Form 8453 PE IRS Gov 2013

What is the Form 8453 PE IRS gov

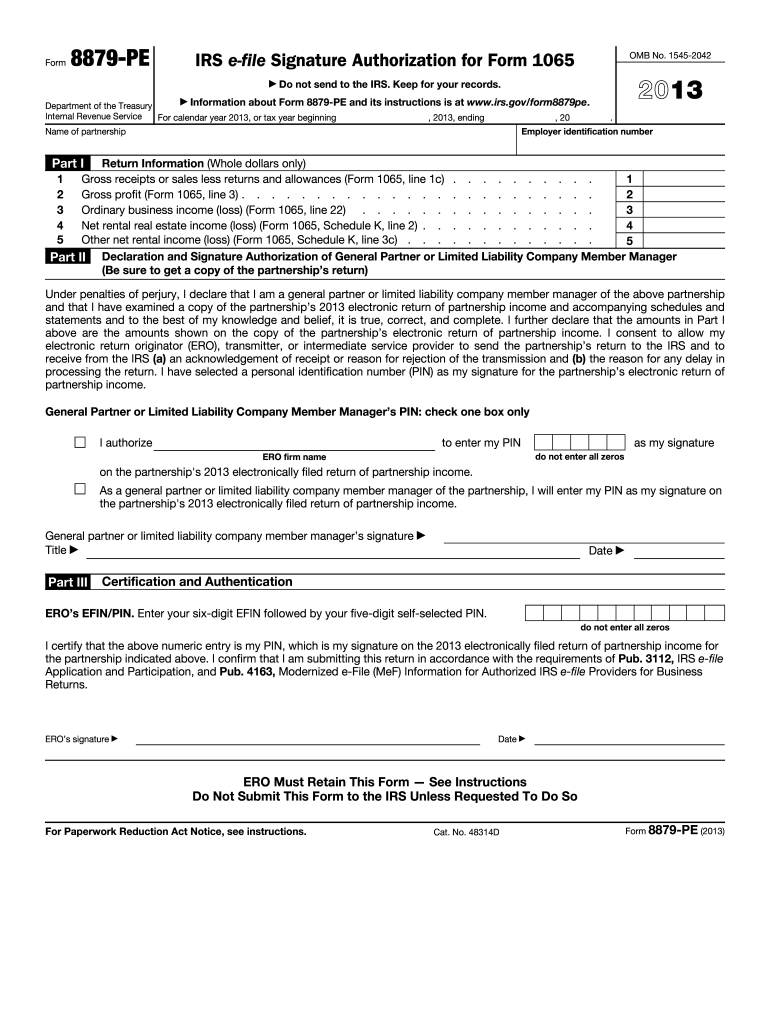

The Form 8453 PE is a document used by partnerships to electronically file their tax returns with the IRS. This form serves as a declaration that the partnership's electronic return is complete and accurate. It is crucial for ensuring that the IRS receives the necessary information for processing partnership tax returns. The form must be signed by an authorized partner, affirming that the information provided is true and correct under penalties of perjury.

How to use the Form 8453 PE IRS gov

Using the Form 8453 PE involves several steps. First, ensure that the partnership has completed its electronic tax return. After that, the authorized partner must print the Form 8453 PE, sign it, and retain it for their records. The form does not need to be mailed to the IRS; instead, it should be kept as part of the partnership's records. The electronic submission of the tax return serves as the official filing, while the signed form acts as a supporting document.

Steps to complete the Form 8453 PE IRS gov

To complete the Form 8453 PE, follow these steps:

- Gather all necessary information related to the partnership's tax return.

- Complete the electronic tax return using IRS-approved software.

- Print the Form 8453 PE once the electronic return is finalized.

- Sign the form in the designated area by an authorized partner.

- Keep the signed form in the partnership’s records for future reference.

Legal use of the Form 8453 PE IRS gov

The legal use of the Form 8453 PE is governed by IRS regulations. This form must be signed by an authorized partner to validate the electronic submission of the partnership's tax return. The form acts as a legal declaration, ensuring that the partnership complies with tax laws. It is important to note that failure to properly complete and retain this form may result in penalties or complications with the IRS.

Key elements of the Form 8453 PE IRS gov

Key elements of the Form 8453 PE include the partnership's name, address, and Employer Identification Number (EIN). Additionally, the form requires the signature of an authorized partner, along with the date of signing. These elements are essential for verifying the authenticity of the electronic tax return and ensuring that the IRS has accurate information regarding the partnership's tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8453 PE align with the partnership's tax return due date. Generally, partnerships must file their tax returns by the fifteenth day of the third month after the end of their tax year. For partnerships operating on a calendar year, this means the deadline is March 15. It is important to be aware of these deadlines to avoid penalties and ensure timely compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 8453 PE does not require mailing to the IRS, as it is only needed for record-keeping purposes. The partnership submits its electronic tax return through IRS-approved e-filing software. This method ensures that the return is filed securely and efficiently. Partners should retain the signed Form 8453 PE in their records, as it may be requested by the IRS during audits or inquiries.

Quick guide on how to complete 2018 form 8453 pe irsgov

Effortlessly Complete Form 8453 PE IRS gov on Any Device

Managing documents online has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the essential tools to create, edit, and electronically sign your documents swiftly without complications. Handle Form 8453 PE IRS gov on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Form 8453 PE IRS gov

- Find Form 8453 PE IRS gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Alter and eSign Form 8453 PE IRS gov while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 8453 pe irsgov

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 8453 pe irsgov

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is Form 8453 PE IRS gov?

Form 8453 PE IRS gov is a form used by partnerships to file electronic tax returns. It serves as the declaration by the partner or taxpayer to authenticate the electronic submission of Form 1065. Understanding this form is essential for ensuring compliance with IRS guidelines.

-

How can airSlate SignNow help me sign Form 8453 PE IRS gov?

AirSlate SignNow offers an intuitive platform to easily eSign Form 8453 PE IRS gov electronically. You can upload the form, add your signature, and send it securely, ensuring a hassle-free signing experience. This streamlines your tax filing process and ensures timely submissions.

-

Is there a cost associated with using airSlate SignNow for Form 8453 PE IRS gov?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, making it a cost-effective solution for eSigning documents like Form 8453 PE IRS gov. You can choose a plan that offers the features you need, including unlimited signatures and advanced integrations.

-

What features does airSlate SignNow provide for managing Form 8453 PE IRS gov?

AirSlate SignNow provides a range of features for managing Form 8453 PE IRS gov, including secure storage, customizable templates, and the ability to set signing order. Additionally, you can track the status of sent documents and receive reminders for pending signatures, ensuring a smooth workflow.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 8453 PE IRS gov?

Absolutely! AirSlate SignNow integrates seamlessly with many popular accounting software solutions, allowing you to manage Form 8453 PE IRS gov directly within your existing tools. This integration enhances efficiency and simplifies your tax filing processes.

-

What are the benefits of using airSlate SignNow for Form 8453 PE IRS gov?

Using airSlate SignNow for Form 8453 PE IRS gov provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced document security. You can expedite the filing process and minimize errors, all while maintaining compliance with IRS standards.

-

Is airSlate SignNow compliant with IRS regulations for Form 8453 PE IRS gov?

Yes, airSlate SignNow is fully compliant with IRS regulations for electronic signatures, including those required for Form 8453 PE IRS gov. This ensures that your electronically signed forms are legally valid and accepted by the IRS, giving you peace of mind.

Get more for Form 8453 PE IRS gov

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat district of columbia form

- 30 day notice to terminate month to month lease residential from landlord to tenant district of columbia form

- 30 day notice 497301597 form

- Dc notice 497301598 form

- Dc month to month form

- Dc 30 day form

- 30 day notice to terminate tenancy at will for residential from tenant to landlord district of columbia form

- 7 day notice to pay rent or lease terminates for residential property district of columbia form

Find out other Form 8453 PE IRS gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors