Irs Form 4626 2012

What is the Irs Form 4626

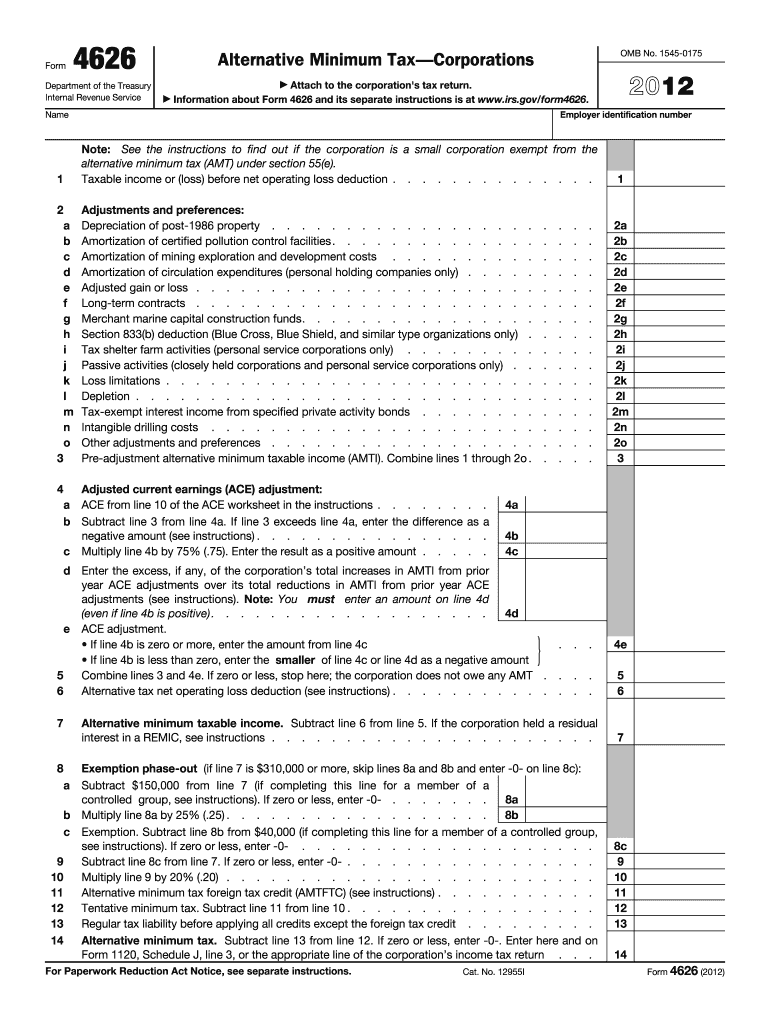

The Irs Form 4626, also known as the Alternative Minimum Tax (AMT) for Corporations, is a tax form used by corporations to calculate their alternative minimum tax liability. This form ensures that corporations pay a minimum amount of tax, regardless of deductions and credits that may reduce their regular tax liability. The AMT is designed to prevent corporations from avoiding tax obligations through excessive deductions and credits.

How to use the Irs Form 4626

To use the Irs Form 4626, corporations must first determine their regular tax liability. After calculating this amount, they will then complete the form to calculate their alternative minimum tax. The form requires information on various adjustments and preferences that may affect the AMT calculation. Corporations must ensure that they report all relevant income and deductions accurately to comply with IRS regulations.

Steps to complete the Irs Form 4626

Completing the Irs Form 4626 involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Calculate your regular tax liability using the standard tax forms.

- Fill out the form by entering required information, including adjustments and preferences.

- Calculate the alternative minimum tax based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Irs Form 4626

The legal use of the Irs Form 4626 is crucial for corporations to ensure compliance with tax laws. Filing this form is mandatory for corporations that meet specific income thresholds or have certain tax preferences. Failure to file or inaccuracies in the form can lead to penalties and interest charges from the IRS. It is essential for corporations to maintain accurate records and seek professional advice if needed to navigate the complexities of the AMT.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Irs Form 4626. Generally, the form is due on the same date as the corporation's income tax return. For most corporations, this means the form must be filed by the 15th day of the fourth month following the end of the tax year. It is important to stay informed about any changes in deadlines or extensions that may apply.

Who Issues the Form

The Irs Form 4626 is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides guidelines and instructions for completing the form, ensuring that corporations understand their tax obligations and how to accurately report their income and deductions.

Quick guide on how to complete 2012 irs form 4626

Prepare Irs Form 4626 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Irs Form 4626 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Irs Form 4626 effortlessly

- Obtain Irs Form 4626 and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with features specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your document, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you prefer. Edit and eSign Irs Form 4626 and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 irs form 4626

Create this form in 5 minutes!

How to create an eSignature for the 2012 irs form 4626

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is IRS Form 4626 and why is it important?

IRS Form 4626 is used to calculate the Alternative Minimum Tax (AMT) for corporations. It helps ensure that businesses pay a minimum amount of tax, regardless of deductions or credits. Understanding how to fill out IRS Form 4626 is crucial for compliance with tax regulations.

-

How can airSlate SignNow assist with IRS Form 4626?

With airSlate SignNow, you can easily prepare, send, and eSign IRS Form 4626 documents electronically. Our platform ensures that your documents are secure and complies with legal standards for electronic signatures, streamlining your tax preparation process.

-

What are the key features of airSlate SignNow for managing IRS Form 4626?

AirSlate SignNow offers features such as document templates, secure eSigning, and automated workflows that simplify the completion and submission of IRS Form 4626. These tools enhance efficiency and reduce errors in your tax documentation.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial period, allowing you to explore all features, including those needed for IRS Form 4626. This is a great opportunity to assess how our solution can help streamline your document management and eSigning processes.

-

What pricing plans does airSlate SignNow offer for businesses needing to handle IRS Form 4626?

AirSlate SignNow provides flexible pricing plans tailored for businesses of all sizes. Whether you’re a small business or a large corporation, you can find a plan that fits your budget and allows for efficient handling of IRS Form 4626.

-

Can I integrate airSlate SignNow with other software for filing IRS Form 4626?

Yes, airSlate SignNow integrates seamlessly with various business software and applications, enhancing your ability to manage IRS Form 4626 effectively. This integration ensures your workflow is smooth and information is synced across tools.

-

What are the benefits of using airSlate SignNow for IRS Form 4626?

By using airSlate SignNow for IRS Form 4626, you benefit from increased efficiency, reduced paper usage, and fewer processing errors. Electronic signatures make the submission process faster, helping businesses stay compliant with tax regulations without hassle.

Get more for Irs Form 4626

- Interrogatories to defendant for motor vehicle accident indiana form

- Llc notices resolutions and other operations forms package indiana

- Indiana claim workers compensation form

- Notice of dishonored check civil keywords bad check bounced check indiana form

- Request for assistance for workers compensation indiana form

- Mutual wills containing last will and testaments for unmarried persons living together with no children indiana form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children indiana form

- Mutual wills or last will and testaments for unmarried persons living together with minor children indiana form

Find out other Irs Form 4626

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT