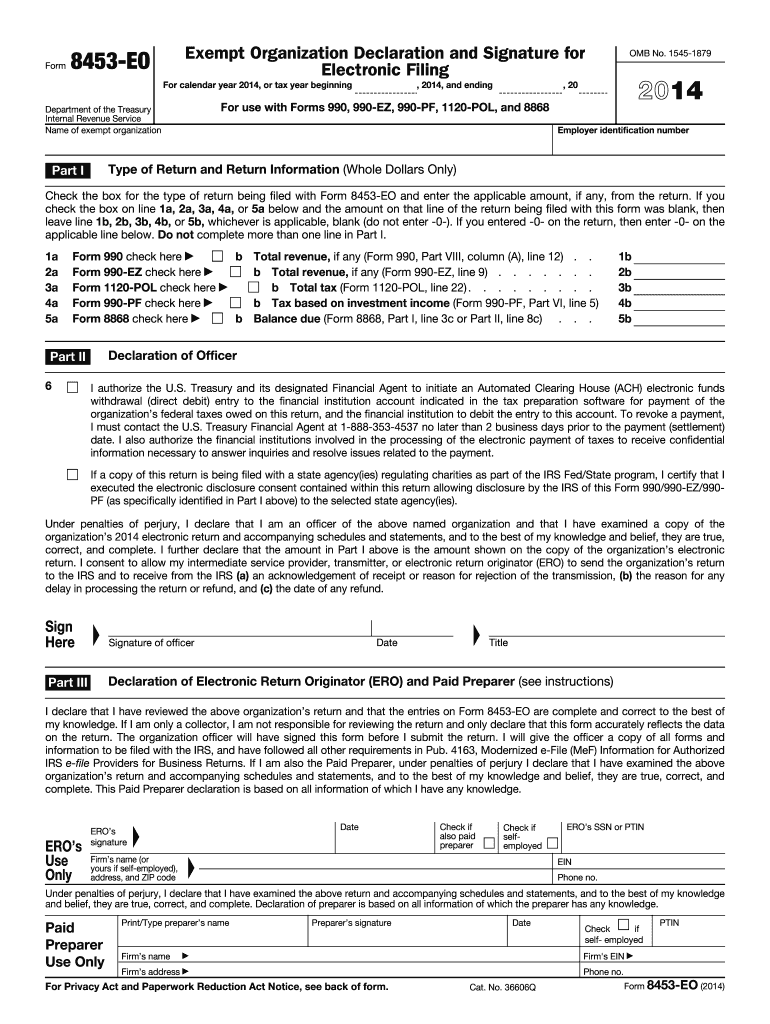

Irs Form 8453 2014

What is the IRS Form 8453

The IRS Form 8453, also known as the "U.S. Individual Income Tax Transmittal for an IRS e-file Return," is a crucial document used by taxpayers who e-file their federal tax returns. This form serves as a declaration that the taxpayer has authorized the electronic submission of their tax return. It is particularly important for individuals who are submitting their returns through tax preparation software or tax professionals. The form includes essential information such as the taxpayer's name, Social Security number, and the type of return being filed.

How to use the IRS Form 8453

Using the IRS Form 8453 involves a few straightforward steps. First, taxpayers should complete their federal tax return using e-filing software. Once the return is finalized, the software will prompt the user to generate the Form 8453. After filling in the required information, the taxpayer must sign the form electronically. This signature confirms the authenticity of the e-filed return. Finally, the completed Form 8453 must be submitted according to the instructions provided by the e-filing software, which typically includes sending it to the IRS via mail.

Steps to complete the IRS Form 8453

To complete the IRS Form 8453, follow these steps:

- Gather necessary information, including your name, Social Security number, and details of your tax return.

- Open your e-filing software and complete your tax return.

- Locate the option to generate Form 8453 within the software.

- Fill in the required fields on Form 8453, ensuring accuracy.

- Sign the form electronically as prompted by the software.

- Submit the Form 8453 to the IRS as directed by your e-filing software.

Legal use of the IRS Form 8453

The IRS Form 8453 is legally significant as it serves to validate the electronic submission of a tax return. By signing this form, taxpayers affirm that the information provided in their e-filed return is accurate and complete. The form must be retained for three years from the date of filing, as it may be requested by the IRS for verification purposes. Compliance with IRS regulations regarding this form ensures that taxpayers maintain their rights and obligations under U.S. tax law.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8453 align with the general tax return deadlines. Typically, individual taxpayers must file their federal tax returns by April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential for taxpayers to be aware of these deadlines to avoid penalties and interest on unpaid taxes. Extensions may be available, but the Form 8453 must still be submitted timely if the taxpayer intends to e-file.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 8453 can be submitted primarily through electronic means as part of the e-filing process. Once the form is signed electronically, it is typically transmitted along with the e-filed tax return. If a taxpayer is unable to e-file, they may need to print the Form 8453 and submit it by mail to the appropriate IRS address. In-person submission is not a standard practice for this form, as it is designed for electronic filing.

Quick guide on how to complete 2014 irs form 8453

Complete Irs Form 8453 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Irs Form 8453 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Irs Form 8453 with ease

- Obtain Irs Form 8453 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Modify and eSign Irs Form 8453 and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs form 8453

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs form 8453

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is IRS Form 8453 and why is it important?

IRS Form 8453 is a document that allows taxpayers to authorize electronic filing of their tax returns. This form is crucial because it verifies that the taxpayer agrees to e-file their tax documents, ensuring compliance with IRS regulations. Utilizing airSlate SignNow can simplify the signing process for IRS Form 8453, making it easier for businesses to manage their tax filings efficiently.

-

How can airSlate SignNow help with IRS Form 8453?

airSlate SignNow streamlines the signing and submission of IRS Form 8453 through its electronic signature capabilities. Users can easily send, sign, and store this form securely, reducing the risk of errors and enhancing the speed of processing. With airSlate SignNow, you can ensure that your IRS Form 8453 is signed promptly and accurately.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8453?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for businesses of all sizes, making it easier to manage IRS Form 8453 and other documents. The pricing depends on the features you choose, but the tools provided deliver signNow value, especially when it comes to electronic filing efficiency. Transparent pricing means you can select a plan that meets your needs without unexpected costs.

-

What features does airSlate SignNow offer for managing tax documents like IRS Form 8453?

airSlate SignNow provides features such as secure electronic signatures, customizable templates, and automated workflows tailored for tax documents like IRS Form 8453. These functionalities ensure documents are processed quickly and accurately, improving overall compliance and organization. Additionally, users can track document status in real-time, making it easier to manage deadlines.

-

Can I integrate airSlate SignNow with other software for filing IRS Form 8453?

Yes, airSlate SignNow offers integrations with various accounting and tax software, enabling seamless management of IRS Form 8453 alongside other important financial documents. This integration facilitates a more streamlined workflow, allowing you to combine data from multiple sources efficiently. Users benefit from increased productivity by connecting tools they already use.

-

How secure is the signing process for IRS Form 8453 with airSlate SignNow?

The signing process for IRS Form 8453 with airSlate SignNow is highly secure, implementing industry-standard encryption and compliance measures. This ensures that your sensitive tax information remains confidential and protected throughout the entire signing process. Trust is crucial when dealing with financial documents, and airSlate SignNow prioritizes the security of your IRS Form 8453.

-

Can multiple signers collaborate on IRS Form 8453 using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple signers to collaborate effortlessly on IRS Form 8453. You can invite team members or clients to review and sign the form simultaneously, streamlining the approval process. This collaborative feature enhances efficiency, especially during busy tax seasons when timely submissions are essential.

Get more for Irs Form 8453

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497303597 form

- Georgia corporation 497303598 form

- Georgia professional corporation form

- Georgia confidentiality form

- Ga directors form

- Ga corporations form

- Georgia limited liability company llc formation package georgia

- Georgia operating form

Find out other Irs Form 8453

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple