Form 8879 PE E File Authorization for Form 1065 2023

Understanding Form 8879 PE E-file Authorization for Form 1065

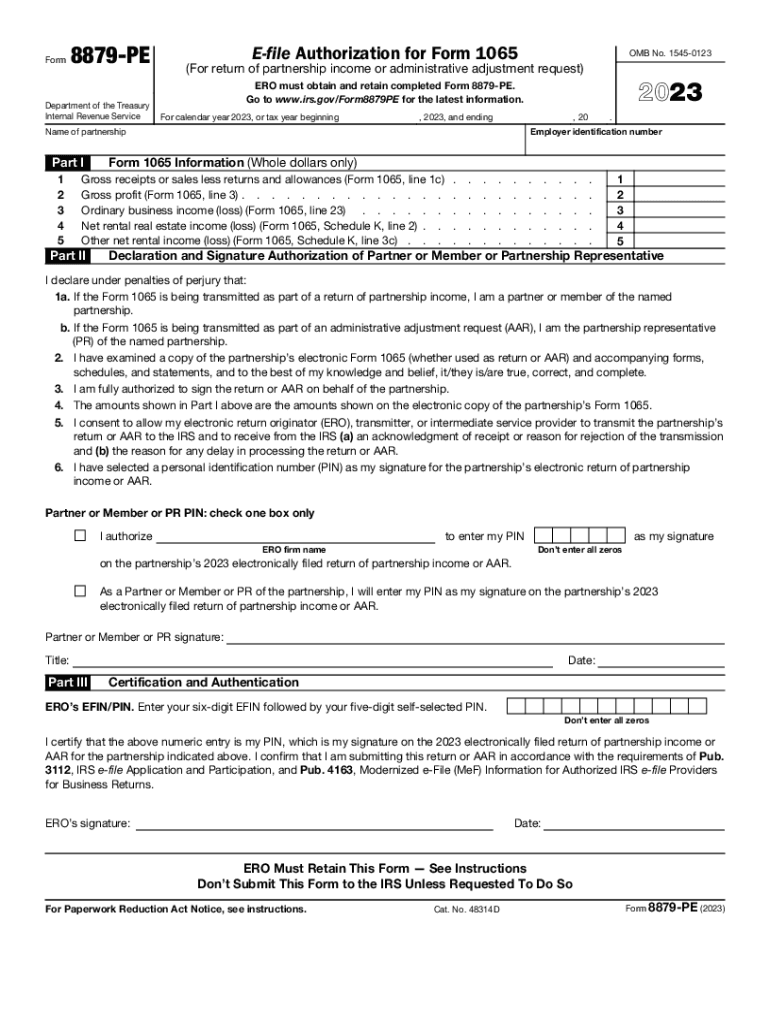

Form 8879, specifically the PE version, serves as an e-file authorization for partnerships filing Form 1065. This form allows the partners to authorize their tax preparer to electronically file their partnership tax return with the IRS. By signing this form, partners confirm that they have reviewed the return and agree to its submission. This process streamlines filing and ensures compliance with IRS regulations.

Steps to Complete Form 8879 PE E-file Authorization for Form 1065

Completing Form 8879 PE involves several key steps:

- Gather necessary information, including the partnership's Employer Identification Number (EIN) and details from Form 1065.

- Ensure all partners have reviewed the tax return and agree with its contents.

- Fill out the form with the required signatures from each partner, confirming their consent for e-filing.

- Submit the completed form to your tax preparer, who will use it to file the partnership return electronically.

Key Elements of Form 8879 PE E-file Authorization for Form 1065

Form 8879 PE includes several important components:

- Partnership information: This includes the name, address, and EIN of the partnership.

- Partner signatures: Each partner must sign the form to authorize the e-filing.

- Tax preparer's information: The form requires details about the tax preparer who will file the return.

- Confirmation of review: Partners must affirm that they have reviewed the tax return before signing.

IRS Guidelines for Form 8879 PE

The IRS provides specific guidelines regarding the use of Form 8879 PE. It is essential for partners to ensure that the form is completed accurately and submitted in a timely manner. The IRS mandates that the form must be signed before the electronic submission of Form 1065. Additionally, the form must be retained by the tax preparer for three years after the return is filed, as part of compliance with IRS record-keeping requirements.

Filing Deadlines for Form 8879 PE

Form 8879 PE must be submitted in conjunction with Form 1065. The deadline for filing Form 1065 is typically March 15 for partnerships operating on a calendar year. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is crucial for partners to ensure that Form 8879 PE is signed and submitted to the tax preparer before this deadline to avoid penalties.

Quick guide on how to complete form 8879 pe e file authorization for form 1065

Complete Form 8879 PE E file Authorization For Form 1065 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form 8879 PE E file Authorization For Form 1065 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and electronically sign Form 8879 PE E file Authorization For Form 1065 with ease

- Find Form 8879 PE E file Authorization For Form 1065 and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 8879 PE E file Authorization For Form 1065 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8879 pe e file authorization for form 1065

Create this form in 5 minutes!

How to create an eSignature for the form 8879 pe e file authorization for form 1065

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8879?

Form 8879 is an IRS document that allows taxpayers to authorize an electronic signature for their federal tax return. By using form 8879, individuals can facilitate the preparation and submission of their tax documents electronically, making the process much faster and more convenient.

-

How can airSlate SignNow help with form 8879?

airSlate SignNow provides a robust platform that enables users to easily create and manage form 8879 for electronic signatures. Our solution simplifies the form signing process, ensuring compliance with IRS regulations while allowing for quick processing and submission.

-

What are the benefits of using airSlate SignNow for form 8879?

The benefits of using airSlate SignNow for form 8879 include increased efficiency in handling tax documents, enhanced security for sensitive information, and easy access from any device. This streamlines the tax filing process, helping you focus on what really matters.

-

Is there a cost associated with using airSlate SignNow for form 8879?

Yes, while airSlate SignNow offers an easy-to-use solution for managing forms like 8879, there is a subscription fee based on your chosen plan. However, the cost is competitive and comes with numerous features that provide great value for businesses in need of document management.

-

What features does airSlate SignNow offer for managing form 8879?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for form 8879. These tools help streamline the signing process, ensuring that your documents are completed accurately and promptly.

-

Can airSlate SignNow integrate with other accounting software for form 8879?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, making it an ideal solution for managing form 8879. This integration helps centralize your document workflow and simplifies data entry across platforms.

-

What security measures does airSlate SignNow have for form 8879?

airSlate SignNow prioritizes security by employing advanced encryption protocols and secure data storage for documents, including form 8879. Your sensitive tax information is protected, ensuring compliance with privacy standards.

Get more for Form 8879 PE E file Authorization For Form 1065

- Writing effective letters fsu career center florida state form

- Motion to dismiss for failure to notice and grant show cause hearing form

- Motionfor judgment of acquittal form

- Motionto dismiss counts of complaint form

- Rfp number 18 007 for request for proposals for form

- Follow up on release of pending order form

- I appreciate you agreeing to act as local counsel for form

- Instructions statement of merger surviving entity is a form

Find out other Form 8879 PE E file Authorization For Form 1065

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word