Form 8879 PE E File Authorization for Form 1065 2024

What is the Form 8879 PE E-file Authorization for Form 1065

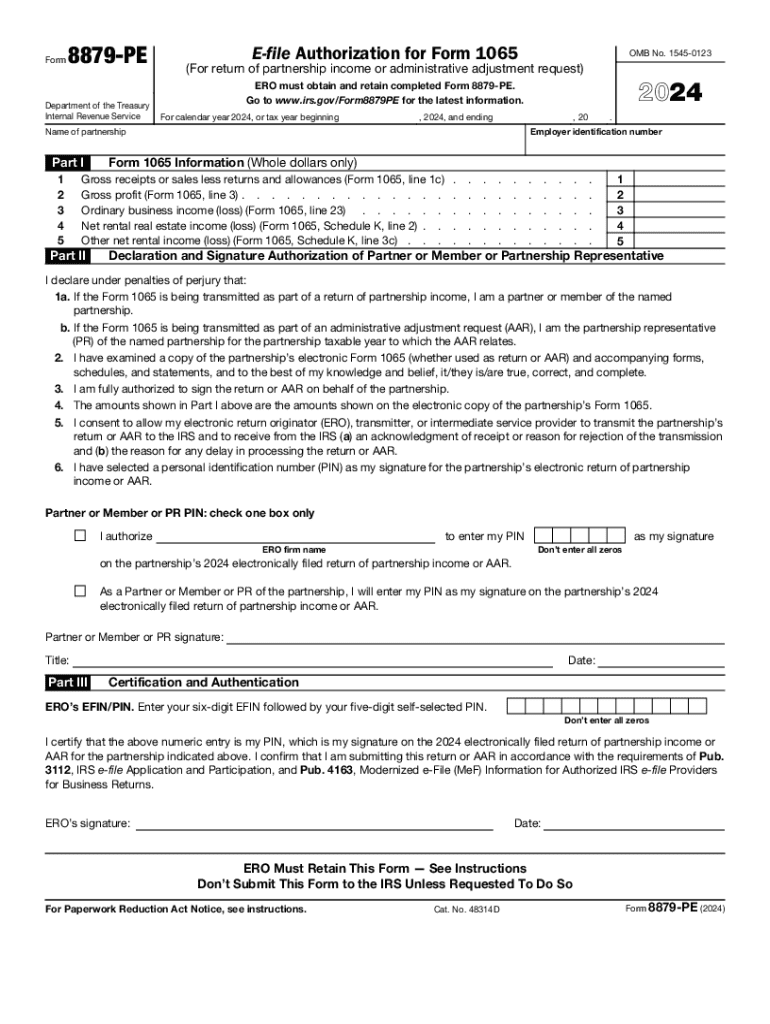

The Form 8879 PE is an essential document used for e-filing partnership tax returns, specifically Form 1065. This form serves as an IRS signature authorization, allowing partnerships to electronically submit their tax returns while ensuring compliance with federal regulations. By signing the Form 8879 PE, partners authorize their tax preparer to file the Form 1065 on their behalf, streamlining the e-filing process and reducing the need for paper submissions.

How to Use the Form 8879 PE E-file Authorization for Form 1065

To effectively use the Form 8879 PE, follow these steps:

- Complete Form 1065 with accurate financial information for the partnership.

- Fill out the Form 8879 PE, ensuring all required fields are completed, including the partnership's name, address, and Employer Identification Number (EIN).

- Each partner must review the completed Form 1065 and sign the Form 8879 PE to authorize the e-filing.

- Submit the signed Form 8879 PE to your tax preparer, who will then e-file the Form 1065 with the IRS.

Steps to Complete the Form 8879 PE E-file Authorization for Form 1065

Completing the Form 8879 PE involves several key steps:

- Gather necessary information, including the partnership's tax details and partner identification.

- Access the Form 8879 PE from the IRS website or your tax software.

- Fill in the partnership's information, ensuring accuracy to avoid delays.

- Each partner must provide their signature, confirming their consent to e-file.

- Review the completed form for any errors before submission.

Key Elements of the Form 8879 PE E-file Authorization for Form 1065

Several critical components are essential for the Form 8879 PE:

- Partnership Information: This includes the name, address, and EIN of the partnership.

- Partner Signatures: All partners must sign the form to authorize the e-filing.

- Tax Preparer Information: Details of the tax preparer, including their name and PTIN (Preparer Tax Identification Number).

- Declaration Statement: A statement confirming that the information provided is accurate and complete.

IRS Guidelines for the Form 8879 PE E-file Authorization for Form 1065

The IRS provides specific guidelines for using the Form 8879 PE. It is crucial to follow these guidelines to ensure compliance:

- The form must be signed by all partners before e-filing the Form 1065.

- Keep a copy of the signed Form 8879 PE for your records, as it may be required for future audits.

- Ensure that the form is submitted in a timely manner, aligning with IRS deadlines for partnership tax returns.

Penalties for Non-Compliance with the Form 8879 PE E-file Authorization for Form 1065

Failure to comply with the requirements of the Form 8879 PE can result in various penalties:

- Potential fines for late filing of the Form 1065.

- Increased scrutiny from the IRS, which may lead to audits.

- Loss of e-filing privileges if the form is not properly authorized.

Create this form in 5 minutes or less

Find and fill out the correct form 8879 pe e file authorization for form 1065 771107322

Create this form in 5 minutes!

How to create an eSignature for the form 8879 pe e file authorization for form 1065 771107322

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8879 pe and how can airSlate SignNow help?

Form 8879 pe is a declaration for electronic filing of tax returns. airSlate SignNow simplifies the process by allowing users to eSign this form securely and efficiently, ensuring compliance and accuracy in tax submissions.

-

Is there a cost associated with using airSlate SignNow for form 8879 pe?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the eSigning process for documents like form 8879 pe, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing form 8879 pe?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking for form 8879 pe. These tools enhance the efficiency of document management and ensure that all signatures are collected promptly.

-

Can I integrate airSlate SignNow with other software for form 8879 pe?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing users to manage form 8879 pe alongside their existing workflows. This integration enhances productivity and ensures a smooth eSigning experience.

-

How does airSlate SignNow ensure the security of form 8879 pe?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and authentication methods to protect sensitive information on form 8879 pe, ensuring that your documents are safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for form 8879 pe?

Using airSlate SignNow for form 8879 pe offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. This solution helps businesses save time and resources while ensuring compliance with tax regulations.

-

Is airSlate SignNow user-friendly for completing form 8879 pe?

Yes, airSlate SignNow is designed with user experience in mind. The intuitive interface allows users to easily navigate the platform and complete form 8879 pe without any technical expertise, making it accessible for everyone.

Get more for Form 8879 PE E file Authorization For Form 1065

Find out other Form 8879 PE E file Authorization For Form 1065

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free