Form 8879 PE IRS E File Signature Authorization for Form 1065 2020

What is the Form 8879 PE IRS E-file Signature Authorization for Form 1065

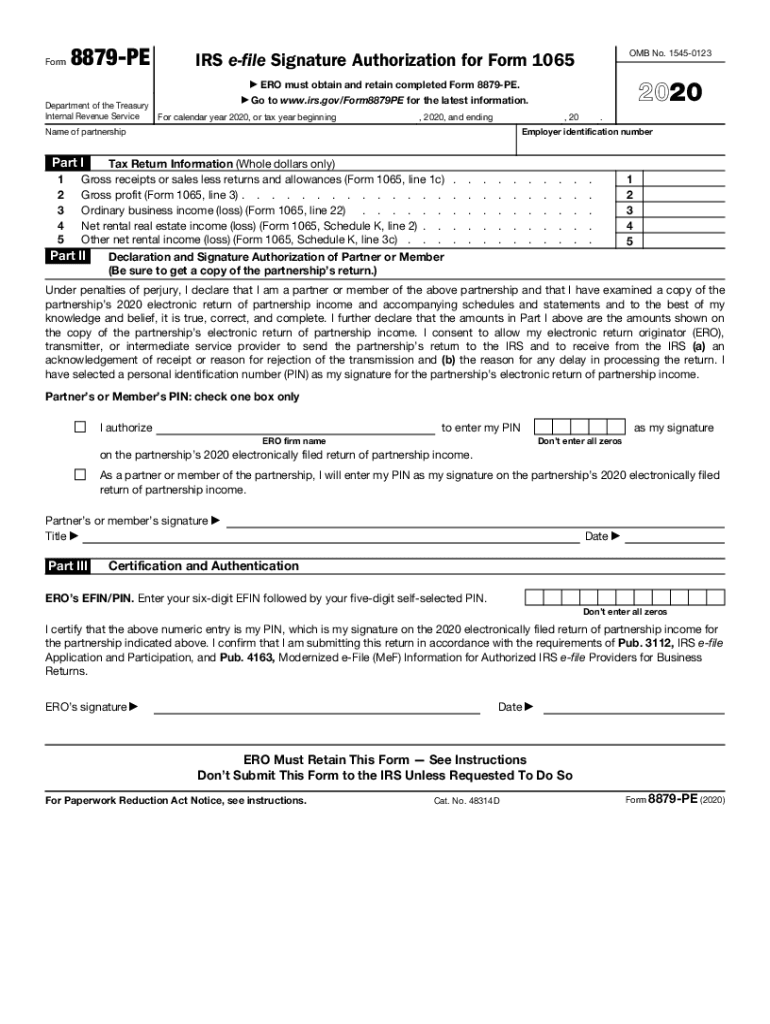

The Form 8879 PE is an essential document used in the e-filing process for partnerships, specifically for Form 1065, which reports income, deductions, gains, and losses from the operation of a partnership. This form serves as the IRS e-file signature authorization, allowing a partner or authorized representative to sign the electronic return on behalf of the partnership. It is crucial for ensuring that the e-filed return is legally binding and compliant with IRS regulations.

Steps to Complete the Form 8879 PE IRS E-file Signature Authorization for Form 1065

Completing the Form 8879 PE involves several key steps:

- Gather necessary information, including the partnership's name, address, and Employer Identification Number (EIN).

- Ensure that the electronic version of Form 1065 is prepared and ready for submission.

- Enter the name and title of the partner or authorized representative who will sign the form.

- Review the completed Form 1065 for accuracy before signing the Form 8879 PE.

- Sign the Form 8879 PE electronically, ensuring compliance with IRS e-signature requirements.

- Submit the signed Form 8879 PE along with the electronic return to the IRS.

Legal Use of the Form 8879 PE IRS E-file Signature Authorization for Form 1065

The legal use of the Form 8879 PE is grounded in its role as a signature authorization for e-filing. By signing this form, the partner or authorized representative confirms that the information provided in the Form 1065 is accurate and complete to the best of their knowledge. This form must be retained for a minimum of three years, as it may be required for verification by the IRS. Compliance with IRS guidelines ensures that the e-filing process is legally valid and protects the partnership from potential penalties.

IRS Guidelines for Form 8879 PE

The IRS has specific guidelines regarding the use of Form 8879 PE. These guidelines include:

- The form must be signed by a partner or an authorized representative of the partnership.

- It must be completed and submitted in conjunction with the electronic filing of Form 1065.

- All information on the form must be accurate and match the details provided in the electronic return.

- The form should be stored securely, as it may be subject to IRS review.

Filing Deadlines for Form 8879 PE

Filing deadlines for Form 8879 PE align with those for Form 1065. Typically, partnerships must file their Form 1065 by March 15 of the year following the tax year. If the partnership requires an extension, they can file Form 7004 to receive an additional six months. It is important to ensure that Form 8879 PE is signed and submitted along with the electronic return by the applicable deadlines to avoid penalties.

Examples of Using the Form 8879 PE IRS E-file Signature Authorization for Form 1065

Form 8879 PE is commonly used in various scenarios, such as:

- A partnership with multiple partners where one partner is designated to sign on behalf of the group.

- A limited liability company (LLC) filing as a partnership, utilizing the form for e-filing compliance.

- Partnerships engaging tax professionals who prepare and file the return electronically on behalf of the partners.

Quick guide on how to complete 2020 form 8879 pe irs e file signature authorization for form 1065

Effortlessly prepare Form 8879 PE IRS E file Signature Authorization For Form 1065 on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, edit, and eSign your files without any delays. Handle Form 8879 PE IRS E file Signature Authorization For Form 1065 across any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form 8879 PE IRS E file Signature Authorization For Form 1065 with ease

- Obtain Form 8879 PE IRS E file Signature Authorization For Form 1065 and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Adjust and eSign Form 8879 PE IRS E file Signature Authorization For Form 1065 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8879 pe irs e file signature authorization for form 1065

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8879 pe irs e file signature authorization for form 1065

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What are the form 8879 instructions?

The form 8879 instructions provide detailed guidelines on how to properly complete the form used for e-filing your federal tax return. Following these instructions is crucial to ensure compliance and avoid issues with the IRS. By understanding the form 8879 instructions, you can accurately verify your tax return without any hassles.

-

How can airSlate SignNow help with form 8879 instructions?

airSlate SignNow streamlines the process of submitting form 8879 by allowing users to eSign documents easily and securely. With our platform, you can access helpful tools and resources related to form 8879 instructions, ensuring that your tax filing is efficient and compliant. This makes the entire process of handling forms much simpler and faster.

-

Are there any costs associated with using airSlate SignNow for form 8879 instructions?

Yes, airSlate SignNow offers various pricing plans, allowing you to choose the option that best suits your budget and needs. Each plan includes different features, making it easy to manage documents and access resources like form 8879 instructions. You can start with a free trial to assess how well our solution fits your requirements.

-

What features does airSlate SignNow provide that support form 8879 instructions?

AirSlate SignNow supports form 8879 instructions through features like document templates, real-time collaboration, and secure eSigning options. These features simplify the document preparation process and ensure that you can comply with IRS requirements. Moreover, the user-friendly interface makes it easy to follow form 8879 instructions without confusion.

-

Can I integrate airSlate SignNow with other software to assist with form 8879 instructions?

Absolutely! AirSlate SignNow offers seamless integrations with popular accounting and tax software that can help manage the completion of form 8879 instructions. This means you can easily send and sign your documents directly from the applications you’re already using, enhancing your overall efficiency.

-

How secure is airSlate SignNow when working with form 8879 instructions?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption methods to protect your data and ensure that your form 8879 instructions are handled safely. Our compliance with industry standards means you can trust us with your sensitive tax documents.

-

What are the benefits of using airSlate SignNow for form 8879 instructions?

Using airSlate SignNow for form 8879 instructions offers numerous benefits, including ease of use, time savings, and enhanced document security. You can expedite the signing process and reduce paper clutter while ensuring that your forms are completed correctly. This strategic advantage can lead to faster tax filing and fewer compliance issues.

Get more for Form 8879 PE IRS E file Signature Authorization For Form 1065

- Ohio department of job and family services fax cover sheet form

- Authorization for minor child visitation form

- Tec connections academy commonwealth virtual school a tuition free form

- Donation receipt true value company 2017 spring reunion form

- Wwwtripadvisorcomshowuserreviews g1509268 dgood review of athletic club ampamp spa anjali at the westin form

- Post construction cleaning checklist pdf form

- Wwwbodypiercingbybinkcom uploads 253state of florida body piercing by bink form

- Form sls2

Find out other Form 8879 PE IRS E file Signature Authorization For Form 1065

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy