Form 709 United States Gift and Generation Skipping Transfer Tax Return 2020

What is the Form 709 United States Gift and Generation Skipping Transfer Tax Return

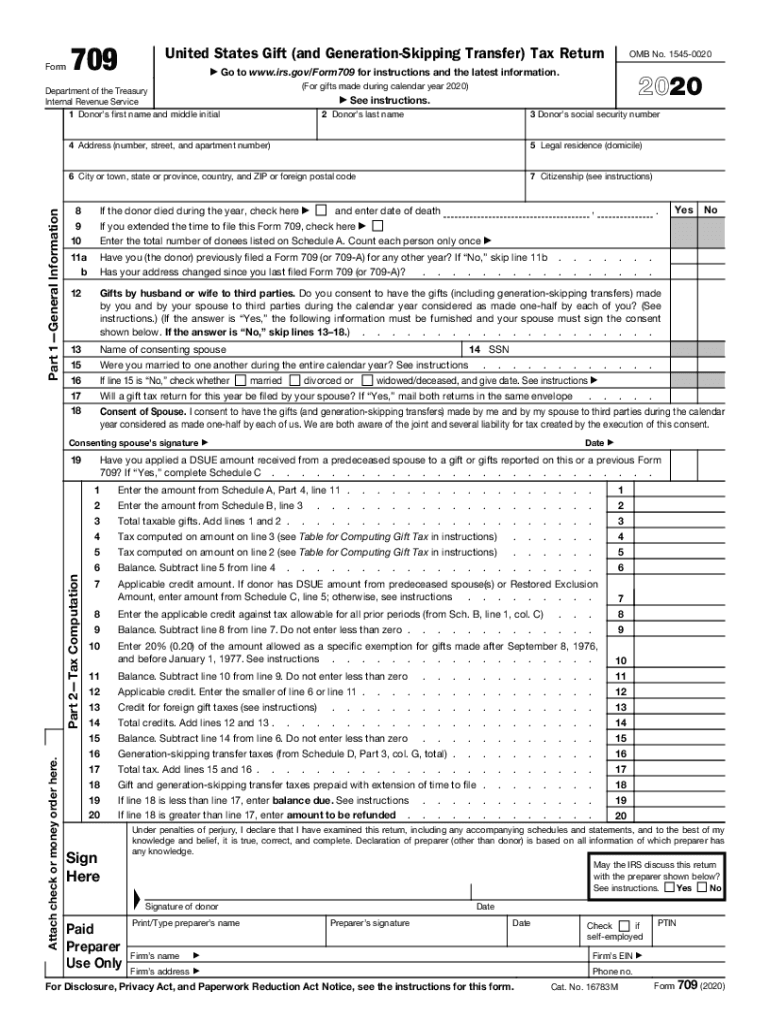

The Form 709, officially known as the United States Gift and Generation Skipping Transfer Tax Return, is a crucial document for individuals in the United States who make gifts above a certain threshold. This form is used to report gifts made during the tax year and to calculate any potential gift tax owed. It also addresses generation-skipping transfers, which occur when a gift is made to a beneficiary who is two or more generations younger than the donor. Understanding this form is essential for proper tax compliance and to avoid penalties.

Steps to complete the Form 709 United States Gift and Generation Skipping Transfer Tax Return

Completing the Form 709 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the gifts made during the year, including the value of each gift and the recipient's details. Next, fill out the form by providing your personal information, including your Social Security number and the details of the gifts. It is important to calculate any applicable exclusions, such as the annual exclusion amount, which allows you to gift a certain amount each year without incurring tax. Finally, review the completed form for accuracy before submitting it to the IRS.

Legal use of the Form 709 United States Gift and Generation Skipping Transfer Tax Return

The legal use of Form 709 is governed by IRS regulations that stipulate when and how the form must be filed. This form is legally binding and must be submitted if your total gifts exceed the annual exclusion limit. Filing this form accurately is essential to avoid legal repercussions, including penalties for non-compliance. The IRS recognizes eSignatures on documents like Form 709, provided that they meet the necessary legal standards, ensuring that your submission is both secure and valid.

Filing Deadlines / Important Dates

Filing deadlines for the Form 709 are typically aligned with the individual income tax return deadlines. For most taxpayers, this means that the form must be filed by April fifteenth of the year following the tax year in which the gifts were made. If you require additional time, you may file for an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid interest and penalties. Keeping track of these important dates is essential for compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 709 can be submitted in various ways, providing flexibility for taxpayers. You can file the form electronically using approved e-filing software that supports IRS forms, which is often the quickest method. Alternatively, you may print the completed form and mail it to the appropriate IRS address. In-person submission is generally not an option for this form, as the IRS does not accept walk-in submissions for Form 709. Ensuring that you choose the correct submission method is vital for timely processing.

Key elements of the Form 709 United States Gift and Generation Skipping Transfer Tax Return

Key elements of Form 709 include sections for reporting the donor's information, details about the gifts made, and calculations for any gift tax owed. The form requires you to list each gift, its fair market value, and the recipient's information. Additionally, it includes a section for claiming any applicable exclusions and deductions. Understanding these elements is crucial for accurately completing the form and ensuring compliance with IRS regulations.

Quick guide on how to complete 2020 form 709 united states gift and generation skipping transfer tax return

Complete Form 709 United States Gift and Generation Skipping Transfer Tax Return effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without hurdles. Manage Form 709 United States Gift and Generation Skipping Transfer Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The most efficient way to modify and eSign Form 709 United States Gift and Generation Skipping Transfer Tax Return effortlessly

- Find Form 709 United States Gift and Generation Skipping Transfer Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Verify all the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 709 United States Gift and Generation Skipping Transfer Tax Return while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 709 united states gift and generation skipping transfer tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 709 united states gift and generation skipping transfer tax return

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the 2020 IRS Form 709 and when do I need to file it?

The 2020 IRS Form 709 is the United States Gift and Generation-Skipping Transfer Tax Return, which must be filed by individuals who gift or transfer assets exceeding certain thresholds. Typically, this form is due on April 15 of the year following the gift and can be extended to October 15. Making sure to file the 2020 IRS Form 709 correctly is crucial to avoid potential penalties.

-

How can airSlate SignNow help me with the 2020 IRS Form 709?

airSlate SignNow provides an efficient way to prepare, sign, and send your 2020 IRS Form 709 electronically. Our platform ensures that your documents are securely signed and sent in compliance with IRS regulations. With user-friendly features, airSlate SignNow simplifies the process so you can focus on managing your gifts instead.

-

Is there a cost associated with using airSlate SignNow for the 2020 IRS Form 709?

Yes, airSlate SignNow is a cost-effective solution that offers various pricing plans tailored to different needs. You can choose a plan that fits your business size and requirements for managing the 2020 IRS Form 709. Our pricing is transparent, with no hidden fees, and you can take advantage of a free trial to explore our features.

-

What features does airSlate SignNow offer for handling the 2020 IRS Form 709?

airSlate SignNow offers a range of features including a customizable template library, cloud storage, and real-time tracking of document status. You can easily create, edit, and share the 2020 IRS Form 709, ensuring that the process is efficient and secure. Additionally, our electronic signature service is legally binding, streamlining your filing.

-

Can airSlate SignNow integrate with other software for managing the 2020 IRS Form 709?

Absolutely, airSlate SignNow seamlessly integrates with popular business tools like Google Workspace, Salesforce, and more. This allows you to sync data and manage documents related to the 2020 IRS Form 709 directly within your existing workflows. These integrations enhance productivity, enabling you to handle your tax documents more efficiently.

-

What are the benefits of using airSlate SignNow for the 2020 IRS Form 709?

Using airSlate SignNow for the 2020 IRS Form 709 offers numerous benefits including time savings and increased accuracy in document handling. Our platform ensures compliance with IRS regulations while providing a user-friendly interface. Additionally, the ability to track and manage your e-signatures in real time minimizes errors and streamlines the filing process.

-

Is airSlate SignNow legally compliant for signing the 2020 IRS Form 709?

Yes, airSlate SignNow is fully compliant with e-signature laws, including the ESIGN Act and UETA. This ensures that your electronically signed 2020 IRS Form 709 holds the same legal weight as a traditional handwritten signature. You can file with confidence knowing that your documents meet all necessary legal requirements.

Get more for Form 709 United States Gift and Generation Skipping Transfer Tax Return

Find out other Form 709 United States Gift and Generation Skipping Transfer Tax Return

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document