Form 4626 Alternative Minimum TaxCorporations 2016

What is the Form 4626 Alternative Minimum TaxCorporations

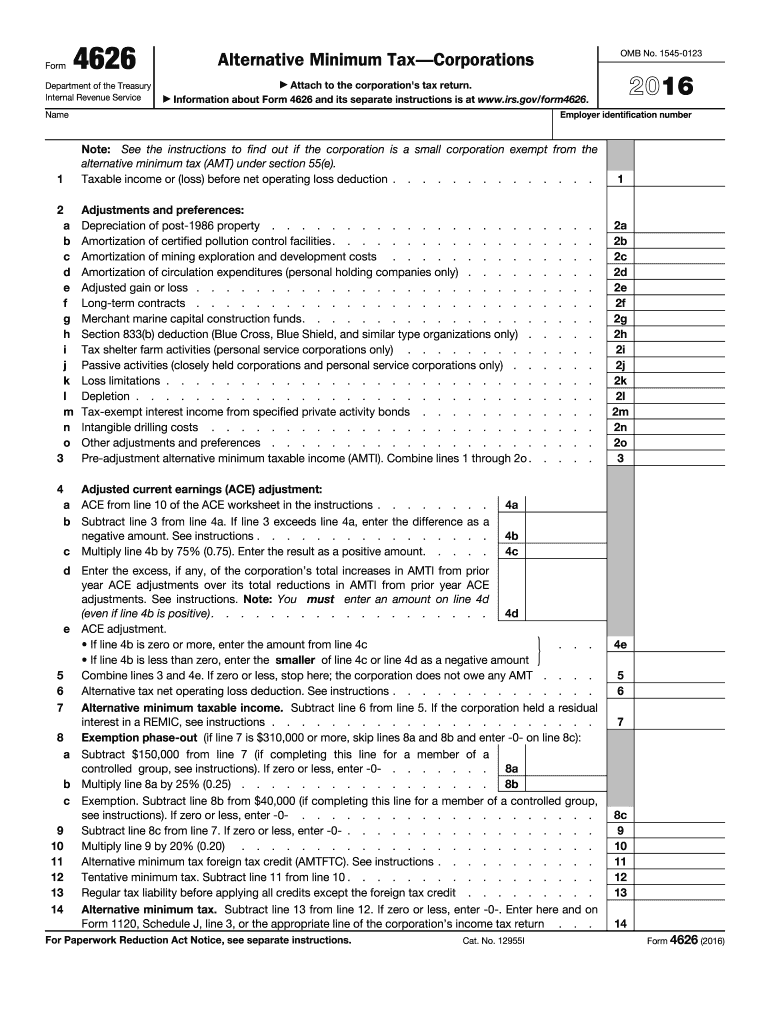

The Form 4626 Alternative Minimum TaxCorporations is a tax form used by corporations to calculate their alternative minimum tax (AMT). This form ensures that corporations pay a minimum amount of tax, regardless of deductions and credits that may reduce their regular tax liability. The AMT is designed to prevent corporations from using loopholes to avoid paying taxes altogether. The form requires detailed financial information, including income, deductions, and credits, to determine the AMT liability accurately.

How to use the Form 4626 Alternative Minimum TaxCorporations

To use the Form 4626 Alternative Minimum TaxCorporations effectively, corporations must first gather all necessary financial documents, including income statements and records of deductions. The form consists of several sections where corporations will input their financial data. It is important to follow the instructions carefully to ensure accurate calculations. After completing the form, corporations must file it alongside their regular tax return, ensuring that all figures are consistent with other submitted documents.

Steps to complete the Form 4626 Alternative Minimum TaxCorporations

Completing the Form 4626 Alternative Minimum TaxCorporations involves several key steps:

- Gather financial records, including income statements and expense reports.

- Complete the income section, detailing all sources of revenue.

- List allowable deductions and credits, ensuring they comply with IRS guidelines.

- Calculate the alternative minimum taxable income (AMTI) using the provided formulas.

- Determine the AMT liability based on the AMTI and applicable tax rates.

- Review the completed form for accuracy before submission.

Legal use of the Form 4626 Alternative Minimum TaxCorporations

The legal use of the Form 4626 Alternative Minimum TaxCorporations is governed by IRS regulations. Corporations must ensure that the information provided is accurate and complete to avoid penalties. The form must be filed in accordance with federal tax laws, and any discrepancies may lead to audits or additional tax liabilities. Using electronic signature solutions like signNow can help ensure that the submission process is secure and compliant with legal standards.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines for the Form 4626 Alternative Minimum TaxCorporations. Typically, the form is due on the same date as the corporation's annual tax return. For most corporations, this means the form is due on the fifteenth day of the fourth month following the end of the tax year. It is crucial to stay informed about any changes in deadlines to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the Form 4626 Alternative Minimum TaxCorporations. The form can be filed electronically through the IRS e-file system, which is often the fastest method. Alternatively, corporations may choose to mail the completed form to the appropriate IRS address. In some cases, in-person submissions may be possible at IRS offices, but this is less common. Each method has its own requirements and processing times, so corporations should select the option that best suits their needs.

Quick guide on how to complete 2016 form 4626 alternative minimum taxcorporations

Complete Form 4626 Alternative Minimum TaxCorporations effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Form 4626 Alternative Minimum TaxCorporations on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Form 4626 Alternative Minimum TaxCorporations without hassle

- Obtain Form 4626 Alternative Minimum TaxCorporations and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to preserve your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 4626 Alternative Minimum TaxCorporations and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 4626 alternative minimum taxcorporations

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 4626 alternative minimum taxcorporations

How to create an electronic signature for the 2016 Form 4626 Alternative Minimum Taxcorporations online

How to generate an electronic signature for the 2016 Form 4626 Alternative Minimum Taxcorporations in Google Chrome

How to create an eSignature for signing the 2016 Form 4626 Alternative Minimum Taxcorporations in Gmail

How to create an electronic signature for the 2016 Form 4626 Alternative Minimum Taxcorporations from your smartphone

How to create an electronic signature for the 2016 Form 4626 Alternative Minimum Taxcorporations on iOS

How to make an electronic signature for the 2016 Form 4626 Alternative Minimum Taxcorporations on Android OS

People also ask

-

What is Form 4626 Alternative Minimum Tax Corporations?

Form 4626 Alternative Minimum Tax Corporations is a tax form used by corporations to calculate their alternative minimum tax (AMT) liability. This form helps ensure corporations pay a minimum amount of tax even if they have signNow deductions or credits. Understanding this form is crucial for compliance and tax planning.

-

How does airSlate SignNow help with Form 4626 Alternative Minimum Tax Corporations?

airSlate SignNow simplifies the process of managing and signing documents related to Form 4626 Alternative Minimum Tax Corporations. Our platform allows for streamlined document workflows, ensuring timely filing and accurate completion of the necessary forms. With easy e-signature options, ensuring compliance has never been simpler.

-

What are the key features of airSlate SignNow for handling tax documents like Form 4626 Alternative Minimum Tax Corporations?

Key features include customizable templates for tax forms, secure e-signatures, and audit trails for compliance. Additionally, our platform offers integration with popular accounting and tax software which helps in managing Form 4626 Alternative Minimum Tax Corporations efficiently. All these features ensure that your tax responsibilities are met with ease.

-

Is airSlate SignNow cost-effective for businesses needing to file Form 4626 Alternative Minimum Tax Corporations?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans cater to various needs and budgets, allowing you to manage the filing of Form 4626 Alternative Minimum Tax Corporations without overspending. The time saved through our efficient processes also contributes to signNow cost savings.

-

Can airSlate SignNow integrate with my existing tax software for Form 4626 Alternative Minimum Tax Corporations?

Absolutely! airSlate SignNow supports integration with various tax software platforms, making it easier to manage Form 4626 Alternative Minimum Tax Corporations directly from your existing tools. This integration helps streamline your workflow and keeps all relevant documents linked and accessible in one place.

-

What benefits does airSlate SignNow offer for eSigning documents related to Form 4626 Alternative Minimum Tax Corporations?

Using airSlate SignNow for eSigning documents related to Form 4626 Alternative Minimum Tax Corporations provides convenience and speed. Signers can authenticate documents from anywhere, at any time, reducing delays commonly associated with traditional signing methods. Plus, you can maintain compliance and ensure security in the eSigning process.

-

How secure is the submission of Form 4626 Alternative Minimum Tax Corporations through airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including those related to Form 4626 Alternative Minimum Tax Corporations. We utilize advanced encryption and security protocols to safeguard your information throughout the signing and submission process. You can confidently manage sensitive tax documents knowing your security is our top priority.

Get more for Form 4626 Alternative Minimum TaxCorporations

- Ohio general warranty deed from husband and wife to llc form

- Louisiana name change instructions and forms package for a minor

- Kansas quitclaim deed from husband to himself and wife form

- New york legal last will and testament form for single person with adult and minor children

- Arkansas warranty deed for fiduciary form

- Kansas bill of sale for automobile or vehicle including odometer statement and promissory note form

- Louisiana power of attorney to transfer motor vehicle signed form

- California promissory note in connection with sale of vehicle or automobile form

Find out other Form 4626 Alternative Minimum TaxCorporations

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online