Www Coursehero Com29 Form 1040 Schedule F#29 Form 1040 Schedule F SCHEDULE FForm 1040 Department of 2021

What is the Schedule F 2021?

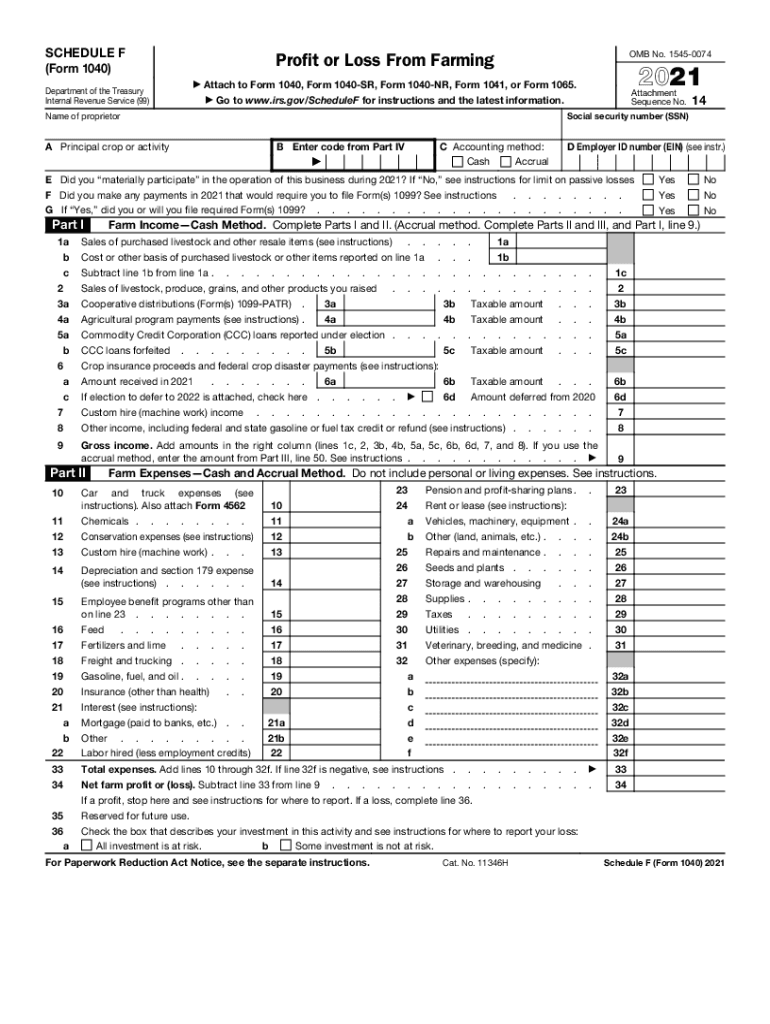

The Schedule F 2021 is a tax form used by farmers and ranchers to report income and expenses related to farming activities. This form is part of the IRS Form 1040, which individual taxpayers use to file their annual income tax returns. The Schedule F allows taxpayers to detail their farming income, including sales of livestock, produce, and other farm products, as well as expenses such as feed, fertilizer, and utilities. Proper completion of this form is essential for accurately reporting income and claiming deductions related to farming operations.

Key elements of the Schedule F 2021

Understanding the key elements of the Schedule F 2021 is crucial for accurate reporting. The form includes sections for:

- Income: This section captures all income earned from farming activities, including sales of crops and livestock.

- Expenses: Taxpayers can list various deductible expenses, such as equipment purchases, maintenance costs, and labor expenses.

- Net Profit or Loss: The form calculates the net profit or loss from farming operations, which is then transferred to the main Form 1040.

Steps to complete the Schedule F 2021

Completing the Schedule F 2021 involves several steps to ensure accuracy and compliance:

- Gather Documentation: Collect all relevant financial records, including sales receipts and expense invoices.

- Fill Out Income Section: Report all income from farming activities in the designated section.

- Detail Expenses: List all deductible expenses, ensuring that each entry is supported by documentation.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss.

- Transfer Information: Transfer the net profit or loss to the appropriate line on Form 1040.

Filing Deadlines / Important Dates

For the 2021 tax year, the deadline for filing the Schedule F is typically the same as the individual tax return deadline, which is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file their returns.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule F 2021. Taxpayers should refer to the instructions provided with the form, which detail eligibility criteria, acceptable deductions, and record-keeping requirements. Adhering to these guidelines is essential to ensure compliance and avoid potential penalties.

Digital vs. Paper Version

Taxpayers have the option to file the Schedule F 2021 either digitally or via paper. Filing electronically can streamline the process, reduce errors, and provide immediate confirmation of submission. Many tax software programs support electronic filing and can automatically calculate figures based on the information entered. Conversely, paper filing requires careful attention to detail to avoid mistakes, and taxpayers should ensure they send the form to the correct IRS address.

Quick guide on how to complete wwwcourseherocom29 form 1040 schedule f29 form 1040 schedule f schedule fform 1040 department of

Complete Www coursehero com29 Form 1040 Schedule F#29 Form 1040 Schedule F SCHEDULE FForm 1040 Department Of seamlessly on any device

Digital document management has become increasingly favored by enterprises and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, as you can obtain the necessary form and securely retain it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Www coursehero com29 Form 1040 Schedule F#29 Form 1040 Schedule F SCHEDULE FForm 1040 Department Of on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign Www coursehero com29 Form 1040 Schedule F#29 Form 1040 Schedule F SCHEDULE FForm 1040 Department Of effortlessly

- Obtain Www coursehero com29 Form 1040 Schedule F#29 Form 1040 Schedule F SCHEDULE FForm 1040 Department Of and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a standard wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from your chosen device. Modify and eSign Www coursehero com29 Form 1040 Schedule F#29 Form 1040 Schedule F SCHEDULE FForm 1040 Department Of and ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwcourseherocom29 form 1040 schedule f29 form 1040 schedule f schedule fform 1040 department of

Create this form in 5 minutes!

How to create an eSignature for the wwwcourseherocom29 form 1040 schedule f29 form 1040 schedule f schedule fform 1040 department of

How to make an e-signature for your PDF file in the online mode

How to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is Schedule F 2021?

Schedule F 2021 is a tax form used by farmers and fishermen to report income and expenses from farming and fishing activities. With airSlate SignNow, you can easily manage and eSign your Schedule F 2021 documents, making tax season smoother.

-

How does airSlate SignNow simplify completing Schedule F 2021?

airSlate SignNow offers user-friendly templates that help streamline the process of completing Schedule F 2021. You can edit, sign, and send your forms quickly, ensuring you stay compliant while saving time.

-

Is there a free trial available for airSlate SignNow when working on Schedule F 2021?

Yes, airSlate SignNow offers a free trial that allows you to test the platform's features for managing Schedule F 2021. Start your trial today to explore how our solution can benefit your tax documentation needs.

-

Can I integrate airSlate SignNow with my accounting software for Schedule F 2021?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easy to import data for your Schedule F 2021 forms. This integration helps ensure that all your financial information is accurate and up-to-date.

-

What features of airSlate SignNow are beneficial for filling out Schedule F 2021?

Key features of airSlate SignNow that benefit users working on Schedule F 2021 include templates, real-time collaboration, and secure document storage. These features simplify the process, enhance productivity, and protect your valuable tax information.

-

How does airSlate SignNow ensure the security of my Schedule F 2021 documents?

airSlate SignNow prioritizes security by using advanced encryption technology to protect your Schedule F 2021 documents. Your data is safeguarded throughout the signing process, ensuring only authorized individuals can access sensitive information.

-

What is the pricing structure of airSlate SignNow for users needing Schedule F 2021 support?

airSlate SignNow offers a variety of pricing plans tailored to different user needs, including those who require assistance with Schedule F 2021. Choose the plan that fits your budget while providing the necessary features for efficient document management.

Get more for Www coursehero com29 Form 1040 Schedule F#29 Form 1040 Schedule F SCHEDULE FForm 1040 Department Of

- Connecticut name change instructions and forms package for a minor connecticut

- Name change instructions and forms package for a family connecticut

- Connecticut note 497301253 form

- Connecticut note 497301254 form

- Connecticut note 497301255 form

- Connecticut installments fixed rate promissory note secured by commercial real estate connecticut form

- Notice of option for recording connecticut form

- Connecticut documents form

Find out other Www coursehero com29 Form 1040 Schedule F#29 Form 1040 Schedule F SCHEDULE FForm 1040 Department Of

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF