Form 8879 Pe 2011

What is the Form 8879 Pe

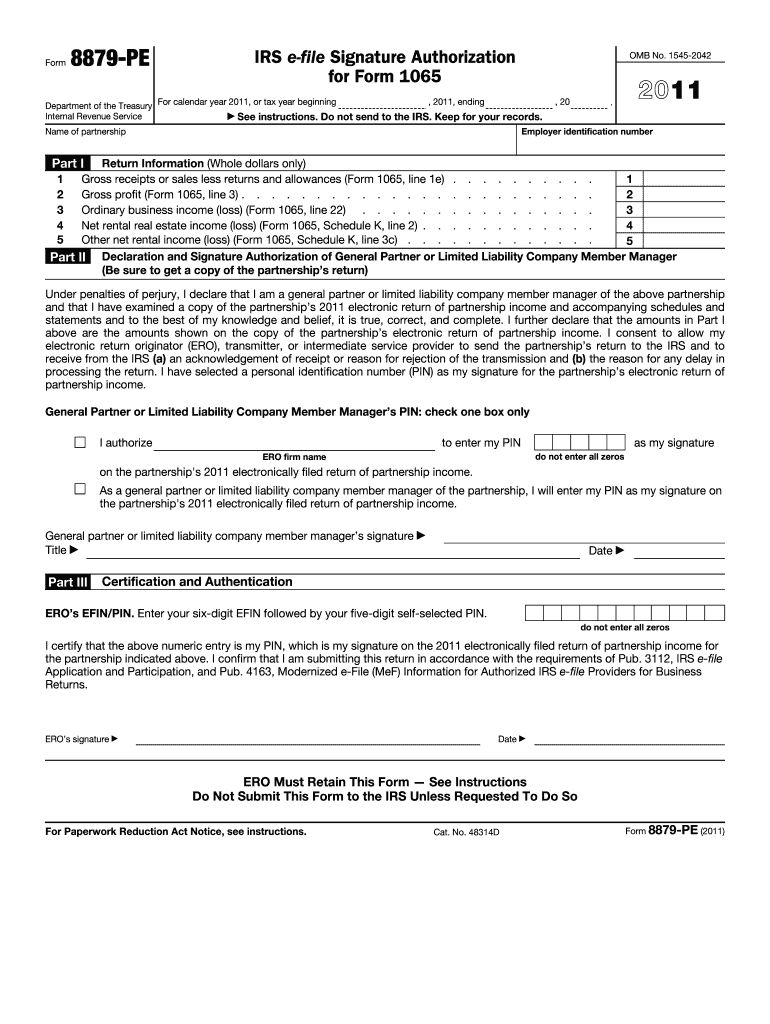

The Form 8879 Pe, also known as the IRS e-file Signature Authorization, is a crucial document for taxpayers who wish to electronically file their tax returns. This form allows taxpayers to authorize an electronic return originator (ERO) to transmit their tax return to the IRS. It serves as a signature substitute, ensuring that the return is filed with the taxpayer's consent. The Form 8879 Pe is specifically designed for use with certain tax forms, including the 1040 series, and is essential for maintaining compliance with IRS regulations.

How to use the Form 8879 Pe

Using the Form 8879 Pe involves a straightforward process. First, the taxpayer must complete their tax return using tax preparation software or through an ERO. Once the return is prepared, the taxpayer needs to fill out the Form 8879 Pe, providing necessary information such as their name, Social Security number, and the ERO's details. After completing the form, the taxpayer must sign it, either electronically or by hand, depending on the method of submission. The signed form must then be retained by the ERO for their records, while the tax return is transmitted to the IRS.

Steps to complete the Form 8879 Pe

Completing the Form 8879 Pe involves several key steps:

- Prepare your tax return using your chosen tax software or ERO.

- Gather your personal information, including your name, Social Security number, and the tax year.

- Fill out the Form 8879 Pe with the required details, ensuring accuracy.

- Sign the form electronically or manually, depending on your filing method.

- Submit the signed form to your ERO, who will file your tax return electronically.

Legal use of the Form 8879 Pe

The legal use of the Form 8879 Pe is governed by IRS regulations, which stipulate that the form must be signed by the taxpayer to authorize the electronic filing of their tax return. This form acts as a legally binding signature, ensuring that the taxpayer's consent is documented. It is important for taxpayers to understand that the Form 8879 Pe must be retained by the ERO for a minimum of three years, as it may be required for audit purposes or verification by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8879 Pe align with the standard tax filing deadlines set by the IRS. Typically, individual taxpayers must file their tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file, which can provide additional time to complete their tax returns and submit the Form 8879 Pe. It is advisable to stay informed about specific deadlines to ensure timely filing and avoid penalties.

Required Documents

To complete the Form 8879 Pe, taxpayers need several key documents:

- Your completed tax return, including all relevant schedules and forms.

- Personal identification information, such as your Social Security number.

- Details of your tax preparer or ERO, including their name and identification number.

- Any supporting documents that may be necessary for your tax return, such as W-2s or 1099s.

Examples of using the Form 8879 Pe

Common scenarios for using the Form 8879 Pe include situations where taxpayers engage the services of a tax professional to file their returns electronically. For instance, a self-employed individual might work with an ERO to prepare their tax return, requiring the use of the Form 8879 Pe to authorize the electronic submission. Similarly, families with multiple sources of income may find it beneficial to utilize the form when seeking assistance in filing their taxes, ensuring compliance and efficiency in the process.

Quick guide on how to complete form 8879 pe 2011

Effortlessly Prepare Form 8879 Pe on Any Device

Digital document management has gained prominence among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Form 8879 Pe on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Form 8879 Pe Without Any Hassle

- Obtain Form 8879 Pe and select Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize important sections of the documents or dark out sensitive information using tools specifically available through airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8879 Pe to ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8879 pe 2011

Create this form in 5 minutes!

How to create an eSignature for the form 8879 pe 2011

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is Form 8879 Pe and how can airSlate SignNow assist with it?

Form 8879 Pe is an IRS form that allows tax professionals to electronically file returns. With airSlate SignNow, you can easily prepare, sign, and send Form 8879 Pe securely and quickly, simplifying the e-filing process for your clients.

-

Are there any additional fees for using airSlate SignNow with Form 8879 Pe?

airSlate SignNow offers a transparent pricing model that includes all necessary features for managing Form 8879 Pe without hidden fees. Our subscription plans are designed to accommodate businesses of all sizes, ensuring you can eSign documents affordably.

-

What features does airSlate SignNow offer for handling Form 8879 Pe efficiently?

airSlate SignNow provides robust features such as customizable templates, advanced security measures, and seamless integrations that enhance the management of Form 8879 Pe. This allows you to streamline your workflow and improve productivity signNowly.

-

Can I integrate airSlate SignNow with other software to manage Form 8879 Pe?

Absolutely! airSlate SignNow integrates with various platforms like QuickBooks and CRM systems, enabling you to automate processes around Form 8879 Pe. This integration makes it easier to sync client data and manage documents effectively.

-

Is airSlate SignNow suitable for individuals or just for businesses handling Form 8879 Pe?

airSlate SignNow is ideal for both individuals and businesses looking to manage Form 8879 Pe. Whether you're a solo tax preparer or part of a large firm, our platform offers the tools you need for efficient document management.

-

How does airSlate SignNow ensure the security of Form 8879 Pe during the signing process?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and multi-factor authentication to protect Form 8879 Pe and any sensitive information you handle while eSigning documents.

-

What are the benefits of using airSlate SignNow for Form 8879 Pe over traditional methods?

Using airSlate SignNow for Form 8879 Pe offers several advantages over traditional paper methods, including faster processing times, reduced paperwork, and enhanced accessibility. Our platform allows you to eSign documents anytime, anywhere, increasing efficiency.

Get more for Form 8879 Pe

- Power of attorney for sale of motor vehicle iowa form

- Wedding planning or consultant package iowa form

- Hunting forms package iowa

- Identity theft recovery package iowa form

- Durable power of attorney for health care iowa form

- Revocation of statutory durable power of attorney for health care iowa form

- Aging parent package iowa form

- Sale of a business package iowa form

Find out other Form 8879 Pe

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast