About Form 709, United States Gift and IRS Tax Forms 2021

Understanding IRS Form 709: Gift Tax Return

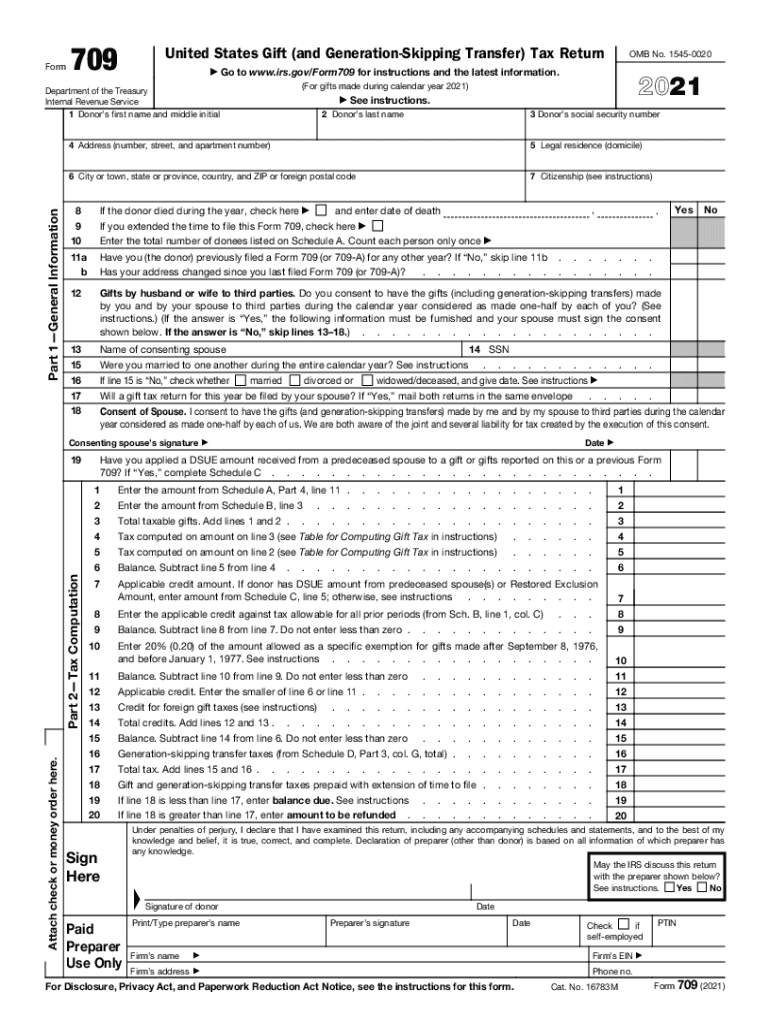

IRS Form 709, also known as the Gift Tax Return, is a crucial document for individuals who make gifts exceeding the annual exclusion limit. This form is used to report gifts made during the tax year and to calculate any gift tax owed. The federal gift tax applies to the transfer of property from one individual to another without receiving something of equal value in return. Understanding the purpose and requirements of Form 709 is essential for compliance with federal tax regulations.

Steps to Complete IRS Form 709

Filling out IRS Form 709 involves several steps to ensure accuracy and compliance. Begin by gathering necessary information, including the names and addresses of both the donor and the recipient, as well as details about the gifts made. Follow these steps:

- Identify the gifts made during the tax year that exceed the annual exclusion limit.

- Complete the identification section, providing your information and the recipient's details.

- List each gift on the appropriate section of the form, including the fair market value at the time of the gift.

- Calculate the total value of all gifts and determine any applicable gift tax based on the current federal gift tax rate.

- Sign and date the form before submission.

Filing Deadlines for IRS Form 709

It is important to be aware of the filing deadlines for IRS Form 709 to avoid penalties. The form is typically due on April fifteenth of the year following the year in which the gifts were made. If you need additional time, you can file for an extension, but be aware that this does not extend the time to pay any gift tax owed. Timely filing is crucial to ensure compliance with IRS regulations.

Legal Use of IRS Form 709

IRS Form 709 serves a legal purpose in documenting and reporting gifts that may be subject to gift tax. The form ensures that the IRS is informed of any transfers that exceed the annual exclusion amount, which is essential for calculating the lifetime gift tax exemption. Properly completing and filing this form protects both the donor and recipient from potential legal issues related to unreported gifts.

Examples of Using IRS Form 709

Understanding practical scenarios can clarify when to use IRS Form 709. Here are some examples:

- A parent gifts a home valued at five hundred thousand dollars to their child, exceeding the annual exclusion limit.

- A grandparent contributes to a college fund for their grandchild, which surpasses the annual exclusion amount.

- An individual donates a valuable artwork to a friend, requiring reporting on Form 709 due to its high value.

Required Documents for IRS Form 709

To complete IRS Form 709 accurately, several documents may be necessary. These include:

- Valuation documents for the gifts, such as appraisals or purchase receipts.

- Records of previous gift tax returns, if applicable.

- Documentation of any gift splitting agreements, if gifts are made jointly with a spouse.

Quick guide on how to complete about form 709 united states gift and irs tax forms

Effortlessly Complete About Form 709, United States Gift and IRS Tax Forms on Any Device

Managing documents online has gained popularity among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Handle About Form 709, United States Gift and IRS Tax Forms on any device using the airSlate SignNow apps for Android or iOS, and streamline your document-related processes today.

The Easiest Way to Edit and eSign About Form 709, United States Gift and IRS Tax Forms with Ease

- Obtain About Form 709, United States Gift and IRS Tax Forms and then click Get Form to start.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any chosen device. Edit and eSign About Form 709, United States Gift and IRS Tax Forms while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 709 united states gift and irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the about form 709 united states gift and irs tax forms

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is IRS Form 709 and why is it important?

IRS Form 709 is used to report gift taxes and any generation-skipping transfers. It's important for individuals who have made gifts above the annual exclusion amount, ensuring compliance with tax laws. Understanding IRS Form 709 helps prevent penalties and manages estate planning effectively.

-

How can airSlate SignNow assist with IRS Form 709?

airSlate SignNow allows you to easily upload, fill out, and eSign IRS Form 709 securely. Our platform streamlines the document management process, making it simple to handle all your tax-related documentation with confidence and legal backing.

-

Is airSlate SignNow affordable for small businesses needing to manage IRS Form 709?

Yes! airSlate SignNow offers flexible pricing plans designed to fit the budgets of small businesses. You can manage IRS Form 709 and other documentation without breaking the bank, ensuring you stay compliant without financial strain.

-

What features does airSlate SignNow offer for handling IRS Form 709?

Key features include customizable templates, real-time collaboration, and secure cloud storage. These features make it effortless to manage IRS Form 709 and ensure all necessary signatures are collected in a timely manner, making tax season less stressful.

-

Can I integrate airSlate SignNow with other applications for handling IRS Form 709?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow. Whether it's accounting software or CRM systems, you can efficiently handle IRS Form 709 alongside your existing tools.

-

How secure is the eSigning process for IRS Form 709 with airSlate SignNow?

The eSigning process for IRS Form 709 is highly secure with airSlate SignNow. We utilize SSL encryption and comply with e-signature laws, ensuring that your sensitive information is protected during the signing process.

-

What are the benefits of using airSlate SignNow for IRS Form 709?

Using airSlate SignNow for IRS Form 709 simplifies the entire process, from creation to signing. It reduces paperwork, speeds up transactions, and enhances accuracy, allowing you to focus on what matters most—your gift-giving strategy.

Get more for About Form 709, United States Gift and IRS Tax Forms

Find out other About Form 709, United States Gift and IRS Tax Forms

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple