Irs Form 2553 Fill in 2002

What is the IRS Form 2553?

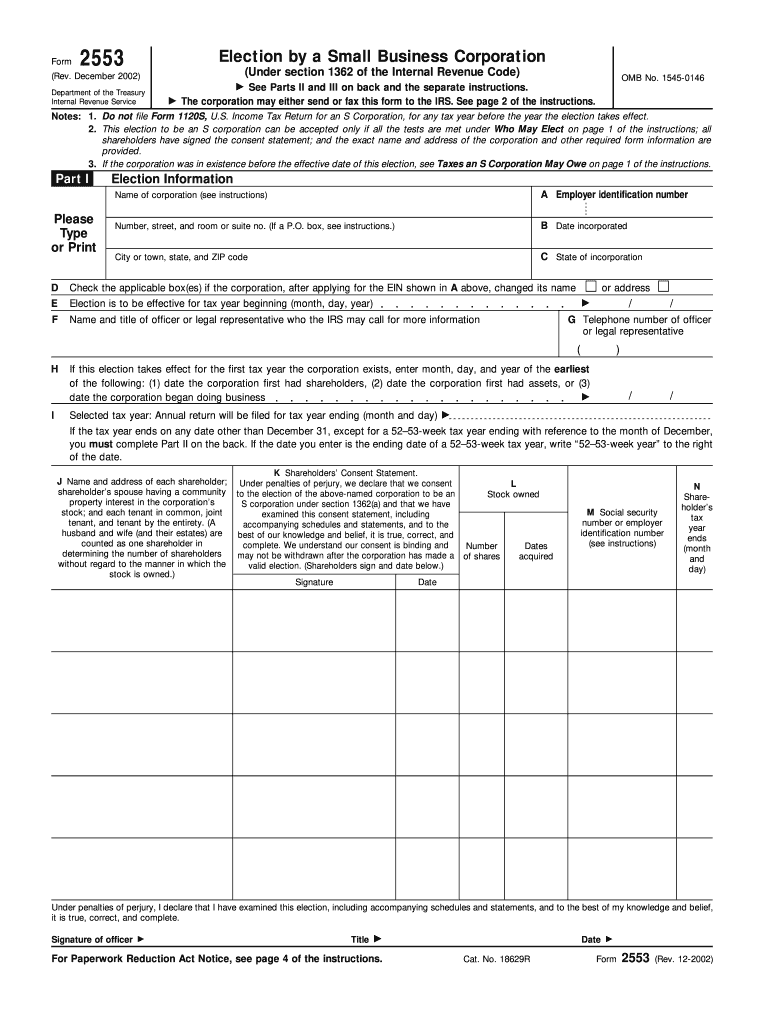

The IRS Form 2553 is a tax form used by small businesses to elect to be treated as an S corporation for federal tax purposes. This election allows the business to avoid double taxation on corporate income. Instead of the corporation paying taxes on its profits, the income is passed through to the shareholders, who report it on their personal tax returns. This form is crucial for businesses that meet the eligibility criteria and wish to benefit from the tax advantages associated with S corporation status.

How to Use the IRS Form 2553

Using the IRS Form 2553 involves several steps to ensure compliance with IRS regulations. First, the business must determine its eligibility, which includes having no more than one hundred shareholders and being a domestic corporation. After confirming eligibility, the business must complete the form accurately, providing necessary details such as the corporation's name, address, and the date the election is to take effect. It's important to ensure that all shareholders sign the form, as their consent is required for the election to be valid.

Steps to Complete the IRS Form 2553

Completing the IRS Form 2553 requires attention to detail. Here are the steps involved:

- Gather necessary information about the corporation, including its name, address, and Employer Identification Number (EIN).

- Determine the eligibility of the corporation and its shareholders.

- Fill out the form, ensuring all sections are completed accurately.

- Obtain signatures from all shareholders, confirming their agreement to the S corporation election.

- Submit the completed form to the IRS by the specified deadline.

Legal Use of the IRS Form 2553

The legal use of the IRS Form 2553 is governed by specific IRS guidelines. The form must be filed within a certain timeframe, typically within two months and fifteen days after the beginning of the tax year the election is to take effect. Failure to comply with these deadlines can result in the denial of S corporation status. Additionally, the form must be filled out completely and accurately to avoid complications with the IRS.

Filing Deadlines for the IRS Form 2553

Filing deadlines for the IRS Form 2553 are critical to maintaining S corporation status. The form must be submitted within two months and fifteen days after the start of the tax year for which the election is to be effective. For newly formed corporations, this means filing within the first 75 days of incorporation. Missing this deadline can lead to significant tax implications, so it is essential to adhere to these timelines.

Required Documents for the IRS Form 2553

When filing the IRS Form 2553, certain documents are necessary to support the application. These include:

- The corporation's Employer Identification Number (EIN).

- Consent statements from all shareholders.

- Any prior tax returns if applicable.

Having these documents ready can streamline the filing process and help ensure compliance with IRS requirements.

Quick guide on how to complete irs form 2553 fill in 2002

Complete Irs Form 2553 Fill In effortlessly on any device

Digital document management has gained popularity among enterprises and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Irs Form 2553 Fill In on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Irs Form 2553 Fill In effortlessly

- Find Irs Form 2553 Fill In and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Irs Form 2553 Fill In and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 2553 fill in 2002

Create this form in 5 minutes!

How to create an eSignature for the irs form 2553 fill in 2002

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the purpose of Irs Form 2553 Fill In?

Irs Form 2553 Fill In is used by small businesses to elect S corporation status. This form allows corporations to enjoy the benefits of pass-through taxation, meaning that income is taxed at the shareholder level, avoiding double taxation. Properly completing the Irs Form 2553 Fill In is crucial for compliance and tax advantages.

-

How does airSlate SignNow assist with filling out the Irs Form 2553?

With airSlate SignNow, users can easily fill in the Irs Form 2553 online, ensuring that all required fields are properly completed. The platform offers intuitive editing tools and templates that simplify the process, minimizing errors. By using airSlate SignNow, businesses can streamline their paperwork, making tax season easier.

-

Is there a cost associated with using airSlate SignNow for the Irs Form 2553 Fill In?

Yes, airSlate SignNow provides a range of pricing plans that cater to different business needs. Each plan includes various features, such as document storage and e-signature capabilities, at an affordable price. Utilizing airSlate SignNow for your Irs Form 2553 Fill In can be a cost-effective solution for compliance.

-

What features does airSlate SignNow offer for completing Irs Form 2553?

airSlate SignNow offers features like easy editing, e-signature capabilities, and cloud storage, specifically for completing forms like the Irs Form 2553 Fill In. Additionally, the platform provides secure access to documents, ensuring your sensitive information remains protected. This makes it easy to manage and submit your forms efficiently.

-

Can I use airSlate SignNow on mobile devices for the Irs Form 2553 Fill In?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to fill in and e-sign the Irs Form 2553 on the go. This flexibility ensures that you can manage your documents anytime, anywhere, which is especially useful for busy professionals. Mobile access enhances your efficiency when dealing with important paperwork.

-

What benefits does e-signing provide for the Irs Form 2553 Fill In?

E-signing the Irs Form 2553 Fill In offers multiple benefits, including quicker turnaround times and convenience for all parties involved. It reduces the need for physical paper and in-person meetings, streamlining the approval process. airSlate SignNow ensures that your e-signatures comply with legal standards, giving you peace of mind.

-

Does airSlate SignNow integrate with other tools to manage the Irs Form 2553?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms, making it easier to manage the Irs Form 2553 Fill In alongside your other business tools. Integrations with accounting software and customer relationship management (CRM) systems can enhance workflow efficiency. This enables you to keep all your documents and data connected.

Get more for Irs Form 2553 Fill In

- Florida enhanced life estate deed form

- Lady bird deed 497302904 form

- Deed tenants common form

- Quitclaim deed for condominium individual to two individuals florida form

- Florida deed timeshare form

- Fl deed trust form

- Agreement real estate 497302909 form

- Quitclaim deed two individuals to two individuals florida form

Find out other Irs Form 2553 Fill In

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online