September Department of the Treasury Internal Revenue Service OMB No Irs 1996

What is the September Department Of The Treasury Internal Revenue Service OMB No Irs

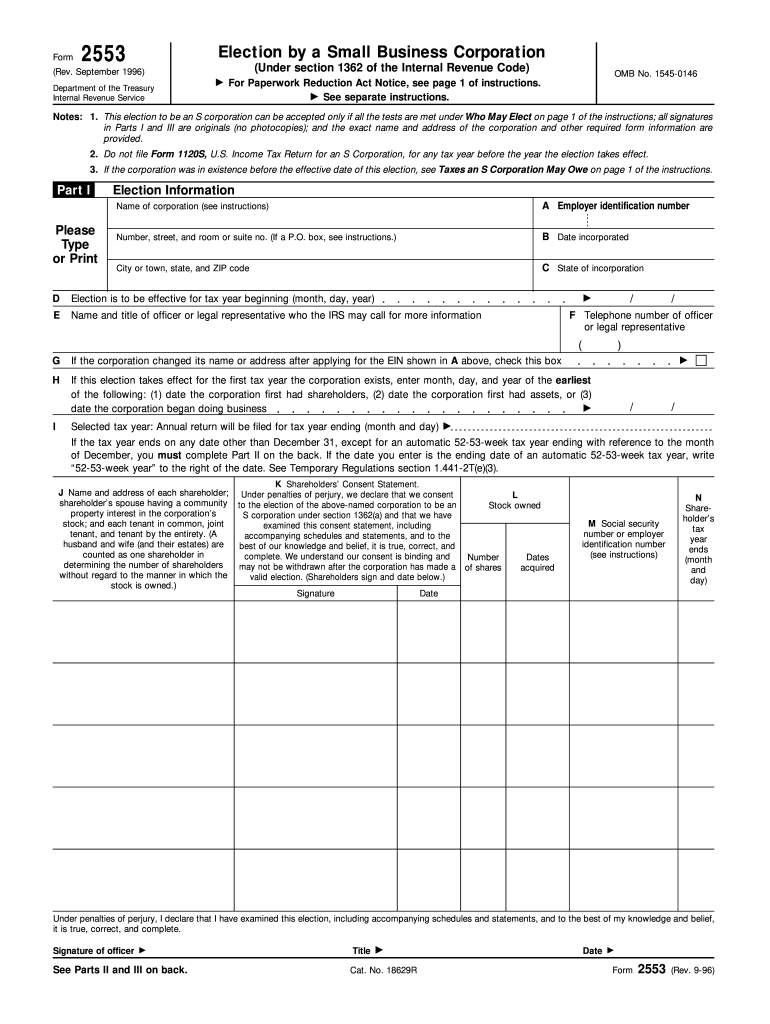

The September Department of the Treasury Internal Revenue Service OMB No Irs form is a government document used primarily for tax-related purposes in the United States. This form is issued by the IRS and is essential for various tax filings and compliance. It serves as an official record that taxpayers must complete accurately to ensure proper processing of their tax obligations. Understanding this form is crucial for both individuals and businesses to maintain compliance with federal tax regulations.

How to use the September Department Of The Treasury Internal Revenue Service OMB No Irs

Using the September Department of the Treasury Internal Revenue Service OMB No Irs form involves several steps. First, ensure you have the correct version of the form, as updates can occur. Next, gather all necessary financial documents, including income statements, deductions, and credits that apply to your situation. Complete the form by filling in the required fields accurately. After completion, review the form for any errors before submission. This careful approach helps avoid delays and ensures compliance with IRS regulations.

Steps to complete the September Department Of The Treasury Internal Revenue Service OMB No Irs

Completing the September Department of the Treasury Internal Revenue Service OMB No Irs form involves the following steps:

- Obtain the latest version of the form from the IRS website or authorized sources.

- Gather all necessary documentation, such as W-2s, 1099s, and other relevant financial records.

- Fill out the form, ensuring all required fields are completed accurately.

- Double-check your entries for accuracy to prevent mistakes.

- Sign and date the form where indicated.

- Submit the form via the appropriate method, whether electronically or by mail.

Legal use of the September Department Of The Treasury Internal Revenue Service OMB No Irs

The legal use of the September Department of the Treasury Internal Revenue Service OMB No Irs form is governed by federal tax laws. To be considered valid, the form must be filled out completely and accurately. It is crucial to adhere to all IRS guidelines regarding submission deadlines and required documentation. Failure to comply with these regulations can result in penalties, including fines or increased scrutiny from the IRS. Therefore, understanding the legal implications of this form is essential for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the September Department of the Treasury Internal Revenue Service OMB No Irs form vary depending on the specific tax year and the type of form being submitted. Generally, individual taxpayers must file by April 15 of the following year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as well as potential penalties for late filing, to ensure compliance and avoid unnecessary fees.

Form Submission Methods (Online / Mail / In-Person)

The September Department of the Treasury Internal Revenue Service OMB No Irs form can be submitted through various methods, including:

- Online submission via the IRS e-file system, which is often the fastest and most efficient method.

- Mailing a paper version of the form to the appropriate IRS address, which may vary based on your location.

- In-person submission at designated IRS offices, which can provide immediate assistance if needed.

Choosing the right submission method depends on personal preference and specific circumstances.

Quick guide on how to complete september 1996 department of the treasury internal revenue service omb no irs

Effortlessly Prepare September Department Of The Treasury Internal Revenue Service OMB No Irs on Every Device

Digital document management has become increasingly popular among enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without any delays. Manage September Department Of The Treasury Internal Revenue Service OMB No Irs on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to Modify and eSign September Department Of The Treasury Internal Revenue Service OMB No Irs with Ease

- Locate September Department Of The Treasury Internal Revenue Service OMB No Irs and select Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method of sharing your document, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new document versions. airSlate SignNow meets all your document management requirements in just a few clicks, regardless of the device you choose. Modify and eSign September Department Of The Treasury Internal Revenue Service OMB No Irs to ensure seamless communication at every step of the form-filling process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct september 1996 department of the treasury internal revenue service omb no irs

Create this form in 5 minutes!

How to create an eSignature for the september 1996 department of the treasury internal revenue service omb no irs

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the significance of the September Department Of The Treasury Internal Revenue Service OMB No Irs?

The September Department Of The Treasury Internal Revenue Service OMB No Irs is essential for tax-related processes, as it outlines the necessary guidelines for various tax forms and eSignature requirements. Understanding this can streamline your documentation, making it easier to comply with federal regulations.

-

How does airSlate SignNow help with the September Department Of The Treasury Internal Revenue Service OMB No Irs requirements?

airSlate SignNow offers an efficient eSignature platform that complies with the September Department Of The Treasury Internal Revenue Service OMB No Irs standards. Our solution ensures that your documents are signed electronically in a legally binding manner, which is critical for tax forms and compliance.

-

What are the pricing options available for airSlate SignNow?

Our pricing for airSlate SignNow is competitive and designed to cater to various business needs while ensuring compliance with the September Department Of The Treasury Internal Revenue Service OMB No Irs. We provide flexible plans that allow you to choose the features that best fit your organization’s requirements.

-

Can I integrate airSlate SignNow with other applications for better compliance?

Yes, airSlate SignNow integrates seamlessly with numerous applications that are vital for handling documents in accordance with the September Department Of The Treasury Internal Revenue Service OMB No Irs. Our integrations allow you to streamline your workflows and maintain compliance across your operations.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes various features such as customizable templates, automated workflows, and secure storage, all designed to support the requirements of the September Department Of The Treasury Internal Revenue Service OMB No Irs. These tools make it easy to manage your documentation and ensure accuracy in submission.

-

How can airSlate SignNow improve my business's eSigning process?

By utilizing airSlate SignNow, your business can enhance its eSigning process signNowly, which is crucial for aligning with the September Department Of The Treasury Internal Revenue Service OMB No Irs. The platform provides a user-friendly interface that allows for quick document signing and reduces turnaround time.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, whether you are a small business or a large enterprise. Adhering to the September Department Of The Treasury Internal Revenue Service OMB No Irs, our platform scales with your needs, allowing you to manage signatures efficiently without compromising on compliance.

Get more for September Department Of The Treasury Internal Revenue Service OMB No Irs

- Joint venture agreements for a construction project or general business venture illinois form

- Parenting agreement document form

- Business credit application illinois form

- Individual credit application illinois form

- Interrogatories to plaintiff for motor vehicle occurrence illinois form

- Interrogatories to defendant for motor vehicle accident illinois form

- Llc notices resolutions and other operations forms package illinois

- Illinois realtors real property disclosure form

Find out other September Department Of The Treasury Internal Revenue Service OMB No Irs

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document