709 Form 2012

What is the 709 Form

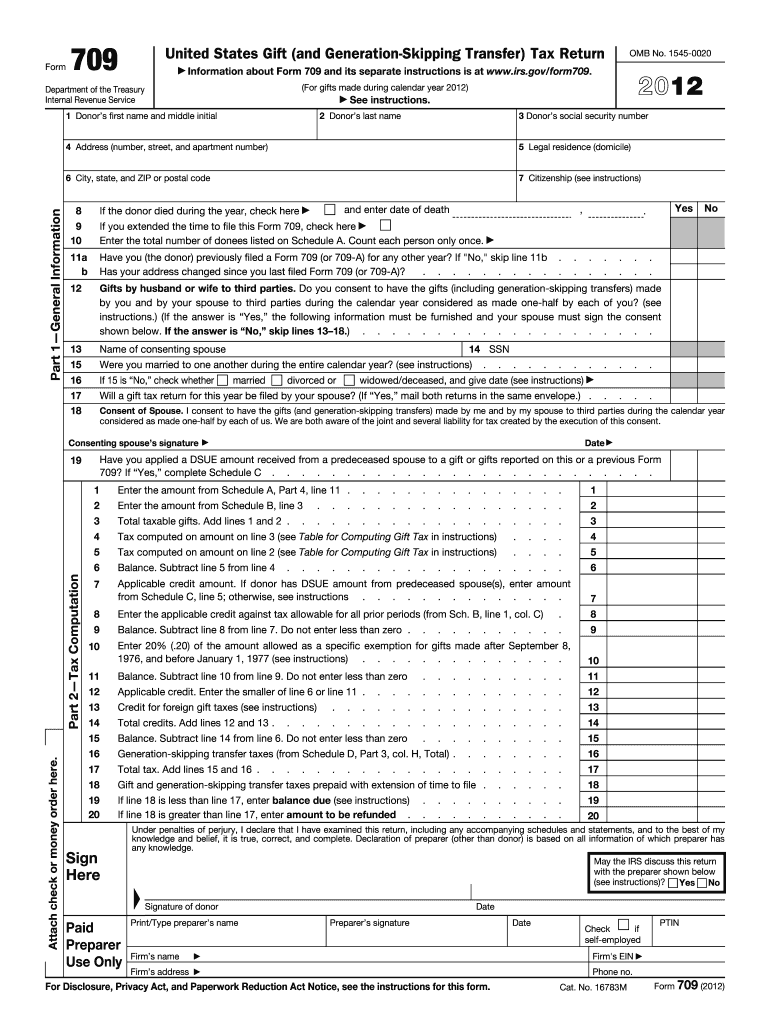

The 709 Form, officially known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a tax form used by individuals to report gifts made during the year. It is primarily utilized for reporting gifts that exceed the annual exclusion limit set by the Internal Revenue Service (IRS). This form is essential for taxpayers who wish to ensure compliance with federal tax regulations regarding gift transfers and to manage their lifetime gift tax exemption effectively.

How to use the 709 Form

To use the 709 Form, individuals must first determine if they have made any gifts that exceed the annual exclusion amount, which is adjusted periodically. The form requires detailed information about the donor, the recipient, and the nature of the gifts. Taxpayers must provide a complete description of each gift, its value, and any applicable deductions. If the gifts are part of a trust or have specific conditions, additional documentation may be required. Once completed, the form must be filed with the IRS, typically alongside the donor's income tax return.

Steps to complete the 709 Form

Completing the 709 Form involves several key steps:

- Gather necessary information about the gifts, including the value and recipient details.

- Fill out the personal information section, including the donor's name, address, and Social Security number.

- List each gift on the appropriate sections of the form, ensuring to include descriptions and values.

- Calculate any applicable exclusions or deductions, such as the annual exclusion or marital deductions.

- Review the completed form for accuracy before submission.

- File the form with the IRS by the due date, which is typically April fifteenth of the following year.

Legal use of the 709 Form

The legal use of the 709 Form is critical for compliance with U.S. tax law. It serves as a formal declaration of gifts that may be subject to taxation. By filing this form, taxpayers can report their gifts accurately and avoid potential penalties for non-compliance. The IRS requires this form to track lifetime gift tax exemptions and ensure that taxpayers adhere to the gift tax regulations. Failure to file the 709 Form when required can result in significant financial penalties and interest on any unpaid taxes.

Filing Deadlines / Important Dates

The filing deadline for the 709 Form coincides with the individual income tax return deadline, which is typically April fifteenth of the year following the tax year in which the gifts were made. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should be aware of these deadlines to ensure timely filing and avoid penalties. Additionally, if an extension is filed for the income tax return, it does not automatically extend the deadline for the 709 Form.

Form Submission Methods (Online / Mail / In-Person)

The 709 Form can be submitted in several ways. Taxpayers can file the form electronically through authorized e-file providers, which can streamline the process and ensure quicker processing times. Alternatively, the form can be printed and mailed directly to the IRS. It is important to send the form to the correct address, which can vary based on the taxpayer's location. In-person submissions are generally not accepted for this form, making electronic and mail submissions the primary methods of filing.

Quick guide on how to complete 709 form 2012

Uncover the most efficient method to complete and endorse your 709 Form

Are you still spending time organizing your official paperwork on physical copies instead of doing it digitally? airSlate SignNow offers an improved approach to complete and endorse your 709 Form and associated forms for public services. Our advanced electronic signature solution equips you with all the necessary tools for quickly working on documents while adhering to formal standards - comprehensive PDF editing, management, security, signing, and sharing tools, all accessible within a user-friendly interface.

Only a few steps are needed to finish filling out and signing your 709 Form:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to enter in your 709 Form.

- Navigate between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your details.

- Enhance the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Obscure sections that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed 709 Form in the Documents folder in your profile, download it, or transfer it to your chosen cloud storage. Our solution also offers adaptable file sharing. There’s no need to print your templates when you must submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a go now!

Create this form in 5 minutes or less

Find and fill out the correct 709 form 2012

FAQs

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

Create this form in 5 minutes!

How to create an eSignature for the 709 form 2012

How to create an electronic signature for your 709 Form 2012 online

How to create an eSignature for the 709 Form 2012 in Chrome

How to create an electronic signature for putting it on the 709 Form 2012 in Gmail

How to generate an eSignature for the 709 Form 2012 right from your smart phone

How to generate an eSignature for the 709 Form 2012 on iOS

How to generate an electronic signature for the 709 Form 2012 on Android

People also ask

-

What is the 709 Form used for in airSlate SignNow?

The 709 Form, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is crucial for individuals making substantial gifts. Using airSlate SignNow, you can easily fill out, sign, and send the 709 Form securely. Our platform ensures compliance and accuracy, making tax season less stressful.

-

How can airSlate SignNow simplify the completion of the 709 Form?

airSlate SignNow streamlines the completion of the 709 Form by providing an intuitive interface for filling out essential fields. The platform also offers templates that guide users through the necessary steps, ensuring that all information is accurately captured. This helps reduce errors and save time during the tax filing process.

-

Is there a cost associated with using airSlate SignNow for the 709 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including the completion of the 709 Form. Our plans are designed to be cost-effective, providing access to essential features for both individuals and businesses. You can choose a plan that best fits your budget while ensuring you can efficiently eSign your documents.

-

What features does airSlate SignNow offer for managing the 709 Form?

airSlate SignNow offers several key features for managing the 709 Form, including customizable templates, secure eSignature options, and document tracking. Users can easily upload their forms, add required signatures, and send them for approval. These features enhance the efficiency of handling tax documents and ensure compliance.

-

Can I integrate airSlate SignNow with other platforms for handling the 709 Form?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, including CRM systems and cloud storage solutions. This allows you to manage the 709 Form alongside other important documents and workflows, enhancing productivity and ensuring all your tax-related paperwork is organized.

-

What are the benefits of using airSlate SignNow for my 709 Form?

Using airSlate SignNow for your 709 Form offers numerous benefits, including enhanced security, easy access, and a user-friendly experience. The platform allows for quick eSignatures and document sharing, minimizing delays in your filing process. Additionally, the ability to track document status ensures you stay informed throughout the process.

-

How secure is my information when using airSlate SignNow for the 709 Form?

airSlate SignNow prioritizes the security of your information when handling the 709 Form. We employ advanced encryption and security protocols to protect your documents and personal data. This ensures that your sensitive tax information is safe from unauthorized access while you complete your forms.

Get more for 709 Form

Find out other 709 Form

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement