Form 2553 2017-2026

What is the Form 2553

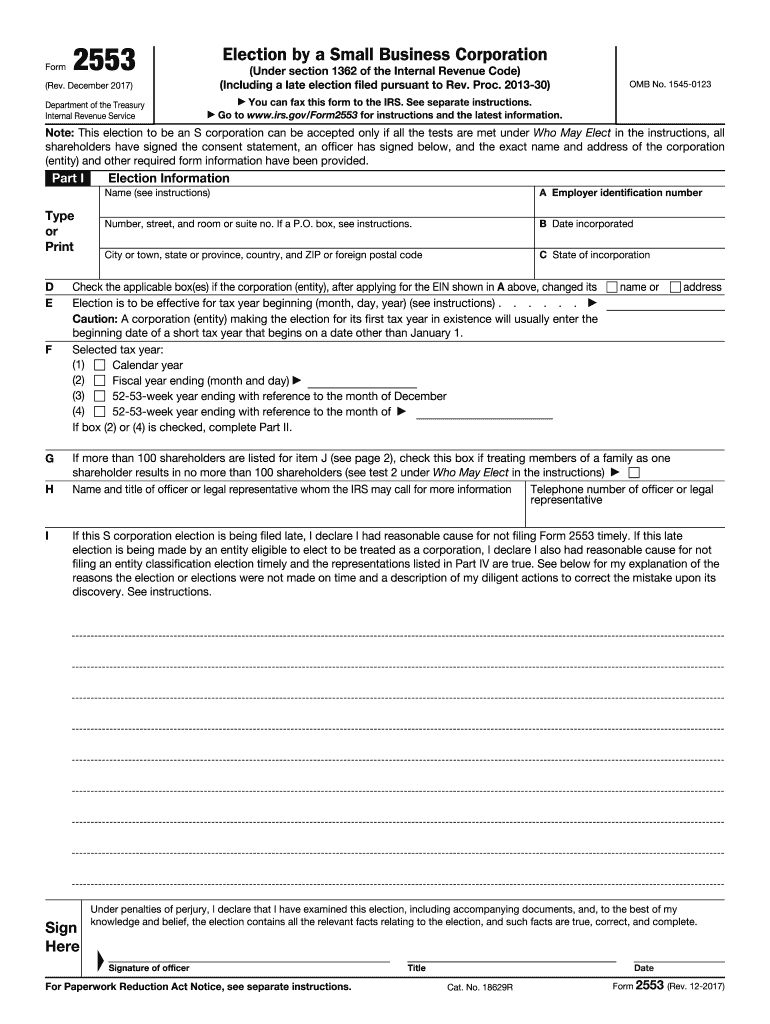

The IRS Form 2553 is a tax form used by small businesses to elect S corporation status. This designation allows corporations to pass corporate income, losses, deductions, and credits directly to shareholders for federal tax purposes. By choosing this status, businesses can potentially reduce their overall tax burden, as S corporations are generally not subject to federal income tax at the corporate level. Instead, income is reported on the individual tax returns of the shareholders.

How to use the Form 2553

To use Form 2553 effectively, businesses must complete the form accurately and submit it to the IRS. The form requires detailed information about the corporation, including its name, address, and the date of incorporation. Additionally, it is essential to provide the names and addresses of all shareholders, along with their consent to the S corporation election. After filling out the form, it should be filed within the designated timeframe to ensure the election is valid for the intended tax year.

Steps to complete the Form 2553

Completing Form 2553 involves several key steps:

- Gather necessary information about the corporation and its shareholders.

- Fill out the form, ensuring all required fields are completed accurately.

- Obtain signatures from all shareholders to confirm their agreement with the S corporation election.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by mail or electronically, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for Form 2553 are critical to ensure the S corporation election is effective. Generally, the form must be submitted within two months and fifteen days after the beginning of the tax year the election is to take effect. For newly formed corporations, the form should be filed within the same timeframe to elect S corporation status for the first year of operation. Missing these deadlines can result in the loss of the S corporation status for that tax year.

Eligibility Criteria

To qualify for S corporation status using Form 2553, certain eligibility criteria must be met. The corporation must be a domestic entity, have no more than one hundred shareholders, and have only allowable shareholders, which include individuals, certain trusts, and estates. Additionally, the corporation can only have one class of stock and must not be an ineligible corporation, such as certain financial institutions or insurance companies. Meeting these criteria is essential for the successful election of S corporation status.

Form Submission Methods (Online / Mail / In-Person)

Form 2553 can be submitted to the IRS through various methods, depending on the preferences and capabilities of the business. The form can be mailed directly to the IRS at the address specified in the form instructions. Additionally, businesses may have the option to file electronically through authorized e-file providers, which can streamline the process and reduce processing time. It is important to verify the submission method allowed by the IRS for the specific tax year.

Key elements of the Form 2553

Key elements of Form 2553 include the corporation's name, address, and Employer Identification Number (EIN). The form also requires the selection of the tax year for the S corporation election and the signatures of all shareholders. Each section must be completed thoroughly to ensure compliance with IRS regulations. Accurate completion of these elements is crucial for the acceptance of the form and the election of S corporation status.

Quick guide on how to complete irs form 2553 2017 2019

Uncover the simplest method to complete and endorse your Form 2553

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow presents a superior approach to complete and endorse your Form 2553 along with similar forms for public services. Our intelligent electronic signature solution equips you with all the necessary tools to handle paperwork swiftly and in compliance with official standards - robust PDF editing, management, protection, signing, and sharing features readily available within an intuitive interface.

Only a few steps are required to fill out and endorse your Form 2553:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to input in your Form 2553.

- Navigate between the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Obscure areas that are no longer relevant.

- Select Sign to create a legally binding electronic signature using any preferred method.

- Include the Date next to your signature and complete your task with the Done button.

Store your finalized Form 2553 in the Documents folder within your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers adaptable form sharing. There’s no need to print your forms when you need to submit them to the appropriate public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct irs form 2553 2017 2019

FAQs

-

How do I properly file form 2553 with the IRS to elect S Corp status for my corporation?

You can download form from the An official website of the United States government and fill out the following information in the form.Name of the companyAddress of the companyEmployer Identification NumberDate of incorporationState of incorporationEffective date of the electionChoose year end fiscal or calendarName of all shareholdersOwnership percentage of each shareholderSocial Security NumberShareholders tax year endYou can either mail or fax to the Internal Revenue Service form 2553 and IRS will send you a approval letter of an S Corporation election.Benefit of S Corporation Election:Your entity becomes a pass-through and all profit and loss transfer to your income tax returns.When should the election be filed?

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

Create this form in 5 minutes!

How to create an eSignature for the irs form 2553 2017 2019

How to create an eSignature for the Irs Form 2553 2017 2019 online

How to make an electronic signature for the Irs Form 2553 2017 2019 in Chrome

How to make an electronic signature for putting it on the Irs Form 2553 2017 2019 in Gmail

How to make an eSignature for the Irs Form 2553 2017 2019 right from your smart phone

How to generate an electronic signature for the Irs Form 2553 2017 2019 on iOS

How to make an eSignature for the Irs Form 2553 2017 2019 on Android devices

People also ask

-

How can airSlate SignNow benefit small businesses?

airSlate SignNow provides small businesses with a streamlined solution for managing document workflows. By allowing easy eSigning and document sending, it saves time and reduces administrative burdens, enabling small businesses to focus more on growth and customer service.

-

What pricing options does airSlate SignNow offer for small businesses?

airSlate SignNow offers flexible pricing plans tailored for small businesses, ensuring affordability while providing essential features. With subscription plans designed to suit various budgets, small businesses can choose the option that best meets their needs without breaking the bank.

-

Is airSlate SignNow easy for small businesses to integrate with existing software?

Yes, airSlate SignNow seamlessly integrates with popular applications such as Google Workspace, Salesforce, and Microsoft Office. This ease of integration allows small businesses to enhance their current workflows without the hassle of adopting entirely new systems.

-

What features of airSlate SignNow are specifically beneficial for small businesses?

airSlate SignNow offers features like customizable templates, bulk sending, and automated reminders which are particularly beneficial for small businesses. These tools not only improve efficiency but also enhance the overall customer experience by ensuring timely document delivery and signature collection.

-

How secure is airSlate SignNow for small business transactions?

Security is paramount for small businesses using airSlate SignNow, as it employs advanced encryption and security protocols to protect sensitive data. This ensures that all transactions and documents remain secure and confidential, allowing small businesses to operate with peace of mind.

-

Can small businesses use airSlate SignNow for remote work?

Absolutely, airSlate SignNow is ideal for remote work as it allows small businesses to send and eSign documents from any location. Its cloud-based platform ensures that you can manage your document workflows efficiently, regardless of where your team or clients are located.

-

What support options are available for small businesses using airSlate SignNow?

airSlate SignNow offers comprehensive support options for small businesses, including live chat, email support, and an extensive knowledge base. This responsiveness ensures that small business users can get assistance when needed, minimizing interruptions in their operations.

Get more for Form 2553

- Eform v36

- Washington residential real estate purchase and sale agreement form

- Eleot observation form

- New miner training recordcertificate msha msha form

- Post incident analysis form example

- Form uia 1028 state of michigan michigan

- T2202a tuition education and textbook amounts certificate cra arc gc form

- Delaware payroll report form

Find out other Form 2553

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template