Form 1040 Schedule F Fill in Capable Profit or Loss from Farming 2007

What is the Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming

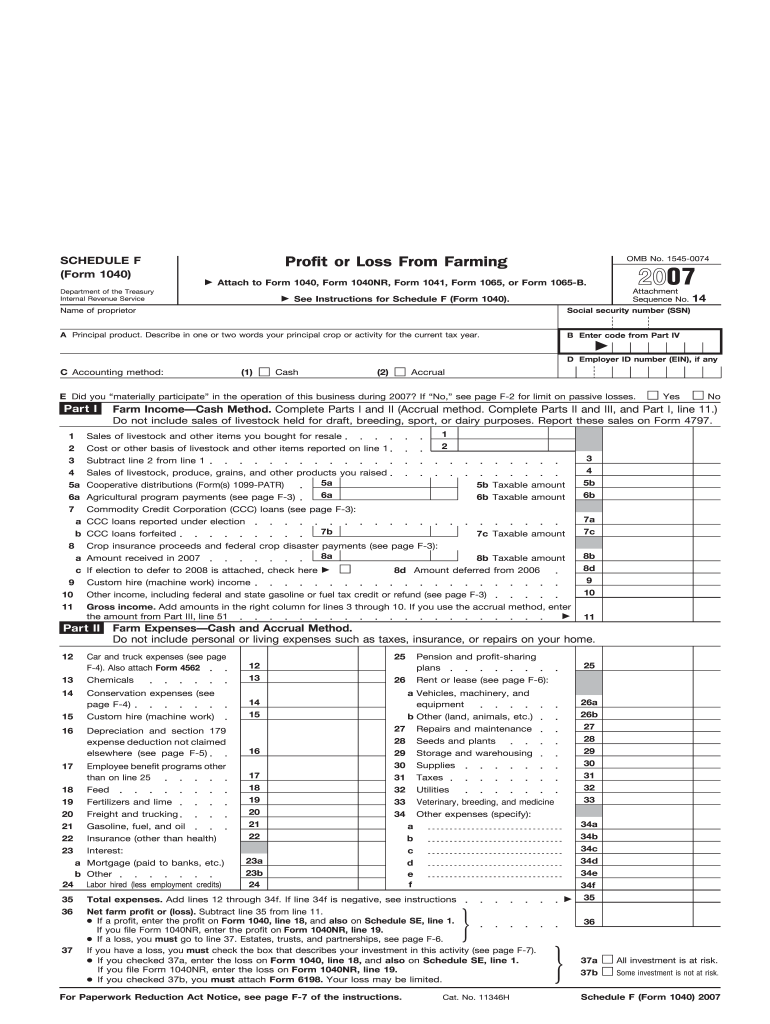

The Form 1040 Schedule F is a tax form used by farmers and ranchers in the United States to report income and expenses related to farming activities. This form allows individuals to calculate their profit or loss from farming operations, which is essential for determining taxable income. It is specifically designed for those who operate a farm as a sole proprietorship or as part of a partnership. The Schedule F form captures various sources of income, including sales of livestock, produce, and other farm products, as well as expenses such as feed, seed, and equipment costs.

How to use the Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming

Using the Form 1040 Schedule F involves several steps to ensure accurate reporting of farming income and expenses. First, gather all necessary financial records, including receipts and invoices for income and expenses. Next, fill out the form by entering total income from farming on the appropriate lines. After that, list all deductible expenses, which can include costs for supplies, labor, and maintenance. Finally, calculate the net profit or loss by subtracting total expenses from total income. This net figure will be reported on your Form 1040, which is the main tax return for individuals.

Steps to complete the Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming

Completing the Form 1040 Schedule F requires careful attention to detail. Follow these steps:

- Start by entering your name and social security number at the top of the form.

- Report your total income from farming activities in Part I of the form.

- In Part II, list all allowable expenses related to your farming business, categorized by type.

- Calculate your total expenses and subtract them from your total income to determine your profit or loss.

- Review the completed form for accuracy before submission.

Legal use of the Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming

The Form 1040 Schedule F is legally recognized by the Internal Revenue Service (IRS) for reporting farming income and expenses. To ensure compliance, it is essential to accurately report all income and expenses, as any discrepancies could lead to audits or penalties. The form must be filed annually, along with your Form 1040, to maintain legal standing. Proper completion of the form also allows farmers to take advantage of various tax deductions available for agricultural activities.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 Schedule F. It is important to follow these guidelines to ensure that all information is reported correctly. The IRS outlines what qualifies as farming income, the types of expenses that can be deducted, and the documentation required to support your claims. Familiarizing yourself with these guidelines can help prevent errors and reduce the risk of audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule F align with the general tax filing deadlines for individuals in the United States. Typically, the deadline for submitting your tax return, including Schedule F, is April fifteenth of each year. However, if you need additional time, you can file for an extension, which usually grants an extra six months. It is important to keep track of these dates to avoid late fees or penalties.

Quick guide on how to complete 2007 form 1040 schedule f fill in capable profit or loss from farming

Manage Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming effortlessly on any gadget

Digital document management has gained traction among enterprises and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Handle Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to edit and electronically sign Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming with ease

- Locate Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Select relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2007 form 1040 schedule f fill in capable profit or loss from farming

Create this form in 5 minutes!

How to create an eSignature for the 2007 form 1040 schedule f fill in capable profit or loss from farming

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 1040 Schedule F and why is it important?

Form 1040 Schedule F is used to report profit or loss from farming activities. It is crucial for farmers as it helps them calculate their net earnings from agricultural operations, which is essential for accurate tax reporting. Utilizing this form can streamline your financial management and ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with filling out Form 1040 Schedule F?

airSlate SignNow offers easy-to-use tools that simplify the completion of Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming. With our platform, you can quickly input data, sign documents electronically, and manage your agricultural financial paperwork efficiently, saving you valuable time.

-

Is there a cost involved in using airSlate SignNow for Form 1040 Schedule F?

Yes, airSlate SignNow provides cost-effective subscription plans designed to meet various business needs. Our pricing ensures that you can access all features required for completing Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming without breaking the bank. Check our website for specific plan details and pricing options.

-

What features does airSlate SignNow offer for handling Form 1040 Schedule F?

-airSlate SignNow includes features like document templates, electronic signatures, and the ability to collaborate in real-time. These tools make it easier to manage Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming efficiently and ensure all necessary documents are completed accurately and quickly.

-

Can I integrate airSlate SignNow with other tools for managing my farm finances?

Absolutely! airSlate SignNow allows seamless integration with various accounting and financial management software. This means you can enhance your productivity by utilizing airSlate SignNow alongside your existing tools for managing Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming and other financial tasks.

-

How does airSlate SignNow ensure the security of my financial documents?

airSlate SignNow prioritizes the security of your documents with bank-level encryption and secure cloud storage. This means that when you work on Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming, your sensitive financial data remains protected and accessible only to authorized users.

-

Is there customer support available if I need help with Form 1040 Schedule F?

Yes, airSlate SignNow provides dedicated customer support to assist you with any inquiries related to Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming. Our support team is available via chat, email, and phone, ensuring you receive timely help whenever you need it.

Get more for Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming

- Legal last will and testament form for single person with adult children georgia

- Legal last will and testament for married person with minor children from prior marriage georgia form

- Legal last will and testament form for married person with adult children from prior marriage georgia

- Legal last will and testament form for divorced person not remarried with adult children georgia

- Legal last will and testament form for divorced person not remarried with no children georgia

- Legal last will and testament form for divorced person not remarried with minor children georgia

- Legal last will and testament form for divorced person not remarried with adult and minor children georgia

- Legal last will and testament form for married person with adult children georgia

Find out other Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement