Form 8879 PE 2014

What is the Form 8879 PE

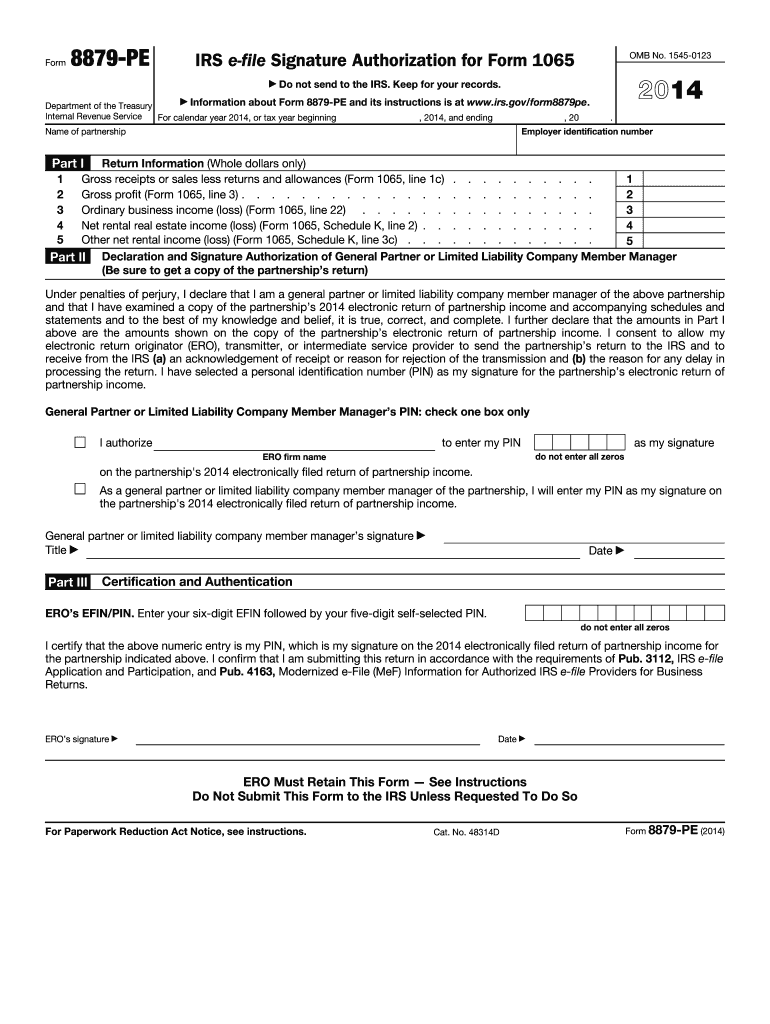

The Form 8879 PE is a critical document used in the tax filing process for partnerships and entities taxed as partnerships. This form serves as an eSignature authorization for the electronic filing of the partnership's tax return. It allows the designated partner to sign the return electronically, ensuring compliance with IRS regulations while streamlining the filing process. The form includes essential information such as the partnership's name, Employer Identification Number (EIN), and the name of the partner authorized to sign.

How to use the Form 8879 PE

Using the Form 8879 PE involves several straightforward steps. First, ensure that all required information is accurately filled out, including the partnership's details and the authorized partner's information. Once the form is completed, the authorized partner must review the information for accuracy. After verification, the partner can electronically sign the form, which then allows for the electronic submission of the partnership tax return. It is important to retain a copy of the signed form for your records, as it serves as proof of authorization for the e-filing.

Steps to complete the Form 8879 PE

Completing the Form 8879 PE requires careful attention to detail. Follow these steps to ensure proper completion:

- Gather necessary information, including the partnership's name, EIN, and the authorized partner's name.

- Fill in the relevant fields on the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Have the authorized partner sign the form electronically.

- Keep a copy of the signed form for your records.

Legal use of the Form 8879 PE

The legal use of the Form 8879 PE is governed by IRS regulations that outline the requirements for electronic signatures. When properly completed and signed, the form is considered legally binding. It is essential to comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) to ensure that the electronic signature holds legal weight. This compliance not only facilitates the electronic filing process but also protects the interests of the partnership and its partners.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8879 PE align with the partnership tax return deadlines. Generally, partnerships must file their tax returns by the 15th day of the third month following the end of their tax year. For partnerships operating on a calendar year, this means the return is due by March 15. If an extension is filed, the deadline may be extended by six months. It is crucial to be aware of these dates to avoid penalties and ensure timely filing.

Required Documents

To complete the Form 8879 PE, certain documents are required. These include:

- The partnership's tax return (Form 1065).

- Financial statements of the partnership, if applicable.

- Any supporting documentation related to deductions or credits claimed.

Having these documents on hand will facilitate the accurate completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete 2014 form 8879 pe

Complete Form 8879 PE effortlessly on any device

Online document management has increased in popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly. Manage Form 8879 PE on any platform using airSlate SignNow Android or iOS applications and enhance any documentation process today.

How to modify and eSign Form 8879 PE effortlessly

- Obtain Form 8879 PE and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with specialized tools provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and bears the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8879 PE and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8879 pe

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8879 pe

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is Form 8879 PE?

Form 8879 PE is an IRS eSignature document that allows partners to authorize their electronic tax returns. By using airSlate SignNow, you can easily manage and sign Form 8879 PE electronically, ensuring a secure and efficient submission process.

-

How does airSlate SignNow facilitate signing Form 8879 PE?

AirSlate SignNow provides a user-friendly platform that allows for the easy uploading and signing of Form 8879 PE. Users can invite partners to sign electronically, reducing the need for physical documents and streamlining the tax filing process.

-

What are the pricing options for airSlate SignNow when using Form 8879 PE?

AirSlate SignNow offers flexible pricing plans suitable for individuals and businesses looking to manage Form 8879 PE and other documents. You can choose from monthly or annual subscriptions, ensuring cost-effectiveness based on your needs and usage.

-

What are the key features of airSlate SignNow for handling Form 8879 PE?

Key features of airSlate SignNow include multi-party signing, document templates, and real-time tracking for Form 8879 PE. Additionally, the platform ensures high-level security and compliance, making it a reliable choice for managing sensitive tax documents.

-

Can airSlate SignNow integrate with other software for processing Form 8879 PE?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the management of Form 8879 PE. This integration allows for smooth data transfer and consistent workflow, saving you time in document processing.

-

What are the benefits of using airSlate SignNow for Form 8879 PE?

Using airSlate SignNow for Form 8879 PE offers several benefits, such as faster turnaround times and reduced paperwork. The electronic signing process signNowly minimizes errors and ensures that all parties can access and sign the document from anywhere.

-

Is airSlate SignNow compliant with IRS regulations for Form 8879 PE?

Absolutely, airSlate SignNow complies with all IRS regulations regarding the electronic signature of Form 8879 PE. This compliance guarantees that your eSigned documents meet the necessary legal standards, allowing for secure electronic submissions.

Get more for Form 8879 PE

- Contractors notice to owner individual iowa form

- Quitclaim deed by two individuals to llc iowa form

- Warranty deed from two individuals to llc iowa form

- Contractors notice to owner by corporation or llc iowa form

- Iowa disclaimer 497304899 form

- Notice to owner of dwelling individual iowa form

- Quitclaim deed by two individuals to corporation iowa form

- Warranty deed from two individuals to corporation iowa form

Find out other Form 8879 PE

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself