Irs Schedule F Form 2016

What is the Irs Schedule F Form

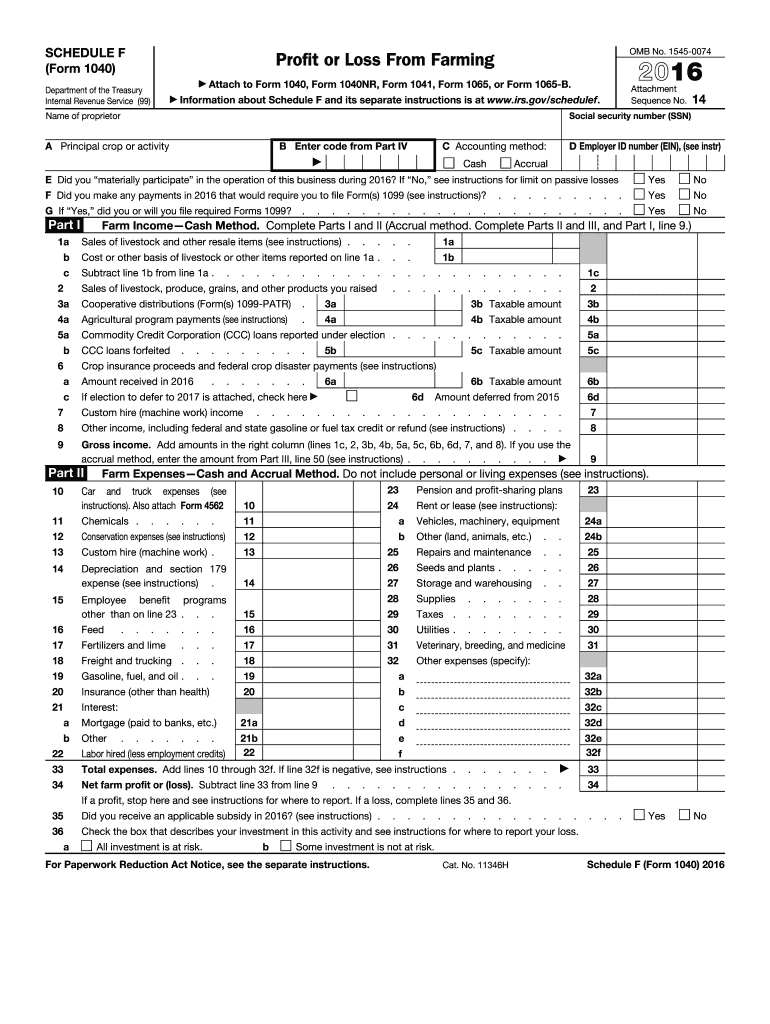

The Irs Schedule F Form is a tax document used by farmers and ranchers to report income and expenses related to farming activities. This form is essential for individuals who earn income from farming, allowing them to calculate their taxable profit or loss. It is typically filed alongside Form 1040, the individual income tax return, and helps the IRS assess the financial performance of agricultural operations.

How to use the Irs Schedule F Form

To use the Irs Schedule F Form effectively, taxpayers must first gather all relevant financial records related to their farming activities. This includes income from sales of crops, livestock, and other farm products, as well as any expenses incurred, such as feed, equipment, and maintenance costs. Once the necessary information is compiled, it can be entered into the appropriate sections of the form, ensuring accuracy and completeness.

Steps to complete the Irs Schedule F Form

Completing the Irs Schedule F Form involves several key steps:

- Gather all necessary financial documents, including sales records and expense receipts.

- Fill out the income section, detailing all sources of farm income.

- Document all allowable expenses in the designated section, ensuring to categorize them correctly.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Transfer the net profit or loss to Form 1040 when filing your taxes.

Legal use of the Irs Schedule F Form

The Irs Schedule F Form is legally recognized as a valid document for reporting farming income and expenses. To ensure compliance with IRS regulations, it is important that all information provided is accurate and truthful. Failure to do so can lead to penalties or audits. Additionally, electronic signatures can be used when filing the form digitally, provided that all legal requirements for eSignatures are met.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the Irs Schedule F Form. Generally, the form must be submitted by April 15 of the following tax year. If additional time is needed, taxpayers can file for an extension, which typically grants an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

When preparing to complete the Irs Schedule F Form, certain documents are required. These include:

- Sales records for all farm products.

- Receipts for farm-related expenses.

- Records of any loans or financial assistance received.

- Documentation of depreciation for farm assets.

Examples of using the Irs Schedule F Form

Farmers and ranchers use the Irs Schedule F Form in various scenarios. For instance, a small vegetable farmer would report income from produce sales and expenses related to seeds, fertilizers, and equipment. Similarly, a livestock rancher would document income from selling animals and expenses for feed, veterinary care, and maintenance of facilities. Each example highlights the form's role in accurately representing the financial status of farming operations.

Quick guide on how to complete irs 2011 schedule f 2016 form

Complete Irs Schedule F Form effortlessly on any device

Digital document management has become increasingly prevalent among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents promptly without delays. Handle Irs Schedule F Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Irs Schedule F Form without stress

- Find Irs Schedule F Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign Irs Schedule F Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 2011 schedule f 2016 form

Create this form in 5 minutes!

How to create an eSignature for the irs 2011 schedule f 2016 form

How to create an eSignature for your Irs 2011 Schedule F 2016 Form online

How to generate an eSignature for the Irs 2011 Schedule F 2016 Form in Google Chrome

How to create an electronic signature for signing the Irs 2011 Schedule F 2016 Form in Gmail

How to make an electronic signature for the Irs 2011 Schedule F 2016 Form straight from your smart phone

How to make an eSignature for the Irs 2011 Schedule F 2016 Form on iOS devices

How to create an electronic signature for the Irs 2011 Schedule F 2016 Form on Android OS

People also ask

-

What is the IRS Schedule F Form?

The IRS Schedule F Form is used by farmers to report income and expenses related to farming activities. It allows for detailed documentation of farm income, costs, and deductions, helping you accurately file your taxes. Using airSlate SignNow can streamline the process of sending and signing the IRS Schedule F Form, making tax season simpler.

-

How can airSlate SignNow assist with the IRS Schedule F Form?

airSlate SignNow provides a user-friendly platform to eSign and send the IRS Schedule F Form quickly and securely. You can easily upload your completed form, gather signatures, and send it directly to the IRS or other stakeholders. This ensures that your documentation is handled efficiently while maintaining compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the IRS Schedule F Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The costs are competitive and provide great value, especially considering the time saved in document handling and eSigning. Customizable plans are available to help you effectively manage your use of the IRS Schedule F Form.

-

What features does airSlate SignNow offer for managing the IRS Schedule F Form?

airSlate SignNow includes features like eSigning, document templates, and cloud storage, making it easy to manage the IRS Schedule F Form. Additionally, you can track the status of your documents in real time and access them from anywhere at any time. This ensures that all your farming tax documents are efficiently organized and readily available.

-

Can I integrate airSlate SignNow with other software for handling the IRS Schedule F Form?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and Salesforce. This means you can easily import or export the IRS Schedule F Form data and streamline your workflow. Integrating with your existing tools enhances productivity and keeps your documents in sync.

-

What are the benefits of using airSlate SignNow for the IRS Schedule F Form?

Using airSlate SignNow for the IRS Schedule F Form saves time and reduces the hassle of paperwork. It ensures that all signatures are collected easily and helps avoid delays in filing. Furthermore, the security features protect sensitive tax information, giving you peace of mind during filing season.

-

Is airSlate SignNow secure for filing the IRS Schedule F Form?

Absolutely, airSlate SignNow employs advanced security measures, including encryption and authentication, to safeguard your IRS Schedule F Form. This ensures that your data is protected throughout the eSigning process. Your sensitive information remains secure and compliant with industry standards.

Get more for Irs Schedule F Form

Find out other Irs Schedule F Form

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement