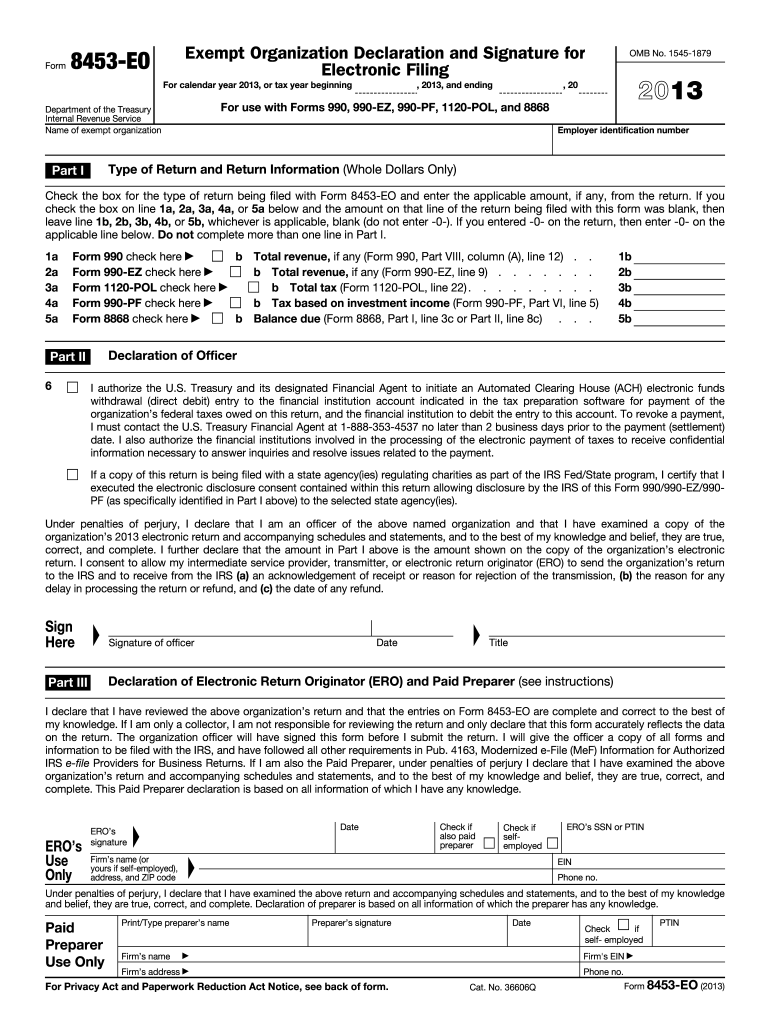

Irs Form 8453 2013

What is the IRS Form 8453

The IRS Form 8453, also known as the "U.S. Individual Income Tax Transmittal for an IRS e-file Return," is a crucial document used by taxpayers who file their returns electronically. This form serves as a declaration that the taxpayer has authorized the e-filing of their tax return and confirms the accuracy of the information provided. It is particularly important for those who are submitting tax returns that require additional documentation, such as supporting schedules or forms that cannot be filed electronically.

How to use the IRS Form 8453

Using the IRS Form 8453 involves several steps to ensure compliance with e-filing regulations. Taxpayers must complete the form accurately, providing their personal information and details about their tax return. Once completed, the form must be signed and dated by the taxpayer or their authorized representative. It is then submitted to the IRS along with the electronic filing of the tax return. This form acts as a cover sheet, ensuring that the IRS has the necessary authorization to process the e-filed return.

Steps to complete the IRS Form 8453

Completing the IRS Form 8453 involves a systematic approach:

- Gather necessary personal information, including your name, Social Security number, and address.

- Provide details about your tax return, including the type of return you are filing and any additional forms or schedules attached.

- Review the form for accuracy, ensuring all information is correct and complete.

- Sign and date the form, which can be done electronically if using a compliant e-signature solution.

- Submit the completed form along with your e-filed return to the IRS.

Legal use of the IRS Form 8453

The IRS Form 8453 is legally binding when completed and signed correctly. It must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which recognizes electronic signatures as valid. To ensure legal compliance, taxpayers should use a secure and reliable e-signature platform that provides a digital certificate, confirming the identity of the signer and the integrity of the document. This compliance is essential for the form to be accepted by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8453 align with the general tax filing deadlines. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may file, which can provide additional time to submit their returns and the accompanying Form 8453.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 8453 can be submitted in conjunction with an electronically filed tax return. When e-filing, taxpayers typically do not need to mail the form separately, as it is transmitted electronically. However, if the e-filing process does not allow for certain attachments, taxpayers may need to print and mail the form along with any required documents. In-person submission is generally not applicable for this form, as it is primarily designed for electronic filing.

Quick guide on how to complete 2013 irs form 8453

Prepare Irs Form 8453 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Irs Form 8453 on any platform using airSlate SignNow's Android or iOS apps and enhance any document-based operation today.

The easiest way to edit and eSign Irs Form 8453 without effort

- Locate Irs Form 8453 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 8453 to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 irs form 8453

Create this form in 5 minutes!

How to create an eSignature for the 2013 irs form 8453

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is IRS Form 8453 and why is it important?

IRS Form 8453 is an important document used to authorize e-filed tax returns. It serves as a declaration that the taxpayer has reviewed the electronic return and agrees with the information provided. Using airSlate SignNow, you can easily eSign and submit IRS Form 8453 securely and efficiently.

-

How can I eSign IRS Form 8453 using airSlate SignNow?

With airSlate SignNow, eSigning IRS Form 8453 is a breeze. Simply upload your form, add the necessary signers, and utilize our electronic signature feature to complete the process. This ensures you are compliant with IRS regulations while saving time and effort.

-

Are there any costs associated with using airSlate SignNow for IRS Form 8453?

airSlate SignNow offers various pricing tiers, making it a cost-effective solution for eSigning IRS Form 8453. You can choose a plan that best suits your needs, whether you are a small business or a larger organization. Competitive rates ensure that you receive great value and functionality.

-

What features does airSlate SignNow offer for IRS Form 8453?

airSlate SignNow provides a suite of features that enhance the eSigning experience for IRS Form 8453. These include templates for easy access, multi-party signing options, real-time tracking, and cloud storage integration. All these functionalities streamline the process while ensuring document security.

-

Can airSlate SignNow integrate with other accounting software for IRS Form 8453?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software to facilitate the processing of IRS Form 8453. This allows users to connect their workflows and ensures that all documentation can be managed from a single platform. This integration simplifies your tax filing process.

-

What are the benefits of using airSlate SignNow for IRS Form 8453?

Using airSlate SignNow for IRS Form 8453 offers numerous benefits, such as enhanced security, reduced turnaround time, and efficient management of documents. The platform assures compliance with IRS standards while providing a user-friendly interface. Additionally, eSigning eliminates the need for printing and physical signatures.

-

Is airSlate SignNow compliant with IRS regulations for IRS Form 8453?

Absolutely! airSlate SignNow is fully compliant with IRS regulations concerning electronic signatures for IRS Form 8453. This compliance ensures that your electronically submitted forms are accepted without issue, providing peace of mind as you file your tax documentation.

Get more for Irs Form 8453

- Storage business package florida form

- Child care services package florida form

- Florida seller form

- Fl purchaser form

- Limited power of attorney where you specify powers with sample powers included florida form

- Limited power of attorney for stock transactions and corporate powers florida form

- Special durable power of attorney for bank account matters florida form

- Florida small business startup package florida form

Find out other Irs Form 8453

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document