Forms and Instructions PDF709 United States Gift and Generation Skipping Transfer Tax ReturnForm 709 United States Gift and Gene 2022

Understanding Form 709 for Gift and Generation Skipping Transfer Tax

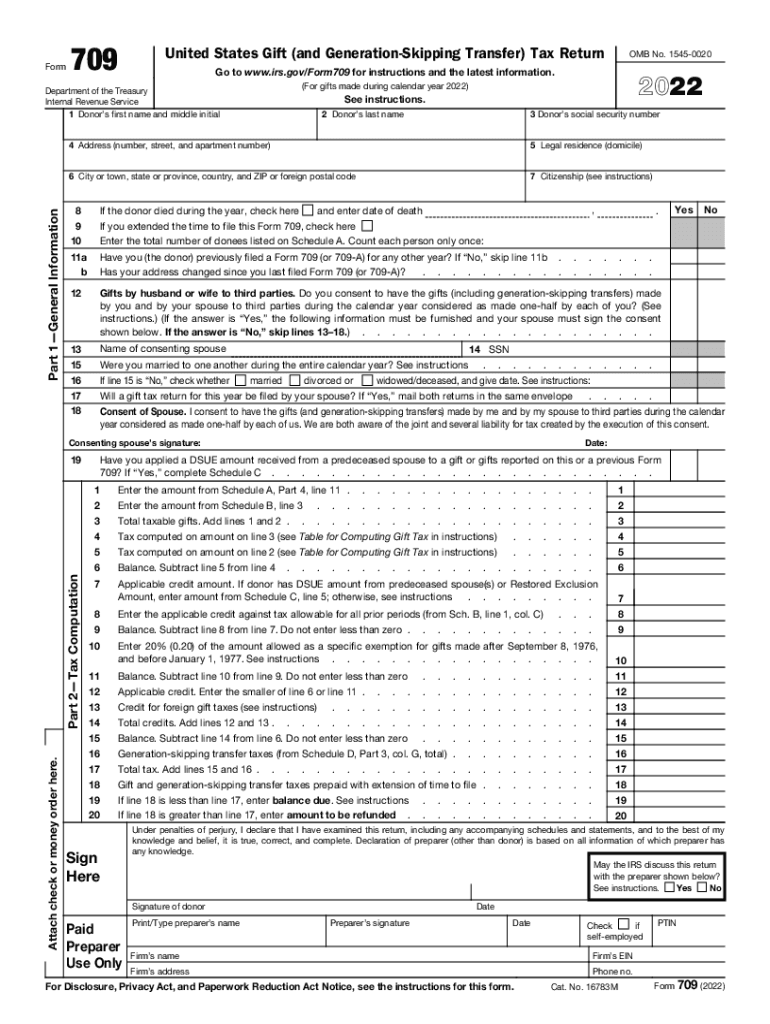

The Form 709 is the United States Gift and Generation Skipping Transfer Tax Return, which is essential for reporting gifts that exceed the annual exclusion amount. This form is crucial for individuals who wish to utilize their lifetime gift tax exemption. The IRS mandates that taxpayers file this form if they give gifts that surpass the annual gift tax exclusion limit, which was $15,000 per recipient in 2021 and $16,000 in 2022. Understanding the implications of this form can help individuals manage their tax liabilities effectively.

Steps to Complete Form 709

Completing Form 709 involves several key steps to ensure accurate reporting. First, gather necessary information about the gifts made during the tax year, including the recipient's details and the value of each gift. Next, fill out the form by providing personal information, including your Social Security number and the total value of gifts. It is important to calculate any applicable exclusions and exemptions accurately. After completing the form, review all entries for accuracy before submission.

Filing Deadlines for Form 709

Form 709 must be filed by the tax return due date, which is typically April 15 of the year following the tax year in question. If you require additional time, you may file for an extension, which grants an additional six months. However, it is important to note that any taxes owed must still be paid by the original due date to avoid penalties and interest. Staying aware of these deadlines is crucial for compliance with IRS regulations.

Key Elements of Form 709

Form 709 consists of several key sections that taxpayers must complete. These include the identification of the donor, the details of the gifts made, and any applicable deductions. The form also requires the reporting of any generation-skipping transfers. Understanding these elements helps ensure that all required information is provided, which is essential for accurate tax reporting and compliance.

IRS Guidelines for Form 709

The IRS provides specific guidelines regarding the use of Form 709, including eligibility criteria for the lifetime gift tax exemption. Taxpayers must adhere to these guidelines to ensure their gifts are reported correctly. The IRS also outlines the process for claiming the exemption, which can significantly affect an individual's tax liability. Familiarizing oneself with these guidelines is vital for effective tax planning.

Penalties for Non-Compliance with Form 709

Failure to file Form 709 when required can lead to significant penalties. The IRS may impose a penalty of five percent per month on the unpaid tax amount, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid taxes from the due date until the payment is made. Understanding these penalties emphasizes the importance of timely and accurate filing of the form.

Quick guide on how to complete forms and instructions pdf709 united states gift and generation skipping transfer tax returnform 709 united states gift and

Finalizing Forms And Instructions PDF709 United States Gift and Generation Skipping Transfer Tax ReturnForm 709 United States Gift and Gene effortlessly on any device

Virtual document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the required form and securely save it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Forms And Instructions PDF709 United States Gift and Generation Skipping Transfer Tax ReturnForm 709 United States Gift and Gene on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

How to modify and eSign Forms And Instructions PDF709 United States Gift and Generation Skipping Transfer Tax ReturnForm 709 United States Gift and Gene with ease

- Obtain Forms And Instructions PDF709 United States Gift and Generation Skipping Transfer Tax ReturnForm 709 United States Gift and Gene and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that reason.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Forms And Instructions PDF709 United States Gift and Generation Skipping Transfer Tax ReturnForm 709 United States Gift and Gene and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct forms and instructions pdf709 united states gift and generation skipping transfer tax returnform 709 united states gift and

Create this form in 5 minutes!

People also ask

-

What is the lifetime gift tax exemption 2022?

The lifetime gift tax exemption 2022 allows individuals to give gifts up to a specified amount without incurring federal gift tax. For 2022, this exemption is set at $12.06 million per individual. This means you can gift a substantial amount to family or friends without tax penalties, making it a valuable strategy in estate planning.

-

How does the lifetime gift tax exemption 2022 affect estate planning?

Incorporating the lifetime gift tax exemption 2022 into your estate planning can signNowly reduce your taxable estate. By using this exemption, you can transfer wealth to heirs while minimizing tax liability. This strategic gift-giving can provide financial support to loved ones while preserving assets for future generations.

-

Are there any limitations to the lifetime gift tax exemption 2022?

While the lifetime gift tax exemption 2022 is generous, it does have limitations. Gifts exceeding the annual exclusion limit ($16,000 per recipient in 2022) must be reported, and any amount used will reduce your lifetime exemption. Additionally, certain gifts, like those to non-U.S. citizens, may have different rules.

-

How can airSlate SignNow assist with documents related to the lifetime gift tax exemption 2022?

airSlate SignNow simplifies the process of preparing and managing documents related to the lifetime gift tax exemption 2022. With our eSigning features, you can quickly execute important gift agreements and letters, ensuring compliance with tax laws. This efficiency helps you manage your gifting process smoothly and securely.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs. We provide a free trial, followed by various subscription tiers to accommodate both individuals and organizations. Regardless of your budget, you can access our features to manage documents efficiently while considering implications such as the lifetime gift tax exemption 2022.

-

Can airSlate SignNow integrate with other software for managing gift tax documentation?

Yes, airSlate SignNow seamlessly integrates with various software applications and platforms. This allows for straightforward collaboration with financial advisors, accountants, and legal professionals while managing documentation related to the lifetime gift tax exemption 2022. Streamlined workflows ensure that important tax documents are easily shared and signed.

-

What features does airSlate SignNow provide to facilitate gift transaction documentation?

airSlate SignNow boasts features such as customizable templates, robust security measures, and user-friendly eSigning options, all essential for documenting gift transactions. These tools ensure that you can efficiently create, manage, and execute gifts, especially when considering the lifetime gift tax exemption 2022. Our platform also simplifies tracking your gifting activities for tax purposes.

Get more for Forms And Instructions PDF709 United States Gift and Generation Skipping Transfer Tax ReturnForm 709 United States Gift and Gene

- Buyers notice of intent to vacate and surrender property to seller under contract for deed oklahoma form

- General notice of default for contract for deed oklahoma form

- Ok disclosure form

- Seller disclosure agreement 497322750 form

- Ok deed form

- Notice of default for past due payments in connection with contract for deed oklahoma form

- Final notice of default for past due payments in connection with contract for deed oklahoma form

- Assignment of contract for deed by seller oklahoma form

Find out other Forms And Instructions PDF709 United States Gift and Generation Skipping Transfer Tax ReturnForm 709 United States Gift and Gene

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT