Schedule F Writeable Form 2012

What is the Schedule F Writeable Form

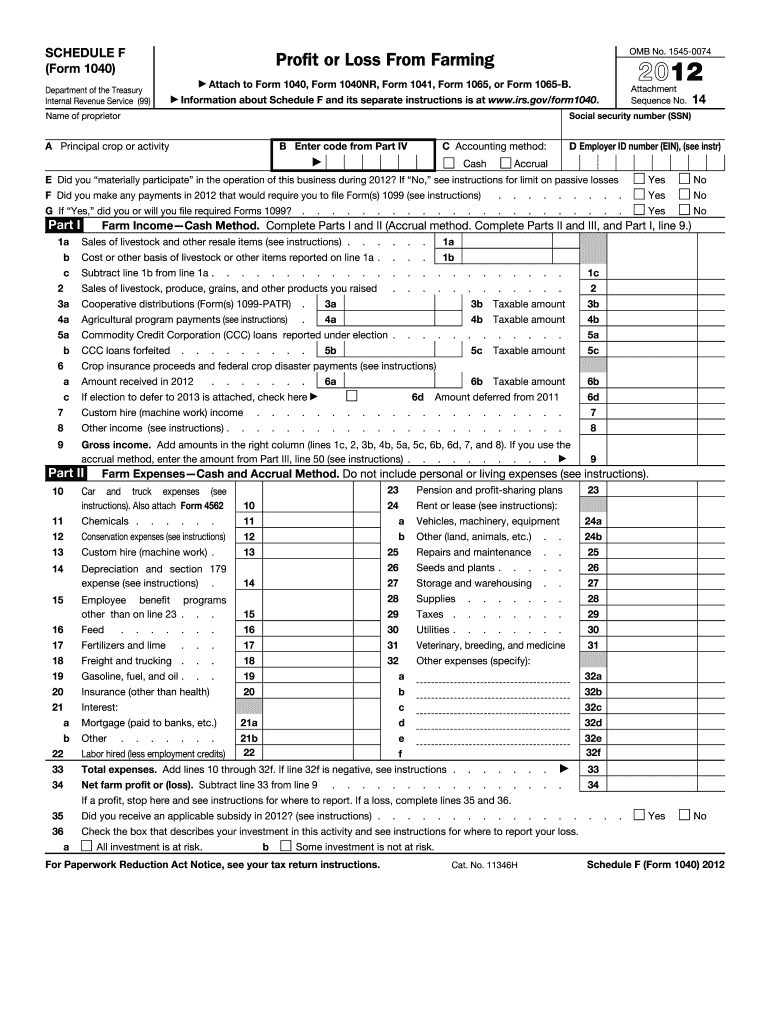

The Schedule F Writeable Form is a tax document used by farmers and ranchers in the United States to report income and expenses related to farming activities. This form allows individuals to detail their farming income, including sales of livestock, produce, and other products, as well as to itemize deductible expenses such as feed, fertilizer, and labor costs. The writeable format enables users to fill out the form electronically, ensuring accuracy and ease of submission.

How to use the Schedule F Writeable Form

Using the Schedule F Writeable Form involves several straightforward steps. First, download the form from a reliable source. Next, open the form using compatible PDF software that supports writeable fields. Fill in the required information, ensuring all income and expenses are accurately reported. Once completed, review the form for any errors, and then save it securely. The final step is to submit the form either electronically or via mail, depending on your preference and the requirements set by the IRS.

Steps to complete the Schedule F Writeable Form

Completing the Schedule F Writeable Form requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents related to your farming activities.

- Open the Schedule F Writeable Form using a PDF editor.

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from farming on the designated lines.

- Itemize your expenses in the appropriate sections, ensuring you include all relevant deductions.

- Double-check all entries for accuracy before saving the document.

- Submit the completed form according to IRS guidelines.

Legal use of the Schedule F Writeable Form

The Schedule F Writeable Form is legally recognized for reporting farming income and expenses. To ensure its legal validity, it must be completed accurately and submitted within the designated filing period. Additionally, eSignature laws, such as the ESIGN Act, allow for electronic signatures on this form, provided that the signer has consented to use electronic records and signatures. This compliance with legal standards ensures that the form is accepted by the IRS and other regulatory bodies.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Schedule F Writeable Form. It is essential to follow these guidelines to avoid penalties or delays in processing. The IRS outlines what constitutes acceptable income and deductible expenses, as well as instructions for reporting. Taxpayers should refer to the IRS instructions for Schedule F to ensure compliance with current tax laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule F Writeable Form typically align with the annual tax filing deadline in the United States. Taxpayers must submit their forms by April 15 unless an extension is filed. It is crucial to keep track of any changes to these dates, as they may vary from year to year. Marking these deadlines on your calendar can help ensure timely submission and avoid potential penalties.

Examples of using the Schedule F Writeable Form

Examples of using the Schedule F Writeable Form include reporting income from the sale of crops, livestock, or other farm products. Additionally, farmers can use this form to deduct expenses related to equipment purchases, maintenance, and operational costs such as utilities and insurance. By accurately documenting these transactions, farmers can ensure they maximize their tax deductions and comply with IRS regulations.

Quick guide on how to complete schedule f writeable form 2012

Effortlessly Prepare Schedule F Writeable Form on Any Device

The management of documents online has gained signNow traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents swiftly without delays. Handle Schedule F Writeable Form on any device using airSlate SignNow’s applications for Android or iOS, and enhance any document-driven process today.

Efficiently Edit and eSign Schedule F Writeable Form with Ease

- Obtain Schedule F Writeable Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Formulate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Decide how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Schedule F Writeable Form and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule f writeable form 2012

Create this form in 5 minutes!

How to create an eSignature for the schedule f writeable form 2012

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Schedule F Writeable Form?

The Schedule F Writeable Form is a document used to report farm income and expenses for tax purposes. It allows farmers and ranchers to easily input their financial data in a structured format, making tax filing simpler and more efficient. Utilizing a digital solution like airSlate SignNow can enhance the user experience with features such as electronic signatures.

-

How can I access the Schedule F Writeable Form?

You can access the Schedule F Writeable Form through airSlate SignNow by signing up for an account. Once registered, you can create, upload, and fill out the form directly online. This makes it easy to manage your farming tax documents in one place.

-

Is the Schedule F Writeable Form available for free?

While the Schedule F Writeable Form can be accessed through airSlate SignNow, the availability and pricing depend on the subscription plan you choose. airSlate SignNow offers various pricing tiers, ensuring that you can find an option that fits your budget and needs. It's best to explore these plans for more details.

-

What features does the airSlate SignNow platform offer for the Schedule F Writeable Form?

airSlate SignNow provides numerous features for the Schedule F Writeable Form, including document editing, e-signature capabilities, and secure cloud storage. Additionally, you can easily share the form with other stakeholders or collaborate on it in real-time. These features streamline the entire process, ensuring efficiency and ease of use.

-

Can I integrate the Schedule F Writeable Form with other software?

Yes, airSlate SignNow allows for integrations with various software applications, making it easy to connect your Schedule F Writeable Form with accounting tools and other productivity apps. This seamless integration enhances your workflow, allowing you to manage your documents and finances efficiently in one ecosystem.

-

How does e-signing work for the Schedule F Writeable Form?

E-signing is a streamlined feature of airSlate SignNow that allows you to sign the Schedule F Writeable Form electronically. This process is not only secure but also signNowly speeds up the review and approval stages. Recipients can sign the form from any device, ensuring convenience and quick turnaround times.

-

What are the benefits of using airSlate SignNow for the Schedule F Writeable Form?

Using airSlate SignNow for the Schedule F Writeable Form offers numerous benefits, including improved accuracy, time-saving capabilities, and enhanced collaboration with your team or clients. The user-friendly interface ensures that you can fill out and sign your forms without hassle. Additionally, the platform's security features protect your sensitive information.

Get more for Schedule F Writeable Form

- Bill of sale without warranty by individual seller iowa form

- Bill of sale without warranty by corporate seller iowa form

- Reaffirmation agreement iowa form

- Reaffirmation agreement iowa 497305095 form

- Verification of creditors matrix iowa form

- Verification of creditors matrix iowa 497305097 form

- Correction statement and agreement iowa form

- Closing documents for home in iowa form

Find out other Schedule F Writeable Form

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form